Can spandex reverse its declining trend?

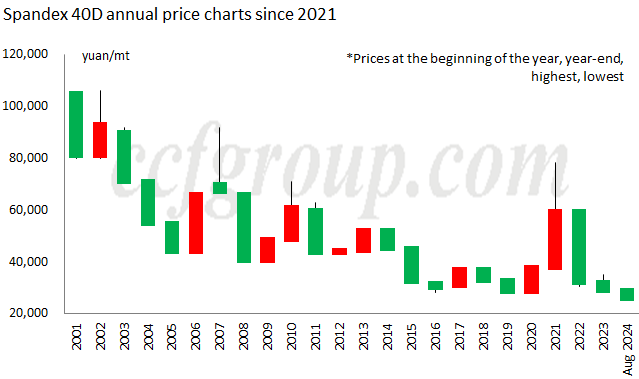

From the annual price trends of spandex over the past 20 years or more, there have been periods of price increases following "bear markets" every two to three years. Currently, spandex prices have been on a downward adjustment for three years since the peak in the third quarter of 2021. With the upcoming traditional peak season of "golden September and silver October," the question remains whether spandex can reverse its declining trend. It is important to note that long-term cyclical patterns are not absolute and that the market is influenced by many other factors.

*Prices of the chart are beginning of the year and at the year-end, and prices of the lines are the highest and lowest.

For example, in 2001, prices began at 10,5000yuan/mt, ended at 81,000yuan/mt, with highest and lowest at 105,000yaun/mt and 80,000yuan/mt.

In RED chart, means the prices at year-end were higher than the beginning of the year.

Excess supply in the industry chain

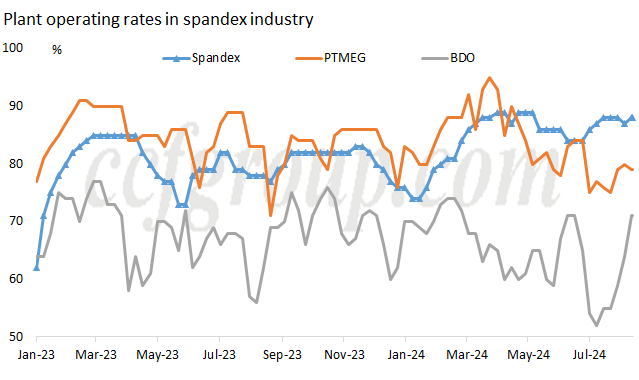

In terms of supply increase in the industry chain, the capacity growth of upstream BDO and PTMEG in 2024 is expected to far exceed that of spandex. The situation of oversupply is particularly prominent, with upstream products competing on price for sales. Under the increasing inventory conditions, upstream BDO plants are mostly operating at 50% to 70%, while PTMEG plants operate at about 75% to 95%; spandex industry is generally running at 80% to 90%, with some occasions below 80%. From the average capacity utilization in the industry from the beginning of the year to late August, upstream BDO is relatively low, while downstream spandex and PTMEG are running at comparatively high levels.

Macro Weakness, domestic textile and apparel sales lull

From a macro perspective, the market situation was tumultuous from July to mid-August this year, fluctuating between "recession trading" and "re-inflation trading," with increased volatility. China domestic short-term policies mainly focus on stabilizing the downward speed of the economy. Attention should be paid to the upcoming Federal Reserve meetings and their implications.

In terms of textile and apparel sales, the growth rate of exports exceeds that of domestic sales in 2024. In July 2024, textile and apparel exports totaled $26.8 billion, a year-on-year decline of 0.5% and a month-on-month decline of 2.2%. Among these, textile exports were $11.54 billion, a year-on-year increase of 4%, but down 5.8% compared to the previous month, while apparel exports were $15.25 billion, down 3.6% year-on-year but up 0.7% month-on-month. From January to July 2024, cumulative textile and apparel exports totaled $169.84 billion, an increase of 1.1%, with textile exports at $80.86 billion, an increase of 3.3%, and apparel exports at $88.98 billion, down 0.8%. According to data from the National Bureau of Statistics, retail sales of clothing, footwear, headwear, and knitted textiles in July reached 93.6 billion yuan, a year-on-year decrease of 5.2% and a month-on-month decrease of 24.3%. Cumulative retail sales from January to July 2024 reached 803.3 billion yuan, a year-on-year increase of 0.5%.

