PFY companies may slightly cut price in December

The price of crude oil has risk to fall and the overall market is still in range bound, which may stop falling and consolidate in short run but may curve downtrend on the whole.

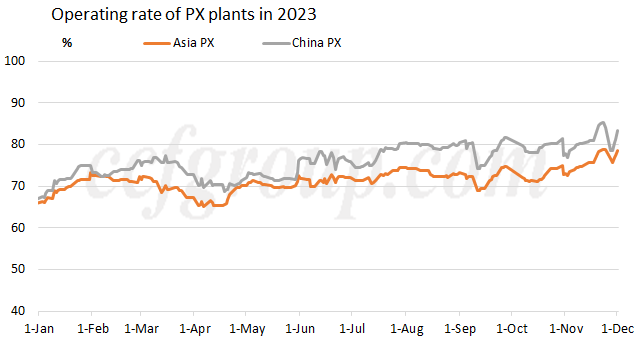

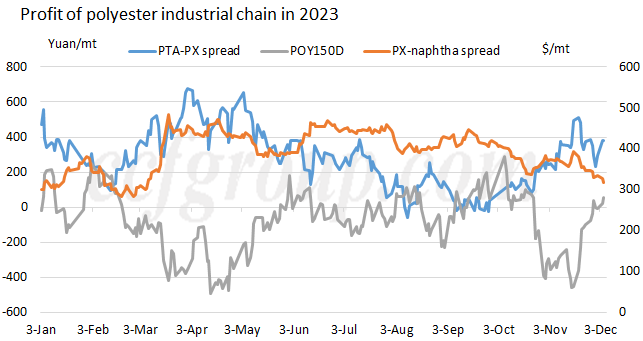

Meanwhile, PXN has been lower than $330/mt this week, hitting new low since Mar. China domestic PX plant operating rate has increased notably in Nov. Shenghong cut PX plant operating rate on Oct 7 and recovered in early Nov, ZPC shut one line temporarily and restarted in early Nov, CNPC Sichuan restarted its 750kt/yr PX plant in mid-Nov after two months of maintenance. China PX plant operating rate rose to hit 85%, this year's new high, despite Weilian Chemical's maintenance on 1 million mt/yr PX line starting from Nov 6 and ending on Nov 19. Outside China, several South Korean producers have raised PX plant operating rates, further leading to rising supply of PX.

Benefitting from falling oil price and shrinking PXN, the profit of PTA and polyester products apparently improved. The processing spread of PTA has been recovered to above 400yuan/mt and the profit of polyester products increased. PFY have turned to be profitable. The cash flow of conventional POY150D and FDY150D recovered to 160yuan/mt and 330yuan/mt respectively.

| Cash flow of major polyester products (Unit: yuan/mt) | ||||||

| Date | Bright FDY75D/36F | PET fiber chip | POY150D | FDY150D | PSF | PET bottle chip |

| 4-Dec | 140.18 | 85.18 | 160.2 | 330.2 | -54.8 | -123.8 |

| 1-Dec | 121.17 | 56.17 | 131.2 | 301.2 | -43.8 | -145.8 |

| 30-Nov | 145.4 | 70.4 | 135.4 | 325.4 | -9.6 | -117.6 |

| 29-Nov | 177.73 | 112.73 | 177.7 | 372.7 | 17.7 | -137.3 |

| 28-Nov | 118.72 | 73.72 | 98.7 | 308.7 | 13.7 | -136.3 |

| 27-Nov | 107.84 | 57.84 | 62.8 | 287.8 | -7.2 | -155.2 |

| 24-Nov | 125.82 | 20.82 | 40.8 | 260.8 | 0.8 | -152.2 |

| 23-Nov | 73.55 | 23.55 | 18.6 | 213.6 | -1.4 | -163.4 |

| 22-Nov | 45.83 | 10.83 | 10.8 | 160.8 | -39.2 | -176.2 |

| 21-Nov | -55.42 | -40.42 | -90.4 | 59.6 | -95.4 | -277.4 |

| 20-Nov | -221.3 | -111.3 | -226.3 | -81.3 | -171.3 | -321.3 |

Sales pressure also gradually ascended when the profit improved. The orders for winter products gradually came to an end from last week. Downstream market tends to slacken again. Coupled with reducing feedstock price, downstream players showed strong watch-and-see stance. PFY plants also started cutting price after holding price firm for a short period.

In terms of market outlook, with rising pressure on polyester market, polyester companies may cut price when the processing spread is improving. However, polyester enterprises do not face apparent inventory burden temporarily when downstream and upstream market is in game. The operating rate of downstream plants declines but remains high. Therefore, price of polyester products is expected to reduce slightly on the whole.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price