Methanol to get supported by spring turnarounds

China methanol market stabilized recently after the sharp decline back from the holiday. Crude oil strengthened, supportive to petrochemicals as well as methanol. Meanwhile, methanol supply and demand fundamentals were likely to paint a rosy picture, and participants expected methanol supply to contract with the upcoming spring turnaround season.

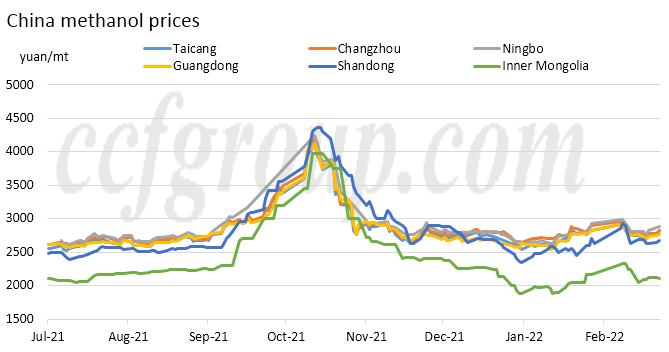

In terms of pricing, it was still greatly affected by feedstock coal and relevant crude oil. Crude oil price strengthened at highs on the back of geopolitical issue and supply concerns. As for coal, demand remained strong in China, and the price rose from lows. Supported by relevant products, methanol market shivered upward.

According to the feedback from traders at coastal regions, trading sentiment in methanol market has picked up, compared to the lukewarm situation prior to the Spring Festival. As for USD-denominated markets, except for FOB USG methanol which pulled back, other markets, CFR Southeast Asia methanol in particular, stayed strong.

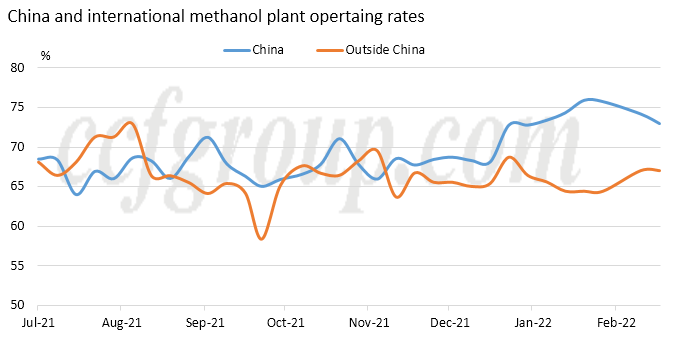

In terms of plant operations, China domestic methanol plant operating rate had rebounded to above 70%. Though there was some drop recently, the operating rate was higher than the level in the latter half of 2021. Methanol plants outside China, especially for those in Iran which were shut earlier due to gas restrictions in winter, had restarted intensively in early Feb and the first half of Feb. Overseas supply increased with average plant operating rate up to 65-70%.

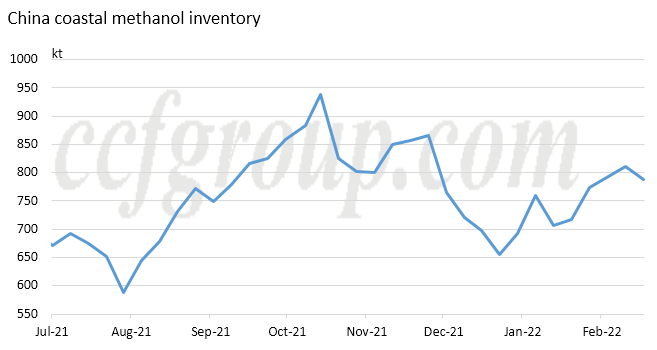

In terms of inventory, it had been increasing in coastal storage reserves since the beginning of 2022, but reduced slightly in the latest week, temporarily supportive to coastal methanol price. In interior regions, product inventory in methanol plants had increased to 8.05 days in Northwest China, bringing slight pressure on producer’s offers. The increase in product inventory was also caused by rising freight, as logistics were impacted by rains and snows in inland China. Producers were under strains from high inventory.

In downstream sector, the composite operating rate of methanol’s downstream plants was steady to higher, but fell back again recently due to reduced profits. It averaged about 60% currently. Methanol-to-olefins profits increased to 300yuan/mt before sliding to lows. Acetic acid profits maintained in the range of 1900-3500yuan/mt, while reducing persistently after the Spring Festival. Formaldehyde and DME profits were even in negative territory.

Looking forward, the upcoming spring turnaround season could bolster methanol market, while methanol market would still be dependent on crude oil and coal. However, it is for sure that methanol supply and demand could play an increasingly important role to the market in the second quarter.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price