Expectations for operating rate of syngas-based MEG units

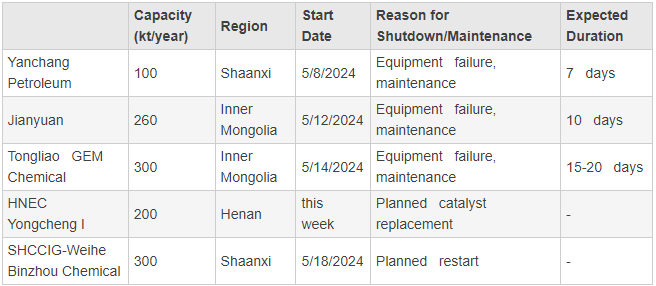

With the concentrated maintenance in coal chemical plants gradually ending, the operating rate for syngas-based MEG plants in early May has rapidly increased. As of May 9th, the operating rate rose to around 67%. However, starting this week, Jianyuan and Tongliao GEM experienced unexpected shutdowns, while Henan Energy (Yongcheng Phase I) replaced catalysts, the operating rate declined again.

According to information received, the shutdown at Jianyuan is mainly due to issues with the air separation system, and the maintenance period is not expected to be too long, with a preliminary restart date set for May 23rd. As for Tongliao GEM, the maintenance involves T104 tower, and the downtime for MEG unit is relatively longer, although it does not affect the normal production of oxalic acid. However, considering the operating rate increase at Qianxi and Zhongkun during the week, it is preliminarily estimated that the operating rate or syngas-based MEG unit will fall back to around 63-64% this week.

Last week, coal prices at ports showed strength, with a rise of around 30yuan/mt for 5500 kcal coal at Qinhuangdao Port. However, the actual purchasing prices at some factories lagged significantly behind, with increases during the week ranging only from 5 to 10yuan/mt. This week, coal prices showed a slight weakness. Short-term costs remain manageable overall, and the cash flow of syngas-based MEG (including discounts but excluding freight) is still profitable. Additionally, due to the spring maintenance season of coal chemical units in March-April, most enterprises have low inventories, leading to a temporary tightness in supplies. Therefore, the enthusiasm for starting operations in the short term remains relatively high for coal chemical companies.

Weihe Binzhou Chemical plans to restart around May 18th, slightly extending the plan from around May 16th. Based on current estimates, the operating rate for syngas-based MEG units is expected to rise to around 70% by the end of May. However, due to the impact of unexpected unit shutdowns this week, the pace of recovery is delayed by about a week compared to previous expectations.

In June, there are currently no maintenance plans scheduled for syngas-based MEG units. Therefore, the assessment at present is that the operating rate will remain high in June. However, June has entered the "peak summer" period, where the upward momentum of coal prices increases. The strong rise in port coal prices last week also indicates a market expectation of a strong coal demand season. At that time, whether coal chemical companies will continue to operate at the current high rate remains uncertain.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price