Why cotton linter import from

The import volume of cotton linter once again grew significantly in Nov after lingering at a low level for several months, especially the outstanding performance of Indian cotton linter with the volume soaring further.

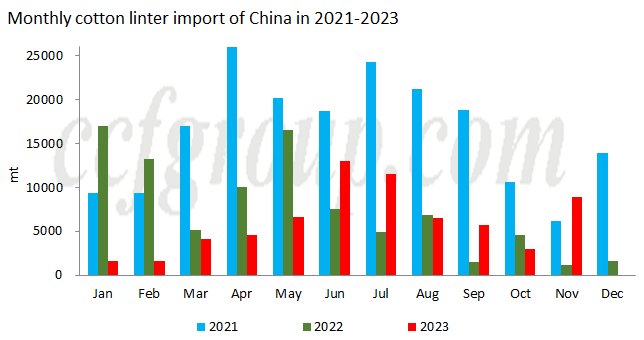

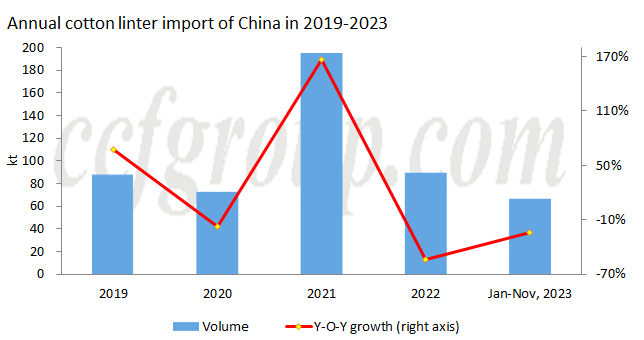

Due to the weak oil and meal market in China, cottonseed oil plans are suffering losses recently, leading to lower operating rates of cottonseed oil and delinting plants. As a result, the supply of Chinese cotton linter has been limited, causing the producers to continue raising prices and resulting in an upward trend. Against this background, cotton linter import market has heated up in recent months and the import volume in Nov has increased again to around 8.862kt, a m-o-m increase of 193.79% and a y-o-y increase of 642.23%. The cumulative import volume from Jan to Nov was about 67.02kt, posting a narrower y-o-y decrease of 24.13%.

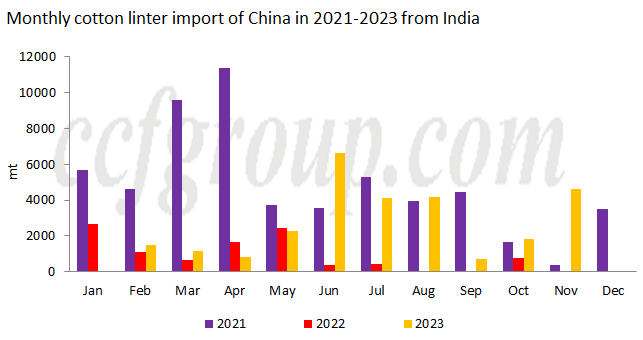

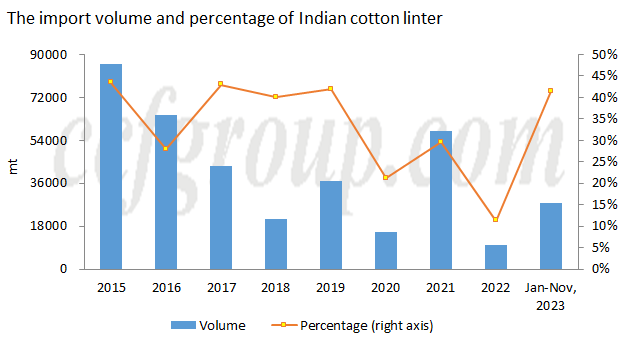

In terms of the import origins, the concentration of cotton linter imports is high this year, mainly from India, Turkey, and Brazil, accounting for 94.2% of the total in Nov, and 92.1% from Jan to Nov. Among them, the import volume of Indian cotton linter has grown dramatically this year, with an import volume of about 4.622kt in Nov, taking up 52.2% of the total. The cumulative import volume from Jan to Nov was about 27.748kt, accounting for 41.4%, a y-o-y increase of 174.9%.

In addition to changes in end-user demand, the main reason for this phenomenon is price. The price of Indian cotton linter is significantly lower than Chinese, Turkish and Brazilian cotton linter. The average import price for Chinese cotton linter in Nov was $397.58/mt, and that of Indian cotton linter was $312.2/mt, which was 21.5% lower than the average price. The average import price for cotton linter from Jan to Nov was $413.23/mt, and that of Indian cotton linter was $311.57/mt, which was 24.6% lower than the average price.

In conclusion, China's cotton linter import market has fluctuated greatly this year, with monthly import volume exceeding 10kt in Jun-Jul, shrinking from Aug to Oct, and increasing again in Nov, mainly from India, Turkey, and Brazil. In particular, the import volume of Indian cotton linter continues to surge. In addition to factors such as demand and resources, price is an important reason.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price