Current pressure on major nylon filament manufacturers not significant

Since June, demand for nylon textile filaments has been gradually weakening. Coupled with the continuous decline in raw material prices, weaving and knitting mills have adopted a cautious procurement approach, leading to a further decrease in the sales/production ratio for filament manufacturers in July. We are currently in the weakest demand phase of the year, and filament manufacturers are experiencing increased pressure due to inventory build-up and rising production costs amid high temperatures.

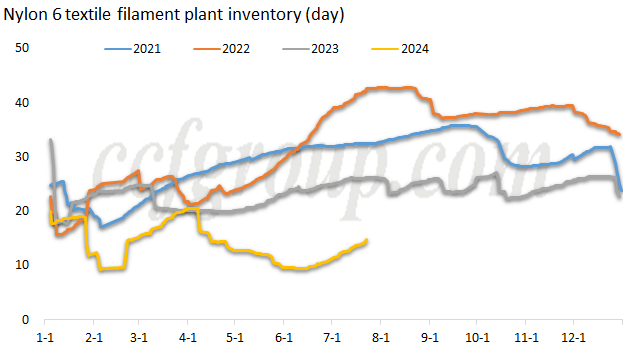

Inventory rising for two months, but still controllable

In June, due to the seasonal decline in demand and the ongoing decrease in raw material prices, new orders for nylon filament weakened. However, the reduction in production by downstream weaving and knitting mills was not substantial, allowing mainstream filament manufacturers to maintain a sales/production ratio around 85-90%, with slight inventory accumulation.

In July, market further dropped, and the characteristics of the off-season became more pronounced, leading to increased production cuts by downstream weaving and knitting mills. For example, the operating rate of circular knitting mills in Shantou decreased from 60-80% in the previous high period to around 40-60%, resulting in reduced demand for nylon. Consequently, the production and sales ratio for filament manufacturers fell further to 70-80%, with some as low as around 60%, and inventory growth accelerated.

However, due to previously low inventory levels for filament manufacturers, even with two consecutive months of inventory accumulation, mainstream manufacturers' inventory remains within a controllable range. Large industry players generally have inventory levels around 18-23 days, with a considerable portion consisting of dead stock for small batches (niche products which need to be fixed and prepared in stock).

Small and medium-sized enterprises, due to differing product structures, show significant variations in inventory levels. Recently, multiple FDY specifications have entered the off-season for demand, such as demand for coarser specifications like 70D/48F and 40D/7F weakening. Additionally, recent new FDY projects, including Xinlun (North Jiangsu project), Guchuang and Sanning, have added the supply against the weakening demand, exacerbating the supply-demand imbalance for FDY. Therefore, filament manufacturers with a higher proportion of FDY production lines are accumulating inventory more rapidly, with some inventory levels exceeding 30 days.

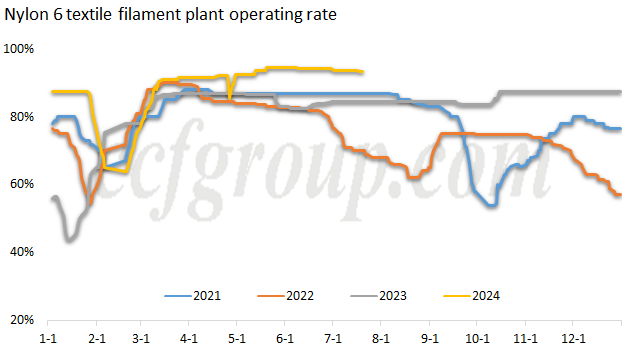

NFY plants' O/R diverge, major plants have no significant pressure to cut production

Although industry inventory continues to rise, several factors mitigate the situation:

1. Mainstream manufacturers' inventory remains within controllable limits.

2. Prices have fallen to a relatively safe low range, minimizing the risk of losses from inventory accumulation.

3. In high-temperature areas, the increasing use of energy storage systems is improving cost reductions and power usage.

4. Production cuts would increase the production cost per ton.

5. Should market conditions reverse, the previously suppressed procurement demand will also be released, with future inventory release expectations remaining stable.

Considering these multiple factors, mainstream manufacturers currently do not face significant pressure or plans for production cuts. However, for specific specs that are accumulating inventory rapidly, adjustments to production lines or local reductions may occur in the future.

In addition, a small number of medium and small-scale filament manufacturers with a higher proportion of FDY production lines have already reduced output by 10-30% due to a combination of factors including tightened funds downstream, high finished goods inventory, fast inventory accumulation, and rolling rest plans.

Overall, we are currently experiencing the worst demand phase for nylon filaments. While filament manufacturers continue to accumulate inventory, overall industry inventory remains within a controllable range, and mainstream medium to large manufacturers are not under significant reduction pressure. Some smaller enterprises are making appropriate production cuts due to differing product structures or downstream customer characteristics. The nylon market has reached a bottom range, and there is little risk of further declines. As time progresses and the traditional off-season comes to an end, if signs of recovery are evident in mid to late August, the current weak transaction phenomenon in the nylon filament market will also ease, with subsequent inventory release pressure remaining manageable.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price