PET bottle chip downstream round-up in Q1-Q2 2024

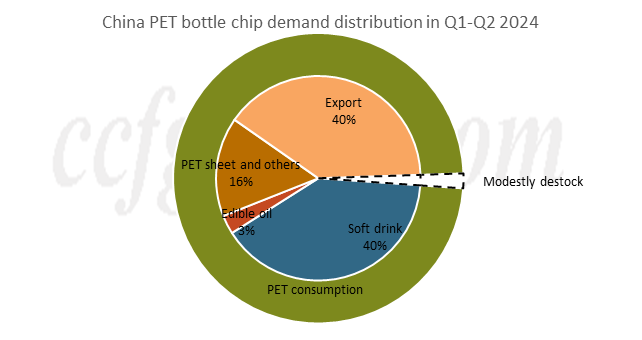

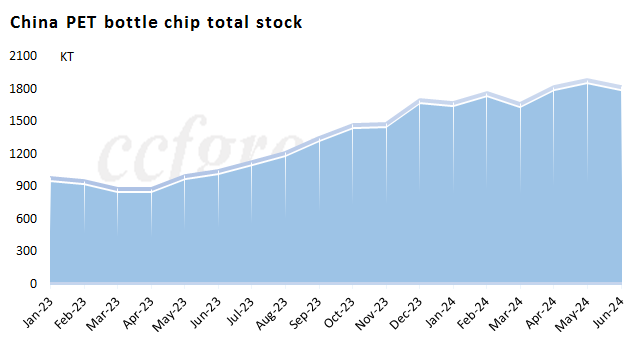

According to CCFGroup statistics, the demand for domestic PET bottle chip in the first half of 2024 hovered around 4.377 million tons, a year-on-year increase of 14.9%, indicating a reasonable performance. The demand for PET from soft drink companies showed particularly bright growth, with a year-on-year increase of 17.8% in the first half of the year, accounting for about 68% of domestic demand. Demand growth from edible oil companies for PET was also acceptable, with a year-on-year increase of approximately 14.4%, mainly due to promotions in the tourism and catering industries, which increased population mobility. Meanwhile, this year, domestic PET bottle chip factories processing spread significantly reduced, essentially making them half or one-third of production costs in some overseas regions, creating a noticeable export price advantage. The total export volume of domestic PET bottle chip from January to June was around 2.97 million tons (estimated on two tariff codes), representing a year-on-year growth of 25.3%, a significant increase from the same period last year. The competition among PET sheet companies remains intense, with demand for virgin PET bottle chips showing a year-on-year increase of merely 0.6%. However, growth in other sectors, excluding the top three, was more favorable, with a year-on-year increase of 34%. Overall, in the first two quarters, both domestic and international demand for PET bottle chip grew simultaneously, but due to excessive supply growth-production reached around 7.47 million tons in the first half year, a 20% year-on-year increase-there was a slight accumulation of inventory.

Specifically, in the bottled water and beverage sectors, the demand for PET packaging was strong in the first half of the year, reaching approximately 2.98 million tons. In the first quarter, beverage companies made few purchases, as preparation for the New Year's holiday peak season was generally made in advance, and concentrated restocking mainly occurred in late February to March post New Year's Day holiday. As many water companies performed well in sales and profit last year, major brands still saw significant production growth in the first quarter, particularly as some company experienced a temporary surge in demand due to brand PR events. Entering the second quarter, from April to early May, domestic downstream manufacturers actively restocked PET in preparation for the summer sales peak. However, from late May to June, as downstream O/R did not meet expectations, PET restocking activities reduced. At the beginning of the third quarter, as high summer temperatures arrived, demand for beverages and bottled water again increased, and inquiries from major downstream manufacturers began to rise.

In the edible oil sector, demand for PET showed a reasonable growth of around 22.3% year-on-year in the first quarter, largely due to increased population mobility during the Spring Festival this year and favorable performances in the tourism and catering industries, indirectly driving PET demand growth. After the Spring Festival, the market entered a relatively slow season, with edible oil companies maintaining an overall operating rate of 60%-80%, some even falling to around 40%-50%. In the second quarter, the peak demand around the Dragon Boat Festival led to average order demand, with only slight increases in operating rates, and overall demand growth significantly slowed to 7.7%.

The demand for PET in sheet and other fields increased at a moderate pace, growing only 7.8% year-on-year in the first quarter and slowing further to 7.2% in the second quarter. Notably, there was almost no growth in the demand for virgin PET from traditional sheet packaging products, with most of the growth coming from other sectors. Currently, the order gap between sheet enterprises in different regions and brands has widened. In East China, the demand for packaging in emerging applications such as fresh food, milk tea, and coffee has developed earlier, maintaining a reasonable operational rate of 60%-80% among sheet companies. Conversely, in South China, intensified homogeneous competition and relatively single downstream products have led many sheet enterprises to opt for recycled PET flake instead of virgin PET to reduce costs. However, this hasn't alleviated the region's long-standing low operational rates, particularly as the Spring Festival holiday came early, with most factories not resuming operations until early March. Subsequently, operational levels often lingered around 40%-50%. Integrated enterprises received relatively more orders and maintained clear cost advantages, resulting in a decent recovery in operations. From April to June, local operational conditions did not show significant improvement, with low operational rates persisting throughout the first half of the year, and some production lines remained shut for long term.

From the perspective of downstream purchasing rhythm, in the first and second quarters of 2024, downstream procurement primarily followed a price-oriented trend, with a considerable amount of advance restocking at low price levels, while the impact of seasonal factors diminished. Due to low prices in the fourth quarter of last year, many downstream clients pre-stocked significant volume at 6700-6950yuan/ton ex-factory. However, as prices rose above 7100yuan/mt, the replenishing sentiment in the market noticeably eased. Meanwhile, with expectation of a significant increase in supply later, downstream factories and traders became less eager to chase up for replenishment. In the first quarter, price fluctuation range was relatively narrow, mainly concentrated between 6980-7130yuan/ton ex-factory. In early second quarter, most domestic downstream procurement of raw materials consisted of temporary spot purchases beyond budget limits, primarily between 6900-7050yuan/ton ex-factory, with some slightly below, around 6850-6880yuan/ton ex-factory. However, since PET bottle chip manufacturers often operated at a loss, by the end of the second quarter and the start of the third quarter, many domestic facilities were reducing or halting production, and refilling price gradually lifted to 7050-7100yuan/ton ex-factory.

Overall, in the first half of 2024, the domestic PET bottle chip market displayed a slight trend of inventory accumulation. In the second half of the year, significant new capacity is expected, with plans tallying around 3.5 million tons. However, some factories may delay their production timelines, meaning the actual new capacity for PET bottle chip could be somewhat lower. Furthermore, since July, there has been considerable output reduction in domestic PET bottle chip facilities, surpassing 5 million tons, which may counterbalance some of the supply pressure from the new capacity. Nevertheless, with idle facilities restarting, the supply-demand landscape in the PET bottle chip market is likely to face a new round of restructuring.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price