China ACN price dips below 10,000yuan/mt, will it go downward further?

Lihuayi lowers the ACN offers below 10,000yuan/mt to 9,800yuan/mt at the weekend, and traders follow the downward trend successively, but the decrement narrows somewhat. The mainstream offers reduce to around 10,000yuan/mt ex-tank, and prices in Shandong market are around 9,900yuan/mt delivered to Shandong. However, there are offers heard at 9,500yuan/mt, so some market players have doubt about the price trend, whether the prices will keep down.

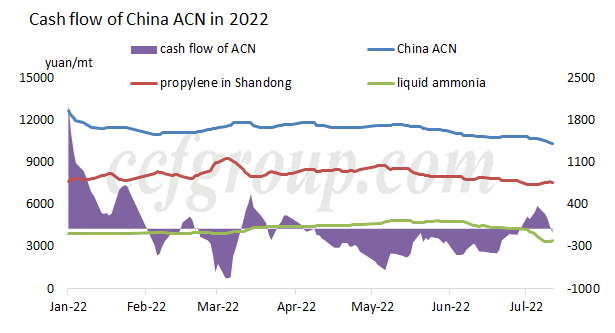

Since Jul, prices of propylene and liquid ammonia are weak overall, especially liquid ammonia, once reaching nearly 3,000yuan/mt. The decline is mainly attributed to the lower prices of urea with the coming slack season of fertilizers, so the demand for liquid ammonia reduces. Feedstock costs for ACN move lower. Under the oversupplied situation, competition in low prices leads to larger downward space for ACN. Currently, the cash flow of ACN is about -70yuan/mt.

ACN demand is lackluster overall. After large reduction of acrylic fiber capacities in 2021, the consumption proportion in total consumption of ACN reduces further. In 2022, the pressure is mainly on ABS market. After experiencing high profits in 2021, prices have been constantly decreasing this year amid weakening demand, and cash flow is also in negative territory. ABS plant operating rate has reduced to a low. Therefore, its consumption for ACN is below the market anticipation. AM prices also move lower following the trend of feedstock, and the operating rate is restrained by high temperature. Demand from other downstream sectors is also lower than market expectation as the transportation and operation is restrained this year by the frequent outbreaks of pandemic.

From the prospective of supply side, the ACN supply is in glut obviously with the start-up of Lihuayi and Sierbang. Though Sierbang and Zhejiang PC shut their one 130kta line respectively for maintenance currently, and KoRuhr and Shandong Haili’s units have not restarted for long time, the stimulus is limited.

Currently, lower offers have been at 9,500yuan/mt. On concern about the coming release of settlement prices, the market players are not expected to see trading prices down further, and settlement prices are likely to be hard to be below 10,000yuan/mt. Therefore, offers are not very likely to keep down. But after the release of settlement prices, whether the prices will stop decreasing is uncertain. Nevertheless, there are some variables, such as the power rationing measures, start-up of new ABS capacity and support policy from government to stimulate the demand.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price