Methanol market weighed by supply recovery and MTO production cuts

In May, China domestic methanol plant operating rate declined heavily with average level down to about 68%. The production losses caused by plant turnarounds reached about 720kt. Methanol supply and demand fundamentals were relatively resilient in the first half of May, due to slow arrivals of imported cargoes but rapid drop in domestic plant operating rate. In the latter half of May, however, plant turnaround season is about to come to an end, while domestic supply is expected to recover amid attractive profits based on coal.

In addition, downstream MTO operating rate has dropped as the economics are poor. Zhejiang Xingxing and Yangmei Hengtong have shut their MTO plants. Nanjing Chengzhi Phase II also plans to shut its plant. Sierbang has been running at reduced operating rate. As a result, methanol price is likely to pull back from highs.

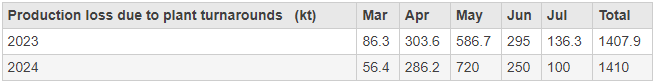

Note: the numbers for May, Jun and Jul of 2024 are estimations.

The spring turnaround season typically lasts from Mar till Jun. As of the time of this writing, about 84% of the capacity with planned turnarounds has undergone maintenance (17.23 million tons out of 20.33 million tons). In late May, there are only Yankuang Yulin and Nanjing Chengzhi left to undergo turnarounds. In Jun, with the turnaround season approaching the end, production loss is estimated at about 250kt. In Jul, the production is expected to recover to normal level, but with Inner Mongolia Junzheng and Henan Jinkai to start their new plants and achieve stable operations, domestic methanol production is likely to rebound to high.

Demand for coal is expected to reach a peak in summer. Coal price is likely to rise in mid or late May. Firstly, temperature is getting higher in Northwestern region and thermal power plants accelerate raising the run rates. Secondly, the preferential policy on railway freight will end in end-Jun, and before the expiry, there is expected to be intensive buying.

China coal price is currently rising and mine-mouth price has risen to 620-670yuan/mt in Ordos, Inner Mongolia. Based on merchant coal price, methanol plants have positive cash flow theoretically, which is assessed at about 245yuan/mt.

The imported coal market is also moving up continuously, but power plants are not willing to accept high prices. Currently, the lowest bid price for imported Indonesian coal is 686yuan/mt. As imported coal has no advantage in terms of price, the delivery of domestic coal is expected to accelerate. However, based on analysis of the coal market for the whole year, it is predicted that the coal price increase this year will not be significant. The range of forecast for coal prices during the peak season is currently maintained at 690-710yuan/mt. Methanol plants would be little affected by economics based on coal during the peak demand season for coal in summer.

Looking forward, there's pressure from supply recovery after plant turnaround season, as well as lower MTO operating rate. The support comes from favorable macro economy, buoyant commodity market and currently low inventory. Methanol market is expected to keep consolidation in the near term.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price