Acrylonitrile price competition benefits acrylic fiber

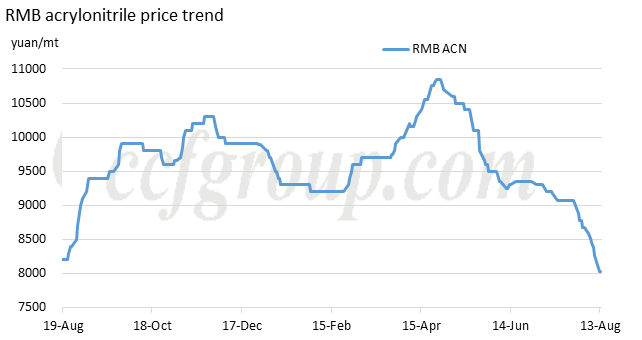

Since August, the CCF acrylonitrile index has dropped from 8,675 to 8,037 yuan/mt, a decline of 7.35%. The main reason lies in the supply side, where price competition emerge due to considerations of market share. Market prices continue to move down, and trading prices follow suit. Cash flow also worsens, with losses increasing. Based on current propylene prices, the theoretical cost of acrylonitrile is estimated to be around 9,000yuan/mt. Although plants with integrated raw materials have a cost advantage, they are still facing losses of over 100 yuan/mt.

Despite ongoing losses, the ACN operating rate has only slightly decreased by about 8% since August, mainly due to cuts and maintenance at Liaoning Kingfa, PetroChina Daqing, and Daqing Refinery. This has limited impact on the Shandong and spot markets. Even a 30% production cut by Koruhr fails to reverse the market's downward trend amid ample supply.

The market decline has been more severe than expected due to several factors:

1. MMA profitability is satisfactory, with recent increases in MMA exports leading to a significant price rise (according to some industry sources, profits from MMA produced via the acrylonitrile process can reach 4,000-5,000 yuan/mt). Plants like Sierbang and Lihuayi have used these MMA profits to offset acrylonitrile losses, enabling continued production despite overall losses.

2. While plants recognize that reducing production could help support prices and increase their market share, none are willing to make these cuts, resulting in intense competition and financial losses for all.

Currently, the market expects plants without MMA profits to face higher cost pressure and a greater chance of shutdowns. Speculators are waiting for opportunities to buy at lower prices.

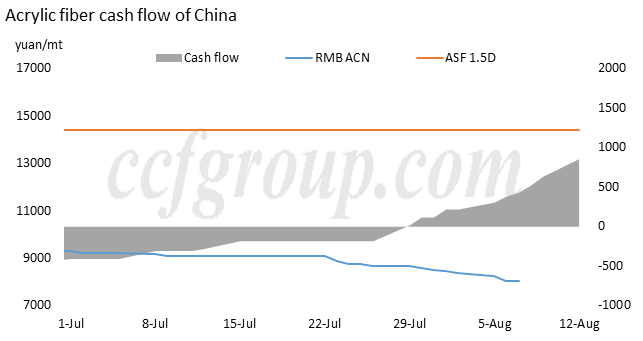

In the acrylic fiber sector, reduced cost pressures from raw material price competition have turned losses into profits, with theoretical cash flow nearing 1,000 yuan/mt. Consequently, plants are running at high rates, and the overall operating rate remains above 70%, showing the strongest cash flow seen this year. Despite this, the yarn market remains weak during the off-season, and sluggish sales are impacting actual profitability. Given the uncertain outlook for the yarn market, a stocking strategy for raw materials may be a more prudent choice.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price