China's spandex import and export descend YOY in Jan-Apr

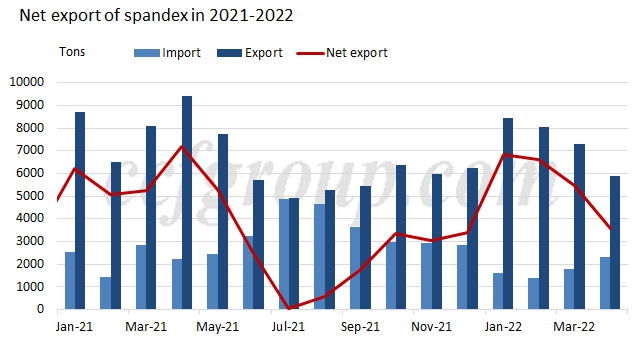

According to the latest data from China customs, exports of spandex amounted to 29.6kt in Jan-Apr, 2022, a year-on-year decrease of 9.5% or 3,096 tons. Imports of spandex declined by 20.7% or 1,883 tons on the year to 7,140 tons in in Jan-Apr. That meant the net exports were at 22.5kt, down 5.1% on annual basis. Imports of spandex remained low in Jan-Apr, 2022, exports gradually fell month by month and net exports were under downtrend.

Export slipped by around 10%

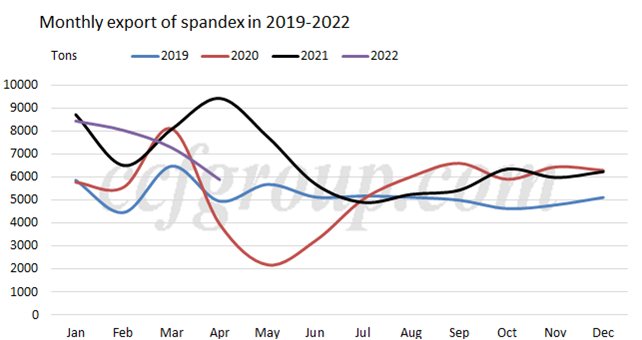

Exports of spandex amounted to 29.6kt in Jan-Apr, 2022, a year-on-year decrease of 9.5% or 3,096 tons. The average export unit price was at $9.060/kg in Jan-Apr, 2022, up by $1.867/kg on the year. Spandex exports gradually dropped month by month in Jan-Apr. The production and export of textiles and apparels recovered in Vietnam and India, while replenishment reduced with rapidly falling spandex prices. Suppliers saw reducing orders. Spandex exports totaled 5,891 tons in Apr, down 19% on the month and 37.5% on the year respectively, with export unit price at $8.528/kg, down by $0.31/kg over last month.

Spandex were exported to 91 nations or regions in Jan-Apr, 2022, up by 5 on annual basis. Turkey remained the biggest export destination, followed by South Korea and Vietnam. The proportion of the top three nations amounted to 50.5% of the total.

Exports of spandex to Bangladesh, Egypt, India and Taiwan, China declined apparently by 20-50% over the same period of last year in Jan-Apr, 2022.

| Major export destinations of spandex in Jan-Apr, 2022 | ||||||

| Destination | Volume/kg | Value/USD | Proportion | Average price/$/kg | YOY change/kg | YOY change/% |

