China's nylon 6 export changes under drastic growth

1. Nylon 6 export growth rate slows in Jan-Jul 2024

Nylon 6 (HS Code: 39081012) export from China has achieved great elevation since the year of 2021, with the total export volume in 2023 almost tripling that of 2020.

During the year of 2016 and 2020, the annual export growth rates were kept between 0% to 40%, as only that of 2018 witnessed a slight decline, and almost none change in 2020. The dull growth in 2020 was mainly related to the COVID-19 pandemic, when global consumption was heavily hit and China's production also limited. But in 2021, as China sustained a high capacity growth for nylon 6 industry and kept a steady and sustainable supply chain to international market, export demand recovered evidently. That is how we see such an outstanding change in 2021, ever since when export growth returns to a slower and normal pace.

With nylon 6 export still growing in 2022-2024, the growth rate gradually reduced from over 100% to around 20%. In the first 7 months of 2024, nylon 6 export has increased by 20%, compared to the same period of last year, indicating a steadier and slower pace of growth trend.

Comparing the cumulative export volume during every Jan-Jul in 2016 and 2024, we have observed similar growth trend to that of annual export growth, while in 2021 and 2023, the year-on-year growth rates in Jan-Jul were higher than that of Jan-Dec, indicating that more positive export in the first half of the year than the second half.

2. Monthly export features different from previous seasonal changes, evident growth seen in Jul

Based on the monthly export trend, we could observe an evident shift in Jan and Feb, when the Chinese Lunar New Year calendar dawned differently. And normally during Mar-Jun, there will be a reviving in export of nylon 6 products, when domestic production recovered and overseas demand also being steady. In Jul to Sep, there will be a weak to flat trend, and evident increase was seen in Oct 2022 and 2023, while gradually decline toward the end of the year.

In 2024, except for the evident shift during Feb 2024, when Chinese New Year holiday settled, a volatile trend was seen during Mar to Jul. Especially in Jul, a traditional slack season, evident rebound in export volume happened. It was possibly related to a sharp decline in China domestic nylon 6 chip market since June 2024, and prices bottoming in July, in contrast to relatively higher prices in overseas market.

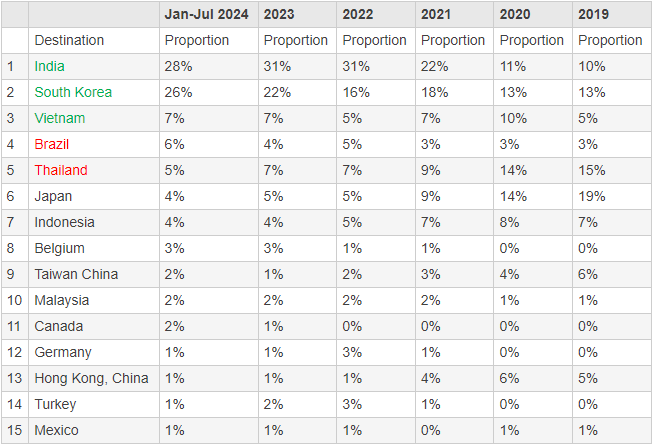

3. Major export destinations shifted in the past 5 years

Observing the major destination of nylon 6 in the past 5 years, there were moderate changes in both volume and proportions. We had seen a steady and substantial growth in the export toward India and South Korea. The export volume to India rose from 12kt to over 146kt, more than 10 times, ad since the year of 2021 India had become the largest destination of China's nylon 6 export, and the fast growth trend did not suspend still. The export proportion of India had grown from 10% to 28% during 2019 and 2024.

South Korea had also taken a growing trend similarly, with its export volume rising from 15kt to 105kt, and it had become the second largest export destination since 2021 as well. The export proportion of South Korea jumped up from 13% to 26%.

Narrower and steady growth was witnessed in the export volume and proportion to Vietnam, and Brazil also had gained proportion during the past 5 years, to the fourth largest one.

In contrast, the previous largest two destinations before 2021, Japan and Thailand saw lower status in terms of their proportions in total nylon 6 export of China, though the volumes to the two countries did not saw evident decline, and even small growth to Thailand. The proportion to Japan dropped from 19% to 4% only, and that of and Thailand lowered from 15% to 5%. This shift was mainly because of the significant growth in volumes to other destinations including the mentioned ones above.

In conclusion, with China's nylon 6 chip capacity still under fast expanding pace in 2024, the export volume will continue rising in the year. First, China's nylon 6 chip production capability is greater, and second, the trend of integration with upstream CPL capacity will enable nylon 6 producer to stabilize their product quality and supply chain. However, based on the already huge export volume in the past few years, the growth rate will slow down, given the limited consumption growth in comparison.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price