Interpretation of USDA's August supply and demand report on cotton

1. USDA forecasts 2023/24 consumption and beginning/ending stocks lower

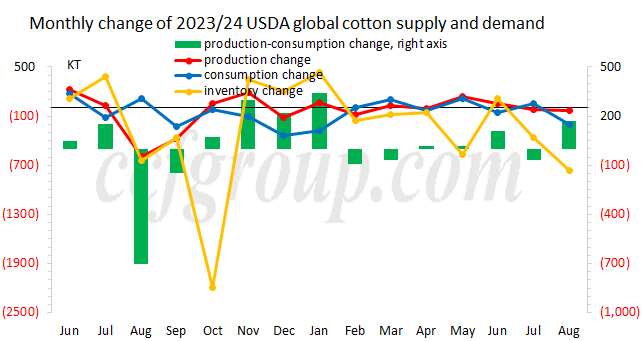

Recently, the USDA released the global cotton supply and demand balance sheet for August. This adjustment notably and unusually reduced the global cotton beginning and ending stocks for the 2023/24 season, and also made downward revisions to consumption. Specifically, the beginning stocks were sharply revised down by 920,000 tons, the ending stocks were cut by 770,000 tons, and consumption was reduced by 200,000 tons. The purpose of these stock adjustments seems to be aimed at lowering the beginning and ending stocks for the 2024/25 season from the current perspective. Overall, with the end of the 2023/24 season, the USDA's revision reflects some subjective signals, indicating a hope that the new season's stock data will support ICE cotton futures.

2. USDA's adjustment for 2024/25 balance sheet

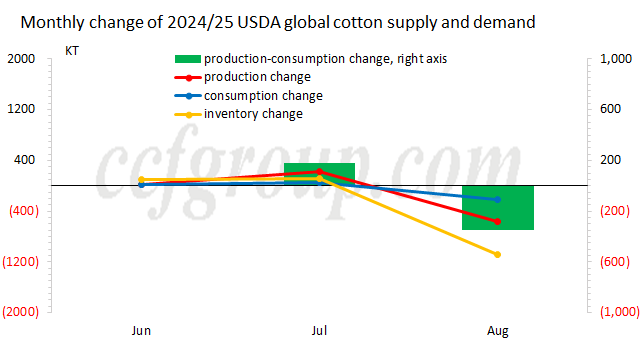

Compared to the previous month's data changes, the main adjustments for the 2024/25 balance sheet continue to focus on substantial reductions in stocks and production, with some reduction in exports and consumption. Specifically, it revises down the beginning stocks by 770,000 tons, ending stocks by 1.09 million tons, and production by 560,000 tons. Imports are reduced by 210,000 tons, consumption by 210,000 tons, and exports by 230,000 tons. The stock changes mainly come from adjustments to China's beginning stocks. Considering current weather conditions, the recent intensification of drought in the U.S. cotton-producing regions has indeed raised concerns about a decline in U.S. cotton production, particularly in Texas where soil moisture conditions are close to last year's levels. Therefore, it is somewhat reasonable for the U.S. to lower its cotton production estimate. According to data from the USDA Farm Service Agency, the planted area is down by 500,000 acres, with an abandonment rate forecasted at 23%, up 6% from last month. Therefore, the harvested area is forecasted at 8.6 million acres, a reduction of 11% from the July supply and demand report. Cotton yield is forecasted at 840 pounds per acre, a slight decrease from last month.

Overall, the reason for the USDA's significant downward revision of the 2023/24 stocks to adjust the 2024/25 stocks in August is worth considering. However, aside from this factor, the reductions in production and consumption have certain reference value. Additionally, after experiencing a slowdown in harvesting over the past two weeks, Brazil's latest harvesting progress has returned to levels roughly consistent with the same period last year, which may exert some pressure on U.S. cotton prices. Meanwhile, India's cotton planting area remains below last year's level, mainly due to the substitution of other economic crops for cotton, despite India's increase in MSP prices. In considering the future direction of ICE cotton, the following points may be considered: first, U.S. cotton is currently in the stage where bolls setting is nearly finished and bolls opening has begun, with weather changes still having significant impacts on growth and quality; second, Brazil's cotton export performance; and third, the Chinese quota usage and the status of imported cotton circulation.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price