Ordering chance is scarce, Oct cotton yarn imports may reduce about 10kt

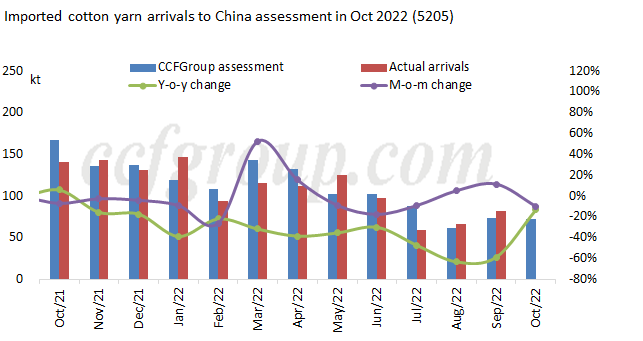

1. It is estimated that cotton yarn imports will reach 71.7Kt in Oct, down about 48.85% on year and down 12.13% on month

With peak season going by, the trading enthusiasm in cotton yarn market gradually moved down. Besides, epidemic in different regions made cotton yarn sales slip dramatically, and spot imported yarn prices were hard to be firm. Meanwhile, the data released by China Customs shown that Oct export value of textile and apparel reached $25.02 billion, down 13.5% on year and down 10% on month. The shrinkage of textile and apparel export value in the second half of this year proved non-ideal order taking of downstream end export. In combination with customs import and export caliber estimation, cotton yarn imports in Oct may fall to 71.7Kt in Sep, down about 10kt on month.

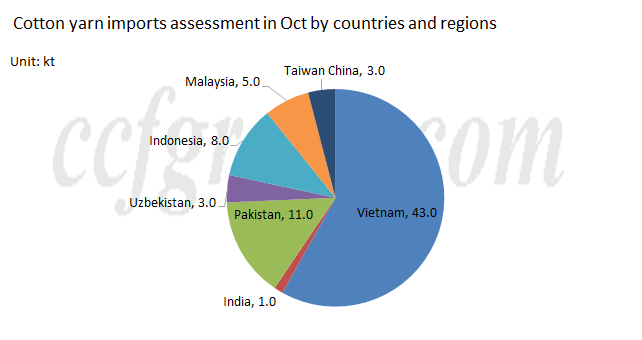

2. Vietnamese and Pakistani cotton yarn imports reduced slightly

Vietnamese and Pakistani cotton yarn imports reduced. On the one hand, Vietnamese yarn imports shown periodical change. The imports that were ordered intensively at previous stage have basically finished till Oct, and the overall volume was not as many as that in Sep; on the other hand, Pakistani yarn imports that have delayed almost one month arrived in Oct. Cotton yarn export volume in other regions changed little. The ordering volume of Indian open-end yarn and combed compact-spun yarn rose a little with the falling of Indian local cotton price, and the imports in Oct are estimated to increase slightly to around 1kt.

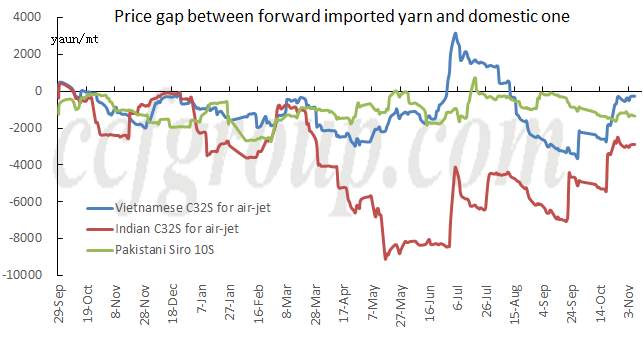

3. Ordering chance was scarce, only few open-end yarn imports arrived at port for replenishment

Entering into Oct, with continuous falling of international cotton price, forward imported yarn prices reached the lowest point recently when ICE cotton futures reached around 70cents/lb. The ordering chance of imported ring-spun yarn was still scarce as spot imported yarn prices continuously dropped, and only imported open-end yarn replenished few. New orders lacked amid the rebound of ICE cotton futures. Cotton yarn prices were obviously hard to follow the rise, and traders were more cautious about ordering.

4. Conclusion and outlook

In the second half of this year, Chinese and international cotton prices were closer again and stayed flat in end-Oct amid macro-economic situation and the reduction of global demand. However, the suspension and rebound of ICE cotton futures made the price of that far from ZCE cotton futures again, which means it will be hard for the prices of cotton yarn from places like Vietnam and Malaysia to compete with Chinese cotton yarn. Meanwhile, Indian cotton and Pakistani cotton arrived slowly and local cotton prices haven’t declined largely, making forward imported yarn prices still higher than domestic one. In the future, traders’ ordering pressure will not only come from high forward yarn price, but also from fast depreciation of spot yarn. Imported open-end yarn with firm spot price will be a good choice for traders.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price