China's MEG imports to drop in March-April

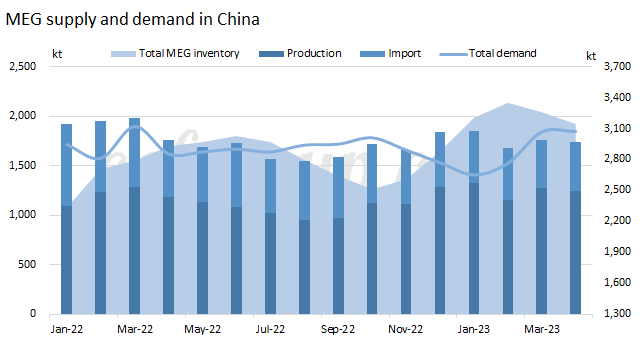

MEG spot and futures remained weak in the first half of February along with the the continued decrease in commodity futures. Coal prices decreased and end-user orders were tepid.

MEG supply also decreased both in and outside China. China's MEG imports may fell to a record low in March-April. China domestic MEG output will also decrease.

China's imports

Local MEG inventory in the US market was tight previously due to the shutdown of Lotte, MEGlobal and Nan Ya. Loadings of US cargoes to China continued decreasing in January and February. China's MEG imports from the US and Canada is estimated at about 100kt per month, and those cargoes are expected to arrive in China in February-April. In addition, suppliers are also inactive to ship MEG to China due to the low price in China.

In Saudi Arabia, Yansab has shut its 910kt/year MEG plant for maintenance. Kayan also plans to shut its 850kt/year plant for maintenance. Sharq is also running its units at lowered rate. Output in Saudi Arabia will decrease apparently in the first quarter and month loadings are expected to fell to about 260-280kt. As a result, some suppliers are also seeking spot cargoes in the market.

PRefChem mainly sells its cargoes to Thailand, and there are no cargoes to China yet. Increase from this plant to China will be seen in March, estimated at about 10-20kt.

As of Iran's cargoes, about 40kt were loaded in H2 Jan and which were expected to arrive in China in H2 Feb. Morvarid unexpectedly shut in early Feb without restart timing yet. No tenders of Morvarid are heard. In Kuwait, EQUATE is running its two units at lowered rate and the contract supply has been also lowered. The 530kta unit will be shut in March for annual maintenance. The contract supply gap will be larger in March.

In general, China's MEG imports will drop to a record low in March-April, estimated at about 480-500kt.

China domestic supply

ZPC and Yulin are running at lowered rate and the restart of Satellite PC's one line has been delayed. Some producers raised EO output due to widening EO-EG spread. China domestic MEG output will also decrease. Market participants are expecting lower coal prices, but Hongsifang, Sanning, Huayi and HNEC Puyang have no restart plan yet. The exact restarts of HNEC Yongcheng and Guanghui are still uncertain. MEG producers will keep lower output due to persistent low profits. Eyes could rest on the product conversion of several major producers.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price