Gasoline blending unlikely to continue supporting toluene and mixed xylenes

Gasoline market picked up with sales improving in the week beginning from Nov 27. The improvement of the market recently was attributed to that firstly, gasoline production from refineries in Shandong is reduced and the inventory is low due to squeezed profits and shortage of feedstock in Oct, and secondly, transaction of gasoline orders became larger recently, indicating better demand.

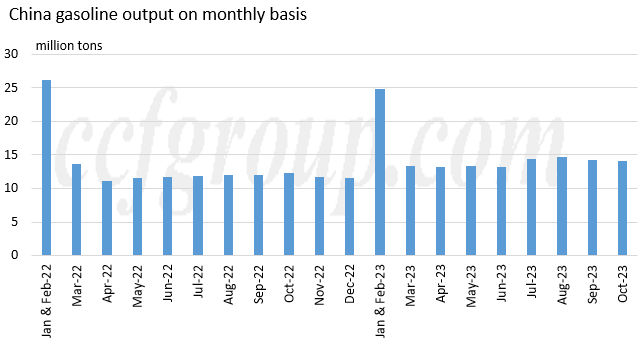

In Jul and Aug 2023, China monthly gasoline output increased notably, up from 13.26 million tons in Jun to 14.35 million tons in Jul, and further to 14.69 million tons in Aug. The output reached this year's high point in Jul and Aug, as gasoline blending demand was robust at that time outside China which led to high profits in China gasoline exports.

Beginning from Sep, however, gasoline blending demand outside China faded, with a squeeze in profits of exports from China. In Oct, in particular, some refineries in Shandong, China cut operating rates of CDUs in response to poor economics. As a result, China gasoline output decreased by 460kt on month to 14.23 million tons in Sep, and further by 150kt to 14.08 million tons in Oct. In Nov, the output is expected to further reduce.

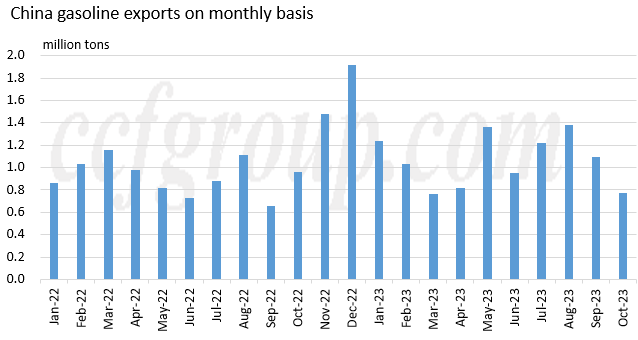

Concerning the exports, China has issued three batches of gasoline export quota in 2023, with a total amount of 39.99 million tons, up 2.74 million tons from the year earlier. In May, Jul and Aug, it recorded high volume of exports, but the exports reduced obviously in Sep due to squeezed exporting profits as well as lower production.

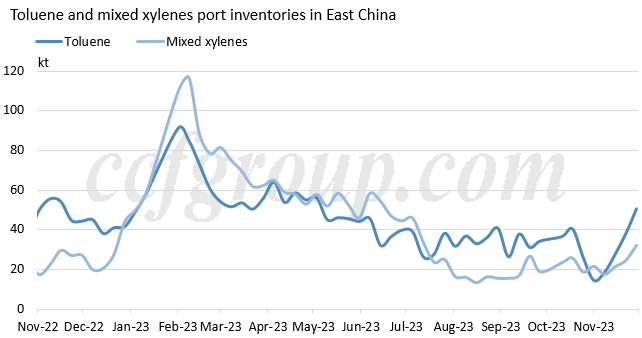

Toward winter, though demand for gasoline may recover, it could not sustain for long, and thus it would be difficult for toluene and MX to find support from gasoline market. In addition, with intensive arriving of cargoes to East China recently, toluene inventory has increased obviously.

Tank inventory of toluene and MX at East China ports has been decreasing persistently since Feb 2023, reaching new low levels in recent years in the latter half of 2023. In Nov, however, toluene inventory rose rapidly. Hengli began selling toluene in Jul, and the selling volume was quite large in Sep and Oct, but reduced in Nov due to cut of production. MX inventory also shows an uptrend with cargoes arriving.

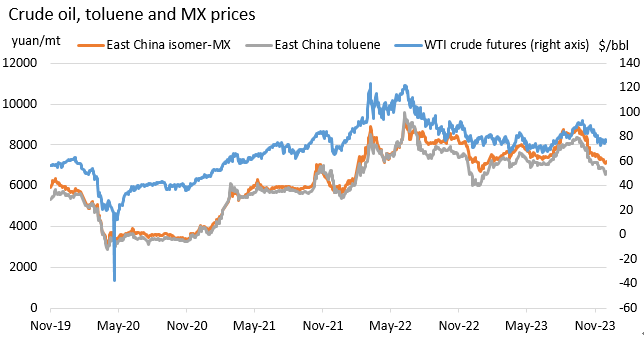

The prices usually decline in Nov and Dec, except for in 2020. In Dec 2023, toluene and MX prices are likely to stay weak with gradual rise of inventory coupled with diminished support from gasoline blending.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price