Polyester industry chain exports diverge, focus on logistics impact

According to the latest Customs export data for April (converted into weight), there is a noticeable month-on-month increase in export volumes, but the year-on-year growth is moderate. Downstream fabrics and garments exports perform better compared to upstream. Due to logistical issues in April and May, the export schedule has been delayed.

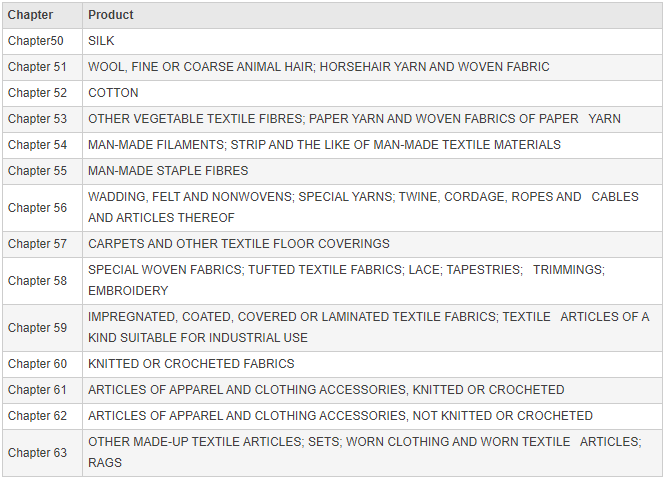

Firstly, by combining the export data for Chapters 50-63, the export volume in April shows a significant increase compared to March, although the increase is not particularly large compared to the same period last year.

The detailed data show, on a month-on-month basis, all categories show varying degrees of growth in April, with Chapters 60-63 (garment-related categories) exhibiting particularly strong growth. However, from a year-on-year perspective, only a few categories have managed to grow.

Categories with significant year-on-year changes

A closer look at the categories with more than a 5,000 tons year-on-year change in April reveal that used clothing and polyester DTY saw large increase and polyester POY and FDY saw significant decrease.

From January to April, the categories with the largest decreases are polyester FDY, polyester POY, viscose staple fiber, and uncombed polyester staple fiber. Conversely, the categories with the largest increases are polyester DTY fabrics, viscose staple fiber fabrics, and polyester DTY. This indicates that the growth in downstream segments is partly substituting for upstream segment growth.

When categorizing these chapters into three main segments (fibers, yarns and fabrics, and garments), it becomes evident that, regardless of whether comparing year-on-year or month-on-month, or cumulative year-on-year, upstream fibers and yarns are performing weakly, while fabrics and garments are performing relatively better.

Impact of Logistical Factors

Due to the influence of logistical factors, export delays are prevalent (recently, sea freight rates have been rising continuously, with various reasons analyzed by the market, including the Red Sea crisis, Panama Canal congestion, and global logistics capacity reduction). Therefore, April's export data may not fully reflect the overall export demand. Given the accelerated increase in sea freight rates in April and May, it is expected that there will still be varying degrees of delay in May. If the issue of tight shipping capacity continues unresolved, it could ultimately negatively impact the annual export demand.

Harmonized System (HS) Code & Tariff Index

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price