Will the adjustment in cumulative inventory levels boost the PTA market?

Since December, PTA plants have been operating consistently, with the majority functioning normally and no announced maintenance plans. However, on Monday afternoon, Yisheng New Materials disclosed a 1-month shutdown for the 3.6 million tons PTA unit, leading to a significant reduction in supply.

Based on recent insights into maintenance plans for January and February, it is anticipated that the operating rate of PTA plants may gradually decrease from the current approximately 85% to around 80-81% in mid to late January.

| Company | Capacity (kt/year) | Plant operation |

| Zhongtai | 1200 | shut on Dec 20 |

| Fuhaichuang | 4500 | O/R at 80% and plans to lower to 50% in mid to-late Jan |

| Yisheng Hainan | 2000 | restarted, O/R at 50% |

| One plant in South China | 2500 | 1-week T/A plan in late Jan |

| Yisheng New Materials | 3600 | 1-month T/A plan in end-Jan |

Despite the potential decrease in operating rates, procurement from polyester plants remains strong due to improved sales last Friday, which alleviated inventory pressure. While some polyester plants may delay maintenance plans, uncertainties surround the maintenance schedules of certain large plants. If additional maintenance plans emerge, the estimated PTA plant operating rate may experience downward pressure. However, overall, the PTA plant operating rate is in a state of consolidation.

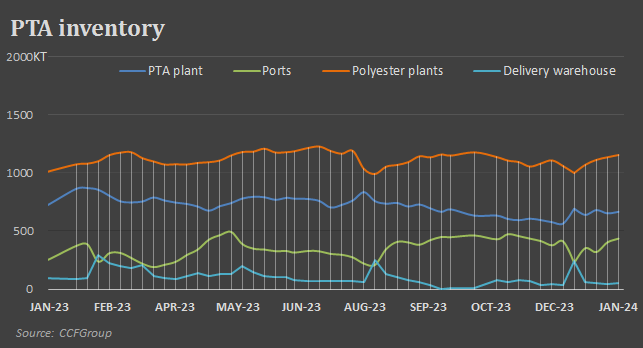

Assuming no major adjustments to the forecast of polyester polymerization rates, it is expected that PTA inventory will increase by 600,000 to 700,000 tons in January and February, 200,000 tons lower than the previous estimation.

Regarding liquidity, the cumulative inventory from December to January has not significantly impacted the basis. The January basis is predominantly maintained around TA2405-40~45. This stability is attributed to delivery demand and increased replenishment enthusiasm from polyester plants starting in mid-December. Despite some regions experiencing tightness last week, there are instances of traders replenishing at high prices. Short-term demand from polyester plants is anticipated to persist, resulting in relatively stable PTA basis in January. In February, the focus will shift to the implementation of polyester plant maintenance. If maintenance occurs as estimated, the enthusiasm of polyester plants for raw material replenishment is expected to decrease, leading to inventory digestion. PTA inventory will mainly be concentrated in PTA plants and ports in February. During this period, PTA is likely to face certain sales pressure, and the basis may exhibit weaker performance. However, based on the expectation of reduced cumulative inventory and improved local excess situations, there is limited downward potential for the basis.

Regarding prices, as long as crude oil experiences no significant fluctuations, PTA is anticipated to maintain a range-bound trend.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price