2023 MEG market highlights

CAPACITY GROWTH SLOWS DOWN

World MEG capacity is expected to increase by 3.65 million mt/year in 2023. China will see an increase of 2.8 million mt/year, and the increase outside China will be around 0.85 million mt/year. Compared to 2021-2022, the growth rate of capacity will slow significantly, with possible delays and even conversion to other products.

Coal-based MEG units to start in the second half of 2023 are highly uncertain. In addition, Sanjiang Chemical originally planned to start a 1 million mt/year ethane-based MEG unit in 2023. Sanjiang plans to carry out technological transformation at this unit for EO production, and MEG capacity will be reduced to about 200kt/year. Whether the unit can be successfully put into production in 2023 is still uncertain.

Shenghong Petrochemical originally planned to start its 1 million mt/year No.2 MEG plant after Chinese New Year. Its February start-up plan has been cancelled and the exact timing of the start-up is uncertain.

Outside of China, Iran's Pars Glycol has started its 450kt/year MEG unit and is now operating at around 80%. The start-up of Indian Oil Corp's 400kt/year MEG unit has been postponed to the second half of 2023.

New units in 2023

| Company | Location | Capacity | Startup |

| Indian Oil Corp | India | 400 | H2 2023 |

| Pars Glycol | Iran | 450 | Jan (80%) |

| Shenghong | Lianyungang, Jiangsu | 1000 | Mar or after Mar |

| Sanjiang | Jiaxing, Zhejiang | 200 | H2 2023 |

| Sinopec Hainan | Hainan | 800 | Feb |

| Ningxia Baoli #1 | Ningxia | 200 | H2 2023 |

| Yulin Energy | Yulin, Shaanxi | 400 | end 2023 |

| Ningxia Baoli #2 | Ningxia | 200 | end 2023 |

| Total | 3650 |

PRODUCTION SWITCH

Due to extremely poor margins in 2022, China's MEG producers, mostly integrated ones, also plan to switch to other products in 2023.

Units to switch production

| Company | Location | Capacity | Output loss since |

| Hengli | Dalian, Liaoning | 900 | May-Jun |

| Satellite | Lianyungang, Jiangsu | 900 | Jun |

| ZPC | Zhoushan, Zhejiang | 800 | Q1 |

| ZRCC #1 | Ningbo, Zhejiang | 650 | Mar |

| BASF-YPC | Nanjing, Jiangsu | 340 | Apr |

| Gulei | Fujian | 700 | Mar |

HIGHER OUTPUT GROWTH

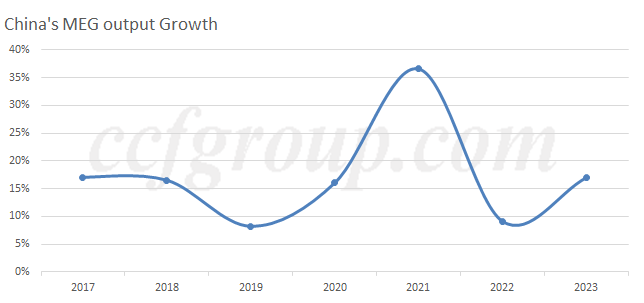

China domestic MEG production in 2023 is estimated at 15.6 million tons, with an estimated growth rate of 16%, higher than in 2022.

IMPORTS CONTINUES TO DECLINE

China's MEG imports will continue to decline, but may also rebound if production margins recover.

China's MEG imports in 2023 will decline further, estimated at about 6.7 million tons, and import dependence will fall to about 30%. MEG production margins are expected to improve in 2023 as U.S. ethane prices fall and MEG-ethylene spreads expand. Some units outside China may be restarted.

OVERSUPPLY IN 2023

The excess of MEG supply over demand in China is estimated at 400-500kt in 2023. January-February will see a clear build-up of inventory and March will see a turning point. Total MEG inventory is expected to decrease in the second quarter. Specifically, we should also pay attention to the implementation of the technical reform of major units and the progress of annual maintenance.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price