Export situation of nylon fabrics in H1 2024 quite good

1. Significant growth in nylon fabric exports in H1 2024

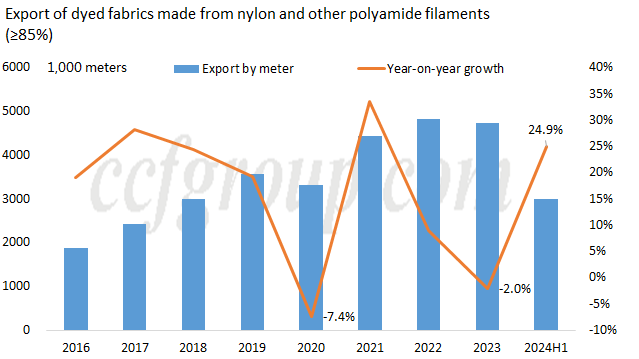

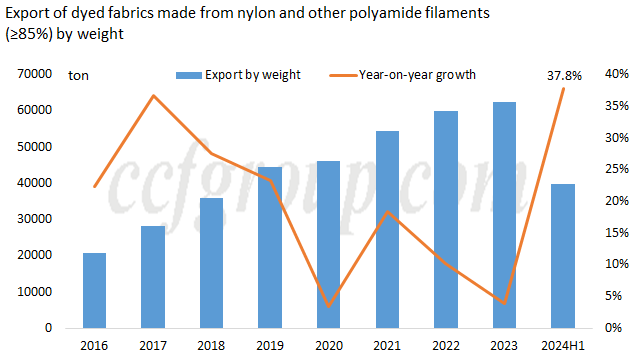

The export volume of dyed fabrics made from nylon and other polyamide filaments (≥85%)-referred to here as "nylon fabrics" - has generally maintained a growth trend in recent years. From 2016 to 2019, exports grew steadily, but there was a noticeable reduction in 2020 due to the pandemic. In 2021, export demand rebounded significantly, but escalating global inflation, economic downturns, and frequent geopolitical conflicts led to a gradual decline in clothing consumption. This trend continued into 2022, where the growth rate of nylon fabrics also gradually decreased, and in 2023, it further declined to -2.0%.

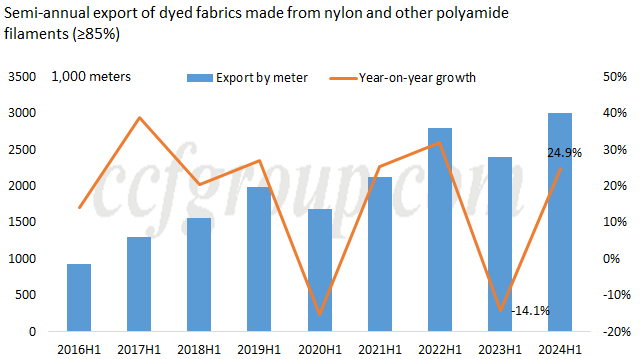

From the comparison of the semi-annual data, in the first half of 2024, total nylon fabric exports exceeded 300 million meters, a year-on-year increase of 24.9%. In contrast, in the first half of 2023, the exports shrank by 14.1%. This year's strong growth is largely attributed to filling the gap from last year's first half. Compared to the first half of 2022, growth in 2024 is only 7.3%.

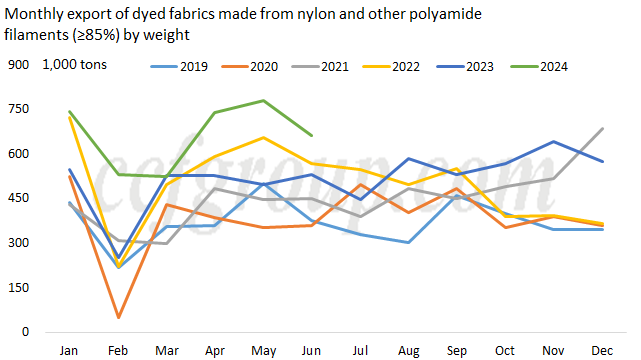

2. Monthly export volumes align with seasonal changes and overall are better than previous years.

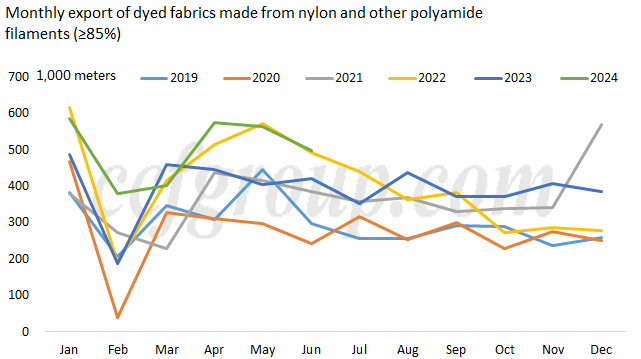

Analyzing monthly export volumes shows typical seasonal variations, such as lower exports in February due to the Chinese Lunar New Year holiday, a peak during March and April, followed by a gradual weakening in May and June. Compared to the same period last year, this year's nylon fabric export volumes were notably higher in all months except for March.

