PFY inventory reduces after price cuts, demand expected to pick up

Polyester filament yarn market sentiment has softened obviously, with some sellers lowering prices to boost sales, as the macro economy is weak. On Aug 6 and 9-10, offers for PFY were lowered, and besides, suppliers provided discounts and kept selling during night trading on Aug 10-11 to outlet products.

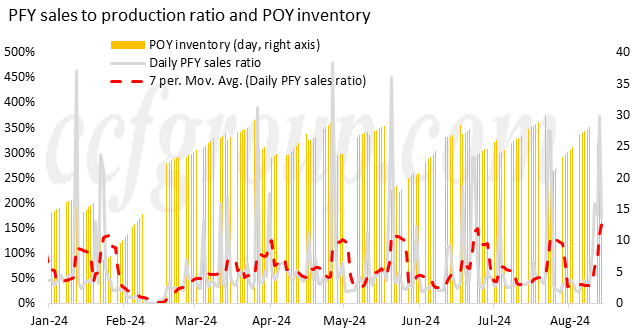

After the price cuts, the offtake of PFY is favorable to suppliers. The sales to production ratio of PFY since last weekend has picked up, and POY inventory at Zhejiang and Jiangsu has reduced to an estimated 20 days mainly owing to the inventory reduction at large plants. That is to say, PFY producers have achieved the transferring of inventory to downstream by the means of price cuts. In addition, the expectation of upcoming peak demand season could give a respite to the plants.

For downstream clients, the incentive to buying is the low price of PFY. The prices of some varieties have downward break this year's low, and some have declined and are just 50~100yuan/mt higher than the low point. Downstream twisting plants and weaving mills cut operating rates earlier and kept feedstock inventory quite low within one week. But after this round of PFY price drop which is attractive to speculators, their feedstock inventory has increased to 2 weeks in average and even to 1~2 months in some plants.

Downstream twisting plants and weaving mills cut operating rate more than expected to 71% and 59% respectively last week, owing to lack of labors under high temperature coupled with weak macro economy. This week, the operating rate rebounded with labors returning and downstream buying recovering. Twisting operating rate is anticipated to bounce to 80% and weaving operating rate to 60-70% in the week ending Aug 16.

The seasonal increase in orders to weaving mills has not emerged yet, while some mills are heard receiving some orders of fabric for hoodies mainly for autumn. This round of PFY price drop could bring opportunities to weaving mills who are receiving seasonal orders. If the macro economy and crude oil become firm, it is likely that mills could see increasing orders.

As for PFY, after the inventory reduction, the pressure gets relieved, and the processing spread and plant operating rate get supported.

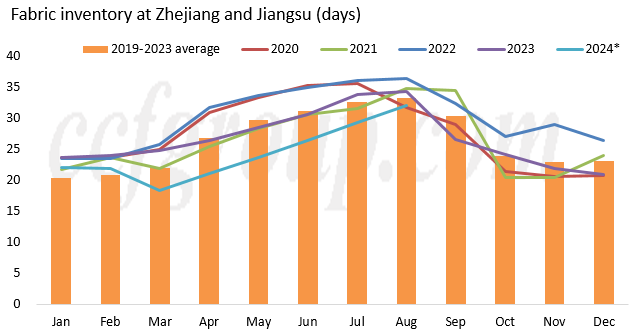

With the upcoming peak season for consumption and investment in Sep and Oct, the inventory mainly concentrates in PFY and fabric segments. And fabric inventory in weaving mills has increased to this year's high, but it is largely equivalent to last years' high level while the woven fabric inventory at some mills is even lower than last years. However, further downstream fabric traders, exporters, apparel and home textile producers are more cautious in building up fabric stocks. Under this circumstance, it is expected weaving mills could see a surge in seasonal orders when it comes. And therefore, though the supply is enough, the varieties may not meet the diversified requirements, which could only be solved by communications between upstream and downstream participants.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price