| Turkey | 11,438,500 | 98,699,920 | 38.60% | 8.629 | 2,752,434 | 31.70% |

| South Korea | 1,952,609 | 15,483,862 | 6.60% | 7.93 | 225,345 | 13.00% |

| Vietnam | 1,583,686 | 15,242,514 | 5.30% | 9.625 | -100,976 | -6.00% |

| Taiwan China | 1,499,832 | 15,416,474 | 5.10% | 10.279 | -445,785 | -22.90% |

| Pakistan | 1,464,983 | 15,208,966 | 4.90% | 10.382 | 207,475 | 16.50% |

| Egypt | 1,304,138 | 13,273,402 | 4.40% | 10.178 | -705,162 | -35.10% |

| Indonesia | 895,159 | 8,295,013 | 3.00% | 9.267 | 161,265 | 22.00% |

| Bangladesh | 784,117 | 7,855,695 | 2.60% | 10.019 | -738,700 | -48.50% |

| Iran | 728,606 | 6,816,734 | 2.50% | 9.356 | 252,102 | 52.90% |

| India | 603,238 | 4,699,586 | 2.00% | 7.791 | -457,697 | -43.10% |

| Other | 7,385,644 | 67,548,374 | 24.90% | 9.146 | -4,245,938 | -36.50% |

| Total | 29,640,512 | 268,540,540 | 100% | 9.06 | -3,095,637 | -9.50% |

Imports greatly decline by 20%

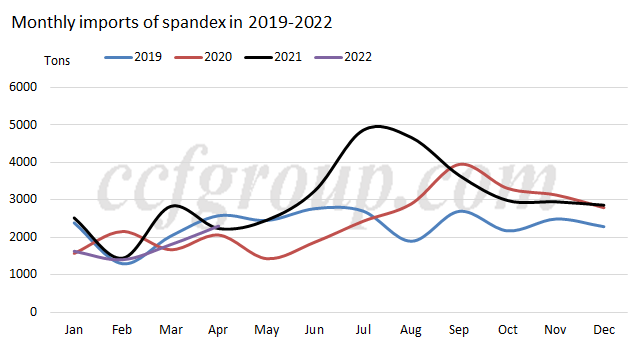

Imports of spandex declined by 20.7% or 1,883 tons on the year to 7,140 tons in in Jan-Apr, and the average import unit price was at $10.872/kg in Jan-Apr, up $2.446/kg y-o-y. Imports of spandex amounted to 2,302 tons in Apr, up 3% y-o-y and 27.5% m-o-m respectively, with import unit price averaged at $9.793/kg, down $1.703/kg on the month. Monthly imports of spandex hit 4-year low in Jan-Apr, 2022.

Vietnam, Singapore and South Korea were major import origins of spandex, with proportion of these three nations at 77.7% in Jan-Apr. Imports from major origins all decreased dramatically in 2022. Among these, imports from Vietnam, Singapore, South Korea and Japan reduced by 23.6%, 12.5%, 8.1% and 30.6% on the year respectively in Jan-Apr.

| Import origins of spandex in Jan-Apr, 2022 | ||||||

| Origin | Volume/kg | Value/USD | Proportion | Average price/$/kg | YOY change/kg | YOY change/% |

| Vietnam | 2,691,514 | 24,680,272 | 37.70% | 9.17 | -833,301 | -23.60% |

| Singapore | 1,584,596 | 19,409,990 | 22.20% | 12.249 | -226,249 | -12.50% |

| South Korea | 1,268,120 | 14,670,425 | 17.80% | 11.569 | -111,239 | -8.10% |

| Japan | 763,082 | 10,692,004 | 10.70% | 14.012 | -336,003 | -30.60% |

| UK | 380,594 | 3,344,279 | 5.30% | 8.787 | -57,746 | -13.20% |

| Other | 451,758 | 4,825,959 | 6.30% | 10.683 | -318,344 | -40.00% |

| Total | 7,139,664 | 77,622,929 | 100.00% | 10.872 | -1,882,882 | -20.70% |

Many multinational companies concentrated on filling the demand outside China after spandex market weakened in China in Jan-Apr, 2022. Textiles and apparels production and export recovered in Southeast Asia with eased pandemic prevention and control, ending up with higher demand for spandex. Overseas companies focused on filling demand from nearby markets. In addition, some multinational companies reduced distributing spandex to Chinese mainland and focused on consuming local spandex with supply glut in China. Due to the pandemic prevention and control in some regions of China, the disinfection on imported goods remained stricter. It took longer time for customs clearance. In addition, high sea freight still impacted spandex imports.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price