Decline in PTA adds to woes of PX

The continuous decline in PX price recently draws much attention. The price of Sep PX futures contract even dropped more than 4% on Aug 14 evening trading hours. Then, what's the cause?

Firstly, crude oil price fell. Amid economic downturn recently, commodity market as well as crude oil price moved lower obviously. Brent crude oil futures price lost a whopping 14.7% from Jul 5 to Aug 5, but then rebounded somewhat. As for PX futures, the price of Sep contract hit the low point on Aug 14 evening, down 12.7% from the high point recorded on Jul 4. The drop in PX lagged behind that in crude oil.

Secondly, PX supply has recovered. With the completion of turnaround season, PX plant operating rate has been rebounding since Jun. Despite the slightly drop recently, China PX plant operating rate has risen by 15 percentage points from end-May, and Asian operating rate gained 7 percentage points. In addition, the supply in Asia increased also on account of inflows of goods from Middle East and India due to weakened demand in the US and Europe.

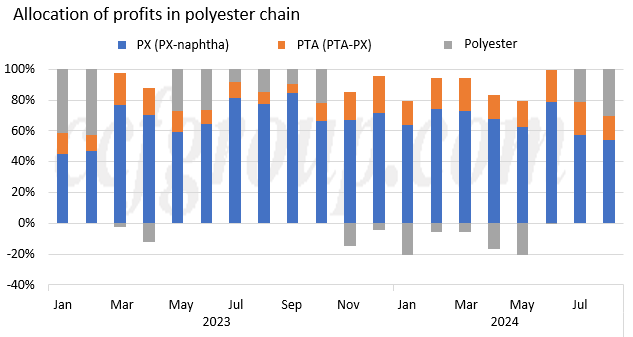

Thirdly, the industry chain is weak despite the expectation of peak demand. Currently, polyester chain is still under strains, in spite of inventory reduction. The rise in polyester plant operating rate is slow and PTA processing margin gets squeezed rapidly. In terms of the profit, PX takes the largest part. Therefore, when PX fundamentals turn weak, the market would be easily affected by weak downstream products.

Fourthly, investors' sentiment is dampened by weak economy, decline in crude oil, as well as increasing PX supply. PX physicals were traded at discounts to formula pricing for much of the time in the first half of 2024, which weighed on investor's confidence. Therefore, sellers in PX market are relatively active while buyers do not stand firm to support the price, and as a result, PX spot price slipped rapidly.

In addition, the long and short battle in PTA futures market is another reason causing the fluctuations in PX.

According to Zhengzhou Commodity Exchange's trading rules, the Sep contract of PTA futures would face higher margin requirements and positions restrictions from Aug 16. Normally, the open positions would decrease rapidly. However, the current situation is that among the top 20 investors, some are still increasing the positions, which means that there're obvious diverged strategies on the trading.

There's different logic behind the going long or short, and the result is now unclear. With the approaching of delivery of Sep PTA contracts, as long as there're different strategies, there would be mixed voices about influencing factors to the market, such as PTA plant production cuts, polyester production cuts, PX prices and plant operations, PTA futures delivery quantity, etc.

In a conclusion, with the intensified competition, PX futures price is not only depending on the fundamentals, but also the volatility in PTA futures.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price