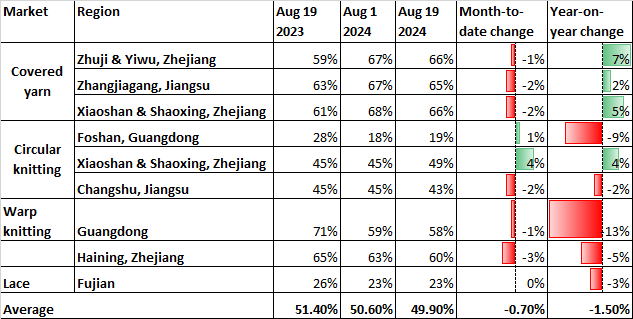

Looking at the capacity utilization of spandex downstream weaving and knitting mills this year, the performance in August was not as strong as last year and was slightly lower year-on-year. The delivery performance of covered yarn for weaving has improved slightly, while the delivery of covered yarn for knitting has been somewhat sluggish. Coupled with wide fluctuations in polyester and nylon prices throughout the year, although there has been a noticeable increase in covered yarn inventory during the off-season, overall capacity utilization has shown a slight year-on-year increase, especially for nylon/spandex covered yarn, which performed better than polyester/spandex covered yarn. However, the capacity utilization in the downstream circular knitting mills and warp knitting mills is year-on-year lower.

Recently, there have been more positive supports for spandex market.

The capacity utilization in some downstream weaving and knitting areas has begun to rise, especially in the double-sided fabric sector, such as the increase in production orders and samples for cotton-spandex sweatshirts in Foshan and double-sided fabric in Shaoxing. Additionally, the capacity utilization in Haining for warp knitting has increased. As downstream spandex weaving and knitting orders gradually pick up, there is hope for marginal improvement in spandex downstream weaving capacity and consumption, and spandex industry inventory may gradually shift towards the mid and lower reaches.

The main raw material for spandex, MMDI, has recently experienced a slight rebound in price, with an increase in maintenance of both domestic and overseas facilities, leading to a small rise in spot prices. Another key raw material, PTMEG, is facing significant cash flow losses; although there is still competitive pricing in the market, the overall decline in profit margins is slowing. The prices of spandex raw materials are fluctuating against each other, providing slightly better support for the cost side of spandex compared to earlier period.

Recently, there has been a resurgence of COVID-19, with over 10,000 new cases reported in Guangdong in July. In addition, the Director-General of the World Health Organization (WHO), Tedros Adhanom Ghebreyesus, recently held a press conference announcing that the rapidly spreading monkeypox variant in Africa constitutes a "public health emergency of international concern," which is the highest level of global health alert under the International Health Regulations framework. It is crucial to closely monitor the developments of public health events such as the COVID-19 pandemic and the monkeypox outbreak, as there may be a slight boost in mask sales.

In summary, spandex prices have repeatedly hit record lows in 2024. However, due to factors such as oversupply in the industry chain, fierce internal competition, and a weak macroeconomic environment, although there is an expectation of seasonal demand strengthening in the short-term downstream weaving and knitting sector and a push from rising spot prices of MMDI on the cost side, it is anticipated that spandex market may not be able to completely reverse the downward trend. Instead, spandex may undergo a phase of bottom consolidation in the short term. Under the pressure of costs for some new products, the potential for further declines may narrow. There remains hope for increased sales of spandex in the industry during the "Golden September and Silver October" period.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price