PX and PTA market during China's National Day holiday and its outlook

During China's National Day holiday in the first week of Oct, international crude oil price hiked sharply owing to the escalation of geopolitical tension in the Middle East. As a result, China chemical prices rose in tandem.

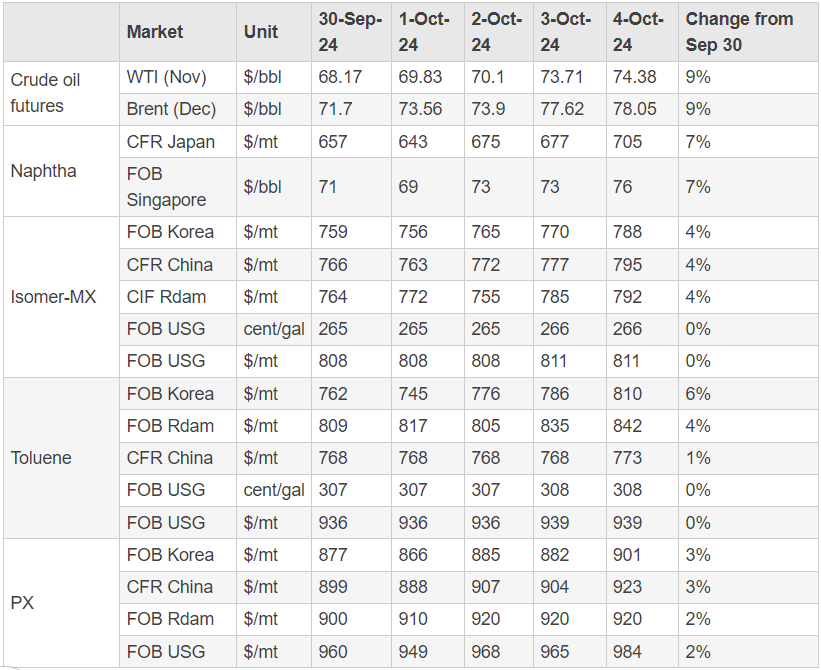

In PX industry chain, crude oil price recorded the largest increase of more than 9% from Sep 30 to Oct 4, gaining over $6/bbl or $45~47/mt, CFR Japan naphtha price rose by $48/mt, FOB Korea toluene price hiked $48/mt, FOB Korea MX price gained $29/mt, while PX price advanced $24/mt on FOB Korea basis over the same period.

PX margin: PX-naphtha and PX-MX price spread both narrowed from the levels before the holiday. However, the current PX-naphtha spread at $218/mt and PX-MX spread at $128/mt were still economically viable for PX units. The PX-MX spread at that level may even incentivize producers to hike operating rate based on MX.

PX trading: During Oct 1-4, there was no trade of PX physicals reported during the trading hours, and transaction volume of papers also decreased sharply, in the absence of direction from ZCE PX futures and participants from China during the holiday. Discussions for PX were relatively stable with Nov spot talked at $13/mt discount and Dec goods at $11/mt discount to formula pricing. On Oct 7, three deals of PX physicals were concluded. Hengli Singapore sold a deal of Nov PX to GS Singapore at $924/mt, Hengli Singapore sold Dec PX to Glencore at $930/mt and to GS Singapore at $929/mt.

During Sep 1-30, South Korea exported about 383kt of PX, down 128kt from the month earlier, data showed. About 363kt went to Chinese mainland, down 62kt on month; 20kt to Taiwan, down 46kt on month. But the country did not export PX to the US in Sep.

Plant operation:

FCFC shut its 950kt/yr PX unit in early Oct as scheduled, for maintenance lasting an expected 3 weeks.

ZPC shut one 2.5 mln mt/yr PX line unexpectedly on Sep 30, and was slated to restart on Oct 10.

PTA trading: During the holiday, China domestic market was closed and the price was little changed. As of Oct 7, PX price gained $29/mt from Sep 30, equivalent to an increase of 155yuan/mt in the cost for PTA. In addition, crude oil price hiked even more, downstream polyester POY and FDY prices rose by 400-600yuan/mt, and DTY price advanced 200-300yuan/mt, which could be reflected in PTA futures.

PTA plant operation: Yisheng New Materials has cut the operating rate of its PTA lines with combined capacity of 7.2 mln mt/yr to 70% and planned to recover on Oct 9. Zhongtai shut its 1.2 mln mt/yr line during the holiday, and the restart date was undecided. Sanfame recovered the operating rate of its 1.2 mln mt/yr line to 80% on Oct 3.

Outlook

China domestic PX output is estimated to drop in Oct and Nov. Beside from the unexpected shutdown of one line of ZPC in the beginning of Oct, there are another two units with combined capacity of 2.6 mln mt/yr (CNOOC Daxie and Sinopec Fujian) to undergo maintenance from Oct 10, lasting 2 months.

In terms of PX imports of China, the volume is forecast at 830-850kt a month. South Korea's S-Oil has slashed its exports due to persistent low operating rate, while cargoes from Middle East increased.

As for PTA, Hengli Huizhou has maintenance plan for one line later, while maintenance announced for Nov is limited and there could be 2 or 3 line under maintenance according to the plan that have been announced.

As for polyester products, with macro economic sentiment turning upbeat, and profits improving, polyester product inventory pressure has been relived and polyester plant operating rate ticks up obviously. Some plants are anticipated to restart in Oct, and the average operating rate may further rise to 92% in Oct. In Nov, the operating rate is estimated to 90-91% due to seasonal weakening of demand, but it is still higher than previous forecast.

In a conclusion, China PX inventory is expected to increase fractionally or keep largely stable in Oct and Nov, while PTA inventory may reduce by 50-100kt in Oct but then rise by 50-100kt in Nov.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price