Coincidentally, in the first half of 2024, the export volumes in four individual months were very close to those in the same months of 2022. However, the first half of 2022 saw overstretched export demand, and global inflation exacerbated the contraction in overseas consumption, leading to a continuous reduction in nylon fabric exports. Although the foreign trade situation remains complex and global economic growth is sluggish in 2024, inflation has eased. Hence, it is unlikely that there will be as significant a reduction in fabric exports in the second half of this year as seen in 2022.

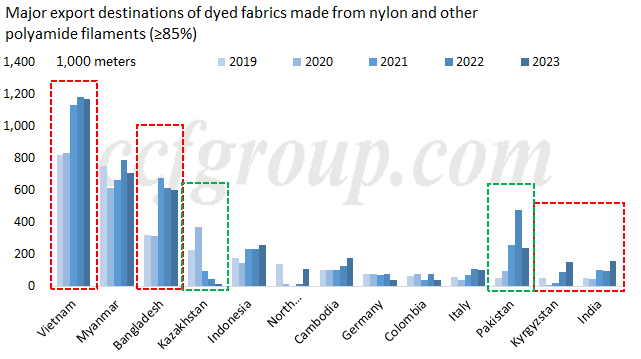

3. Significant changes in the export directions of nylon fabrics over the past five years

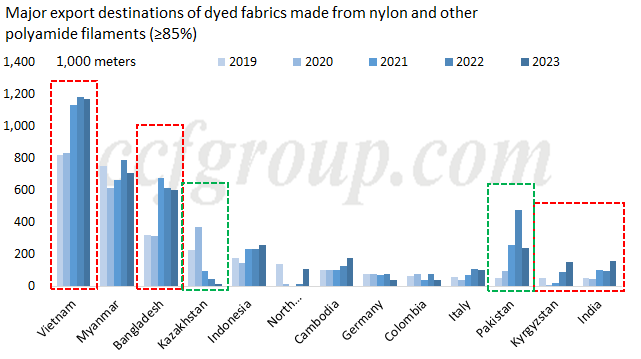

The directions of nylon fabric exports have varied considerably over the past five years, influenced by various factors, including but not limited to trade frictions, the pandemic, and economic policies.

Exports to Vietnam and Bangladesh: There was a noticeable increase in 2021, primarily due to a strong recovery in clothing orders following the pandemic's severe impact, although there was a slight overstretch. However, from 2022 to 2023, demand growth was weak, and the demand for nylon fabrics did not continue to rise significantly. In the first half of 2024, due to a significant increase in clothing export orders and local e-commerce orders in Vietnam, there was a clear increase in demand for nylon fabrics.

As a major garment export country, Bangladesh also showed growth in export orders in the first half of the year, reflecting an increase in demand for nylon fabrics. However, internal conflicts in Bangladesh may exacerbate supply chain instability, putting pressure on order growth.

Exports to Cambodia, Kyrgyzstan, and India: These have seen gradual year-on-year growth. This is mainly due to the relatively small scale of the local nylon clothing industry, which is still in a developmental stage, combined with an increase in export orders and the rapid growth of local fast-fashion e-commerce, resulting in steady demand for nylon fabrics.

Exports to Kazakhstan and Pakistan: After an initial increase, there has been a decline. Kazakhstan's local clothing industry is not large, and Pakistan has faced multiple challenges, including reduced foreign trade orders, significant losses, and an economic downturn, leading to substantial losses for clothing enterprises, making it difficult to sustain operations.

Changes in other regions have been smaller in magnitude or the trends are not particularly obvious.

4. Nylon fabric for exports are heavier in 2024 than in 2023, favoring growth in nylon consumption.

Measured by weight, the export growth of nylon fabrics in the first half of this year is significantly more pronounced than when measured in meters. In the first half of this year, nylon fabric exports totaled 40,000 tons, a year-on-year increase of 37.8%, which is considerably higher than the 24.9% increase measured in meters. This indicates that the overall volume of exported fabrics in the first half of this year is thicker compared to the same period last year. Moreover, looking at monthly data, the tonnage of exports in the second quarter did not match closely with the 2022 figures, suggesting that the growth in heavier fabric exports primarily occurred in the second quarter.

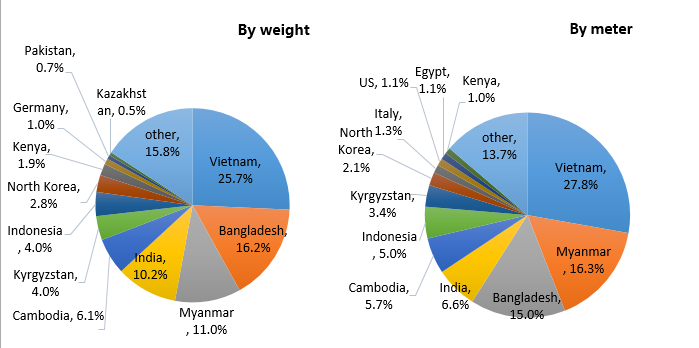

Additionally, comparing different measurement units reveals variations in the thickness of nylon fabrics consumed by various countries. Countries with a proportion of imports measured by weight greater than those measured in meters tend to import thicker nylon fabrics, such as India and Bangladesh. Cambodia, Kyrgyzstan, North Korea, and Kenya also show slight thickness but not significantly. Conversely, countries like Vietnam, Myanmar, and Indonesia tend to consume thinner nylon fabrics.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price