Spandex market witnesses stabilizing price & improving sales after Dual Control

Prices of raw materials of textiles and apparels advanced obviously impacted by the Dual Control of energy consumption. Price of polyester, nylon, cotton and cotton yarn hiked since late-Sep, with increment at 4.1%-28%. Price of mainstream spandex 40D soared as high as 106% in Jan-Aug and hit 13-year high but shivered at high level in end-Q3 and early-Q4. However, sales of spandex improved before and after the National Day holiday (Oct 1-7) impacted by the regulation of energy consumption.

Price of mainstream spandex was largely stable amid the regulation of energy consumption and some sellers discounted price for promotion with high stocks. Most downstream buyers showed higher rigid demand for spandex. Some large customers slightly increased replenishing. Price of spandex stopped falling and stabilized recently. Sales of spandex improved in the first half of Oct but slightly slowed down from this week.

Firstly, from the perspective of supply, impacted by the regulation of energy consumption, the production of spandex and the launch of new spandex units will have uncertainty.

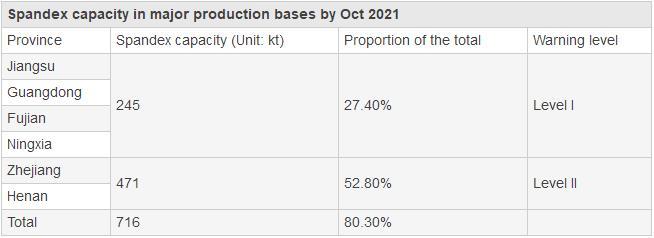

The Dual Control of energy consumption affects most major spandex production bases, covering near 80% of spandex capacity in China.

Spandex capacity in major production bases by Oct 2021

However, few spandex factories suspended or cut production supported by high cash flow and low stocks. Spandex companies that covered various industries mainly ran at stable capacity, while some plants’production was impacted in Zhejiang, Jiangsu and Guangdong. The operating rate of spandex plants declined to 89% from 97% in mid-Sep and climbed up to 92% after the National Day holiday. Some plants plan to resume operation later while some would see shrinking production due to the limit of electricity consumption. There are many new spandex plants to be launched in Q4, including 50kt/year from Huafon and 30kt/year from Xinxiang Chemical Fiber. Monthly supply of spandex may tend to grow marginally.

Secondly, as for the operation rate of fabric mills, it sustained low.

The Dual Control has eased slightly, while export orders did not chase up smoothly. Fabric mills failed to see good performance during the traditional peak season in Sep-Oct, coupled with the influence of electricity consumption restriction. The operating rate of downstream fabric mills ascended after the National Day holiday and increased by 8.4 percentage points to 49.0% in end-Sep, still apparently lower than that in Aug. Most covered yarn plants and warp knitting mills ran at above 50-60% of capacity while circular knitting plants and lace knitting units ran at 30-50% of capacity.

Sales of fabrics apparently improved after the National Day holiday with widely rising price of raw materials of textiles and apparels. Some factories saw abundant orders and advancing cash flow and they were active in running at high capacity, while the regulation of energy consumption restricted the raise of run rate. Printing and dyeing plants also witnessed tight schedule. With surging feedstock prices, downstream buyers increased restocking. Stimulated by better sales, stocks of spandex declined to above 11 days.

Price of spandex has been stable and high after the National Day holiday. After new spandex units successively started operation, more spandex from new plants may be discounted. The existing spandex plants may run at around 90% of capacity. Monthly spandex production may marginally improve later. The durability of downstream orders, the transfer of higher price and the consumption of residents should be observed further. Price of spandex may shiver at high level in short run amid low stocks and that of spandex from new plants may be slightly discounted.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price