China’s cotton yarn imports decrease in Jan-Feb 2024

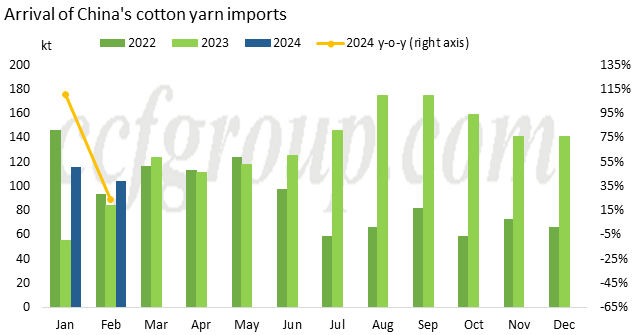

I. China's cotton yarn imports showed a year-on-year increase but a month-on-month decrease in January and February 2024

According to the latest customs data, the import volume of cotton yarn in China in January and February 2024declined significantly compared to the second half of 2023. In January, the total import volume of cotton yarn was approximately 116,200 tons, a decrease of nearly 25,000 tons compared to December 2023. In February, due to the impact of the Chinese New Year holiday, the import volume of cotton yarn further dropped to 104,300 tons. The bottoming out and rebound of external yarn prices before the Chinese New Year limited the opportunity for the Chinese market to stock up on purchases. The bottoming out and rebound of foreign yarn prices before the Chinese New Year limited the opportunity for the Chinese market to stock up on purchases. However, the cumulative import volume of cotton yarn in January and February still showed a year-on-year increase of 58.33% compared to the same period in 2023, to some extent reflecting the high expectations placed on the post-holiday market by the trading sector in the previous period.

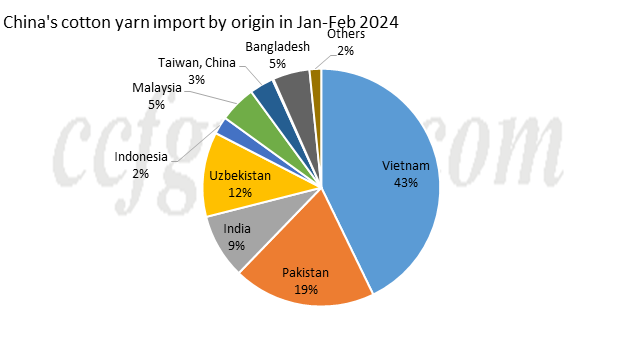

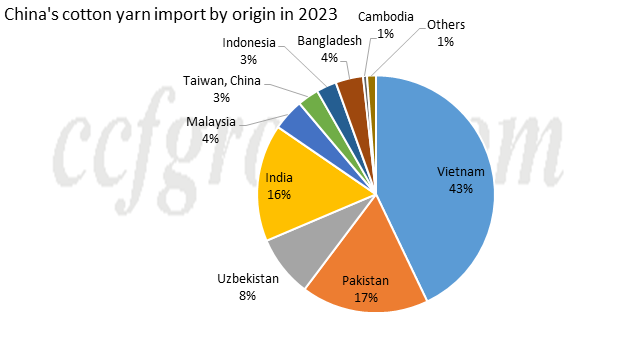

II. China's cotton yarn imports by origin in Jan-Feb 2024

In January and February 2024, Vietnamese yarn imports was around 94,400 tons, accounting for approximately 43% of the total, which was similar to its import share in 2023. Although the monthly import volume of Pakistani yarn slightly decreased compared to previous months, the total import volume in January and February still reached 42,800 tons, with its share rising to 19%, indicating a further expanding trend compared to 2023. Uzbekistan surpassed India to rank third, with a total import volume of 25,400 tons in January and February, accounting for 12% of the total. The advantage of low prices in the previous period helped boost export sales. The monthly import volume of Indian yarn once again dropped below 10,000 tons, with a total import volume of 19,400 tons in January and February, reducing its import share from about 16% for the entire year of 2023 to 9%. However, its combed yarn has a relatively high

