PP market review in 2024

1. Spot Price

In terms of price trend, PP granule market in 2024 strengthened first and then weakened. In the first half of the year, affected by factors such as geopolitics, macro policies, crude oil prices and plant maintenance, the spot price of PP fluctuated higher, reaching the highest point of the year at the end of May and the beginning of June. In the second half of the year, as the bullish sentiment was gradually digested, the supply increased and the demand weakened, the market trend changed from rising to falling. Although September is traditionally the peak season of demand, the actual demand was lower than expected and the market performance was not ideal. In late September, stimulated by the unexpected interest rate cut by the Federal Reserve and the frequent introduction of domestic macroeconomic favorable policies, the spot price continued to rise. After the National Day holiday, the peak demand season in Oct ended early and the market fell again.

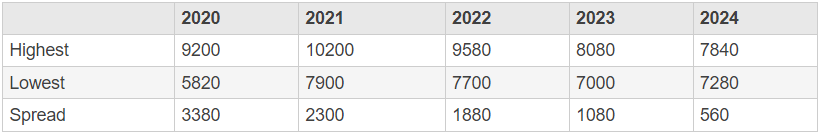

In terms of price fluctuation range, with the increase in supply, the fluctuation range of PP price has been decreasing year by year.

2. Cash Flow

From the perspective of theoretical data, taking the price of homo PP raffia as the calculation standard, PP has been in a loss-making state for a long time at present. Currently, the best-performing one is the imported propylene-based PP. However, most domestic production units are integrated units, and the imported propylene-based PP only accounts for about 4.57%.

3. New Production Capacity

In 2024, China PP granule production capacity increased to 43.785 million tons/year. The implementation rate of the newly added output was far from meeting expectations. In addition, although some plants have already been put into production, they are not running stably.

|

Sources of propylene |

Region |

Company |

Capacity(KTA) |

Startup |

|

Oil-based |

South China |

PetroChina Guangdong PC II |

200 |

Jan |

|

PDH |

South China |

Zhongjing PC(capacity expansion) |

150 |

Feb |

|

PDH |

South China |

Zhongjiang PC(capacity expansion) |

150 |

Feb |

|

Out-sourced propylene |

South China |

Huizhou Lituo New Material |

150 |

Mar |

|

PDH |

South China |

Quanzhou Grand Pacific Chemical |

450 |

May |

|

Oil-based |

East China |

Anhui Tianda |

150 |

May |

|

PDH |

North China |

Qingdao Jineng Technology II |

900 |

May |

|

PDH |

South China |

Zhongjing PC II #2 |

600 |

Jun |

|

Oil-based |

North China |

Sinopec/Ineos Tianjin |

350 |

Oct |

|

Oil-based |

North China |

Jincheng Petrochemical #1 |

150 |

Nov |

|

Oil-based |

Northwest China |

Inner Mongolia Baofeng #1 |

500 |

Dec |

|

Oil-based |

North China |

Yulong Petrochemical #1, #3, #5 |

1100 |

Dec |

|

Total |

4850 |

|||

4. Imports and Exports

As a major highlight of PP in 2024, the changes in PP imports and exports cannot be ignored. From January to November 2024, the import volume of PP was approximately 3.3347 million tons, a year-on-year decrease of 10.90%. The export volume of PP was approximately 2.2094 million tons, a year-on-year increase of 81.10%. The net import volume of PP was approximately 1.1253 million tons, a year-on-year decrease of 55.39%.

As the domestic production capacity continues to be released, the import and export structure is constantly changing. China's polypropylene will gradually transform from a net importer to an exporter.

5. Downstream BOPP

In 2024, the operation of the BOPP market, which is downstream of PP, was relatively stable, with little price fluctuation. The price remained around 9,000yuan/mt for a long time. The annual price fluctuation range was about 250 yuan/mt, among which the fluctuation range in the first half of the year was only 100 yuan/mt. In 2024, the BOPP price witnessed relatively obvious rises and falls only in October. The highest price appeared in mid-October, while the lowest price occurred in mid-to-late September.

In 2024, the cash flow of the BOPP industry was relatively stable. However, compared with previous years, the cash flow of the BOPP industry continued to decline in 2024. Specifically, the cash flow of the BOPP industry continued to decrease in the first half of the year, and there was even a loss situation from June to July. The cash flow situation improved slightly from August to November.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price