MEG falls 3 percent amid falling costs and weak fundamentals

MEG futures for January 2025 delivery (EG2501) at Dalian Commodity Exchange closed at 4,571 yuan/mt on September, down 142 yuan/mt or 3.01% from the previous settlement price, marking the largest single-day drop since February. In the afternoon, prices for this week's delivery traded at around 4,590-4,595 yuan/mt at the low end, with a noticeable strengthening of the near-term cargo basis, but the forward-month basis showed weak follow-through.

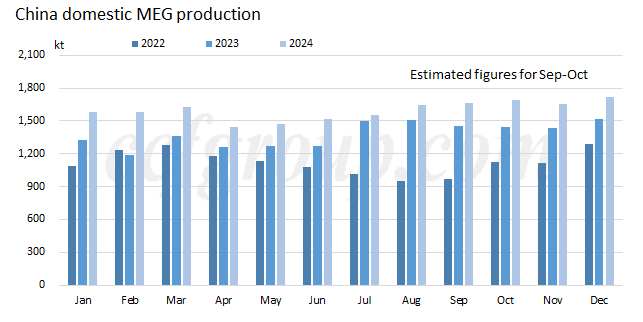

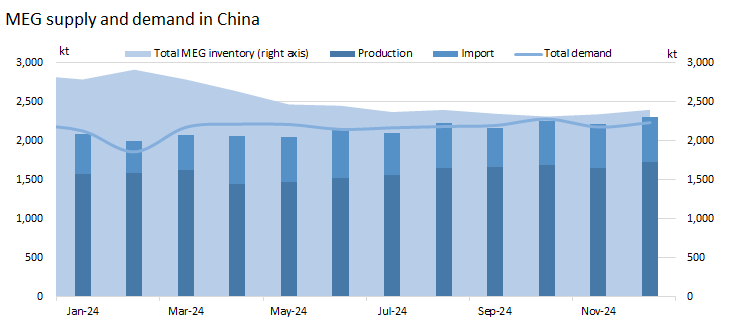

As MEG prices pushed higher, both domestic and international supply showed signs of recovery expectations. The rate of inventory reduction narrowed in the near term, with a shift towards inventory accumulation expected from November. This logic seems to be continuing. HNEC's 200kt/year plant in Puyang, which has been shut down since October 2023, is now planned to restart around the 20th of this month. One production line at Shenghong Refining & Chemical, which was shut down in late August, has resumed production and is increasing its run rate. Both lines at Shenghong will maintain high rate operations to compensate for the production loss from the previous shutdown.

Regarding new capacities, CNCEC's new 300kt/year syngas-to-MEG plant has started its gasification furnace, with MEG production expected by the end of this month. The stability of this facility's operation will be closely watched in the fourth quarter. Overall, domestic MEG production is expected to reach around 1.7 million tons in October.

Additionally, the collapse in costs has accelerated the downward trend of MEG. U.S. August ISM Manufacturing index at 47.2 was below expectations, with the new orders/inventory ratio falling to recession levels. Concerns about weak demand continue to be validated, with U.S. crude oil prices falling rapidly, breaking below $70/barrel on Wednesday. The commodity market showed a significant downturn, putting obvious pressure on the MEG market.

In the short term, under the release of negative sentiment, MEG continues to show a weak pattern. However, during August, as the spot basis continued to strengthen, polyester factories mainly consumed their own inventories, with reduced stockpiling. As market prices fall to low levels, there is restocking demand in the polyester sector, providing some support for buying interest at lower levels. Moreover, with few import cargoes arriving in September, import volume is expected to be only around 500-510kt, with continued low arrivals in the Zhangjiagang area. The basis for near-term cargo is expected to remain strong in the first half of September.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price