|

Country or region |

Import volume(kg) |

Import value (USD) |

Average import price($/kg) |

|

Vietnam |

94361617 |

241371654 |

2.56 |

|

Pakistan |

42811415 |

100855106 |

2.36 |

|

Uzbekistan |

25449578 |

57177955 |

2.25 |

|

India |

19416340 |

51597162 |

2.66 |

|

Bangladesh |

11042610 |

11352465 |

1.03 |

|

Malaysia |

10972763 |

28458091 |

2.59 |

|

Taiwan, China |

7258882 |

14854819 |

2.05 |

|

Indonesia |

5252536 |

14076877 |

2.68 |

|

Cambodia |

1493625 |

1561725 |

1.05 |

|

Ethiopia |

458944 |

3847976 |

8.38 |

|

Tajikistan |

422148 |

955714 |

2.26 |

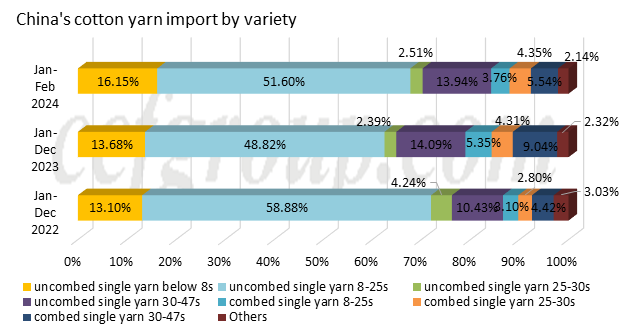

III. China's cotton yarn imports by structure in Jan-Feb 2024

It is not difficult to find that in January-February 2024, China's cotton yarn import structure is more concentrated on the conventional specifications. The proportion of carded single yarn below 8s has increased to 16.15% (35,600 tons); carded single yarn 8-25s accounts for over 50% again, totaling approximately 51.60% (113,700 tons); the proportion of carded single yarn 30-47s has decreased to 13.94% (30,700 tons). Comparatively, the overall proportion of combed yarn has significantly declined, especially in January-February, with only 12,200 tons of combed single yarn 30-47s arriving, accounting for 5.54%. The import share of combed single yarn 25-30s has slightly increased, reflecting the gradual increase in market demand for differentiated stocking.

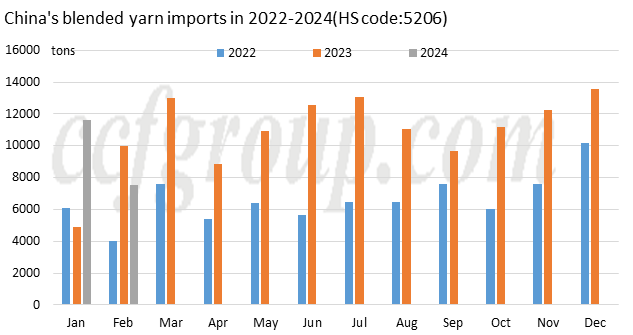

IV. China's blended cotton yarn imports in Jan-Feb 2024

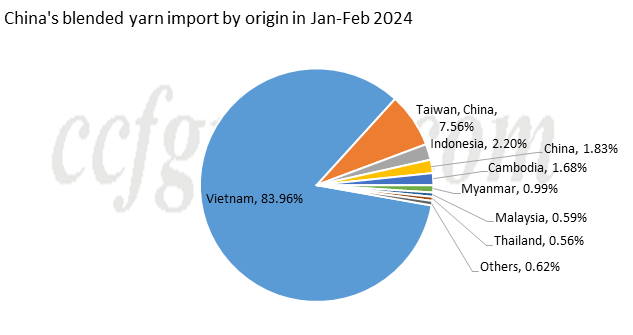

The data on the import of blended cotton yarn show that the overall import volume has not fluctuated significantly. In January, the total import volume of blended cotton yarn reached 11,600 tons, and in February, due to the Chinese New Year holiday, only 7,544 tons were received. In recent years, with the downgrading of overseas apparel orders and the continuous substitution of cotton, the overall import demand for blended cotton yarn in the domestic market has been increasing. At the same time, the accelerated pace of Vietnamese cotton yarn mills in switching production has provided the domestic market with more import choices. In January and February, the blended cotton yarn from Vietnam still accounted for a high proportion of 83.96%, followed by 7.56% from Taiwan, China. The production demand for foreign blended yarns has to some extent driven the export of polyester staple fiber raw materials from China.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price