Spandex producers curtail production again amid weaker demand and cost

Falling selling price of spandex is not only related with lower feedstock price, but also impacted by apparently reducing consumption worldwide with inflation, regional conflict and energy crisis etc. The economic development is under downtrend and internal circulation of consumption is hard to hike, which is obviously in contrast with great expansion in supply of spandex. The inner competition of spandex value chain is escalated. Price of spandex has slowly headed south since late-Oct and most spandex suppliers face apparent selling pressure. Players worry the inventory of spandex and feedstock to be depreciated. Some spandex producers plan to cut or suspend production and some have begun.

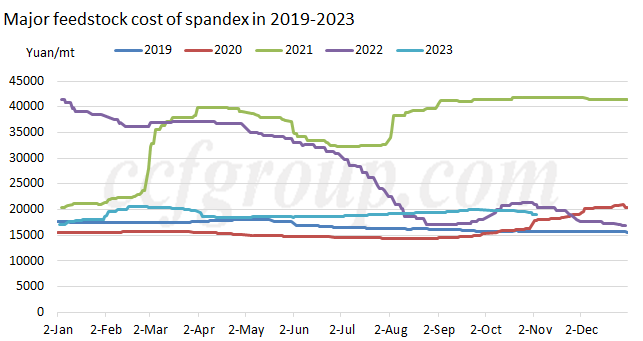

Feedstock cost: retreating from high level

Price of PTMEG has peaked and slightly decreases, which may reduce more after supply increases. The cost of spandex market is still likely to collapse. Some spandex plants who are not integrated with PTMEG production will slightly slash or halt production. Many MDI units have turnaround recently. Ningbo Wanhua and Covestro will have maintenance. Therefore, supply of MMDI is expected to apparently decrease. Demand for MMDI is weak but as supply reduces, the market fundamental may be strong and price of MMDI is estimated to move up. Combined the price trend of PTMEG and MMDI, major feedstock cost of spandex may keep falling in Nov.

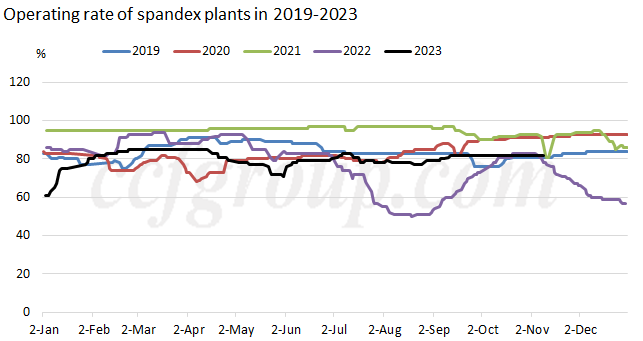

Operating rate of spandex plants is at 82% now and may be the peak in Q4 2023. The run rate of companies who are not integrated with PTMEG production is around 85% now and is anticipated to descend in expectation of increasing production cut in Nov-Dec amid weaker supply/demand and cost. The run rate of spandex enterprises who are integrated with PTMEG production is near 76% now and may increase later. The change of operating rate should pay attention to downstream demand and PTMEG price.

Demand: the performance in Oct was worse than anticipated and the run rate of fabric mills was weak-to-stable

Price of major raw materials of textiles and apparels has kept dropping since Oct, with decrement of PFY, NFY and cotton yarn at 4.6-8% and that of rayon yarn and spandex smaller at 0.4-1.6%. Most spandex plants have suffered losses for long and are firm in curbing price from declining in traditional peak season.

| Price change of major raw materials of textiles and apparels | |||||

| Date | Chemical fiber | Cotton textiles | |||

| Spandex 40D | Polyester POY150/48 | Nylon 6 FDY 70D/24F | Cotton yarn40S | Rayon yarn 30S | |

| 2023-9-28 | 31,000 | 7,985 | 18,350 | 25,630 | 17,020 |

| 2023-11-9 | 30,500 | 7,350 | 17,500 | 24,040 | 16,960 |

| Change: Yuan/mt | -500 | -635 | -850 | -1,590 | -60 |

| Change: % | -1.60% | -8.00% | -4.60% | -6.20% | -0.40% |

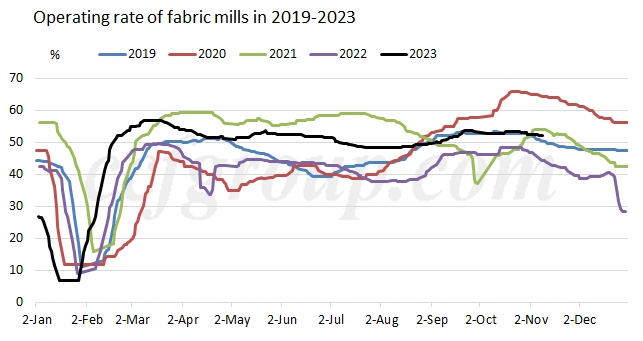

The operating rate of most downstream plants inches down. Sales of seasonal winter fabrics reduce and orders for spring and summer fabrics remain insufficient when feedstock price is not steady. Players show bearish view toward spandex market and mainly adopt sidelined attitude. Most downstream participants control inventory. The inventory of spandex is mainly in the hands of spandex suppliers. The operating rate of downstream plants is diversified now, with that of circular knitting mills in Zhejiang and Jiangsu around 50%, that of circular knitting plants in Foshan, Chaozhou and Shantou from Guangdong at 30-40%, that of covered yarn mills in Zhejiang and Jiangsu and warp knitting plants in Haining at above 60%, that of warp knitting mills in Guangdong at above 70% and that of lace knitting mills in Fujian and braid producers in Guangdong at 30-50%.

Remark: above run rate is the average run rate of conventional covered yarn plants in Zhejiang, circular knitting plants in Guangdong, Zhejiang and Jiangsu, warp knitting plants in Guangdong, lace mills in Fujian and core-spun yarn plants in Zhangjiagang.

Spandex suppliers still encounter selling pressure with weaker downstream demand. Although some orders for spring and summer wear may chase up in end-2023 and some orders for winter goods may appear, as the capacity of spandex market and fabric manufacturing sector is in obvious glut, demand for spandex is hard to hit expectation but may continue shrinking. Appropriately slashing production may be the best choice for spandex companies who are not integrated with feedstock production. With rapid development of spandex and upstream industry, more spandex companies are integrated with upstream PTMEG production, and those integrated spandex producers may ramp up run rate in short run, while the long-term trend needs to pay attention to the demand change. The operating rate of spandex plants is estimated to rise slightly at first and then apparently decrease in Q4 2023. Price of spandex is expected to remain weak with pressure from supply/demand and plunging cost.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price