PX supply remains tight, but new plants expected to start

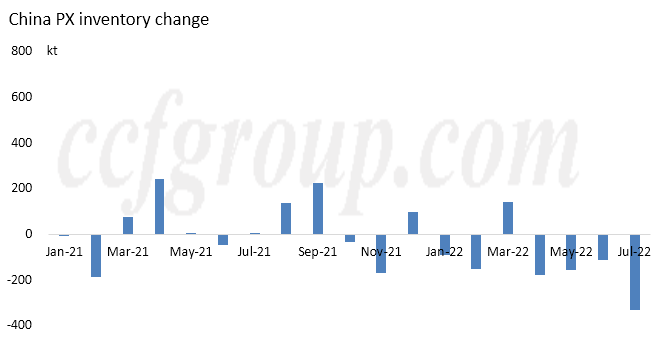

China PX inventory has been reducing continuously, shedding more than 800kt throughout the first 7 months of 2022 according to CCFGroup’s statistics. Domestic PX supply remains tight, especially when some imported cargoes are delayed. Several domestic PTA plants are under strains from lack of feedstock. According to CCFGroup’s investigation, PX stocks in some PTA plants has decreased to what can be consumed to maintain current production for only 1 week. As a result, China domestic PTA plant operation rate has been restricted by low PX availability since mid-Jul.

Tight supply of PX is currently expected to continue.

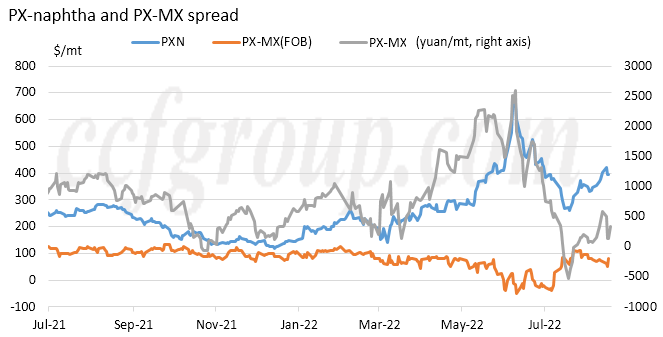

In terms of profits, though PX-naphtha spread hovers high, PX-MX spread stands at medium or low level. PX-MX spread on FOB Korea basis broke $100/mt temporarily in end-Jul, but then fell back to $80/mt, barely above breakeven line. The spread on yuan basis has recovered from negative in early Jul, but is still under breakeven line. Therefore, PX production based on merchant MX is restricted by losses, with low plant operating rate.

On supply front, Sinopec ZRCC is going to conduct maintenance on its 750kt/yr PX plant in end-Aug for 90 days, Fuhaichuang is preliminarily expected not to restart one 800kt/yr PX line until late Sep and the restart date of the other line is undecided. In addition, some plants running at reduced O/R is unlikely to raise production in the short term. Therefore, China domestic PX production in Sep is anticipated to be little changed from Aug, though Sinopec Shanghai and Zhongjin Petrochemical increases production.

In terms of imports, according to the latest news, China monthly PX imports in Jul could hit new low since Dec 2012, amounting to about 600kt. The imports could increase in Aug, as South Korea’s S-Oil has restarted its plant and cargoes from Asia to US reduces. However, other plants would hardly raise the operating rates, while Reliance, Rabigh and Hengyi Brunei even cut O/R in Aug. In Sep, South Korea’s SK plans to shut its 1.3 million mt/yr PX plant for 45-day maintenance and some producers based in South Korea would cut contract supply. Therefore, China PX imports are expected to increase slightly to 700-900kt a month in Aug and Sep.

| South Korea’s PX exports (tons) | |||

| Aug 1-10 | Jul 1-10 | Jul | |

| Chinese mainland | 155,993 | 72,696 | 259,938 |

| Japan | 5,000 | 4,753 | |

| Taiwan | 24,728 | 10,000 | 29,113 |

| US | 9,600 | 49,212 | 130,170 |

| Total | 195,321 | 131,908 | 423,974 |

With limited PX supply increase, PTA plants could still be pressured by low PX availability in Aug and Sep, and plant operations could be restricted.

As for PX, though the tight supply continues, trading in the market centers on Oct and Nov goods, and the supply and demand situation could change with upcoming new plants. Dongying Weilian is expected to start its Phase II PX plant in mid-Oct, Shenghong Refining also plans to to start its new 2 million mt/yr PX plant in Oct; and PetroChina Guangdong is poised to start its new plant in Nov. Though PTA capacity would expand at the same time, due to excessive PTA capacity and anemic demand growth, PX supply increase would outpace that of demand. In a conclusion, PX market is under strong situation against weak expectation. With rollover of laycans and expectation of new plants releasing production, PX market could get impacted.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price