Is there opportunity for replenishment after imported yarn inventory reaches low?

The cotton textile industry is currently experiencing a slack season, with downstream demand remaining weak. Both spinners and fabric mills are facing continuous declines in operating rates. In the short term, the slack season is expected to persist, as there are no clear bullish factors in the industry, and the overall market sentiment is still predominantly bearish.

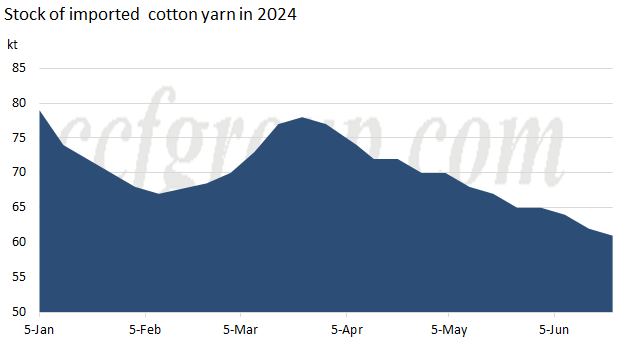

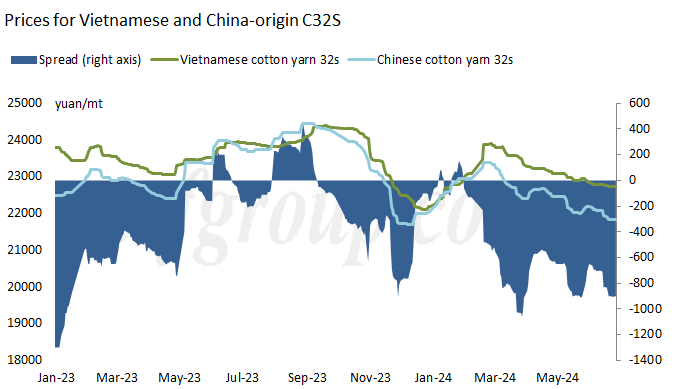

However, imported yarn inventories have essentially reached the lowest level for the year. After the traditional off-season, the market is expected to enter the traditional peak season. How is the current replenishment opportunity? In terms of price difference between domestic and imported yarn, the most significant one is seen in Indian yarn, as imported C32S is around 1000yuan/mt higher than domestic C32s. However, there might be some opportunities for low count ring-spun yarn of certain brands. Vietnamese and Pakistani siro-spun yarns do not exhibit significant price difference between imported price and domestic price, and the Vietnamese yarn is currently showing a mix of high and low prices. For example, for C32S, the price difference between medium-to-lower quality and good quality carded yarn is around 13 cents, with the traded price relatively low. Traders can make certain replenishments based on their own needs. It is understood that some traders have already taken actions in ordering, whether it is for higher quality or medium-to-lower quality yarn.

| Offer($/kg) | On RMB parity(yuan/mt) | Selling price(yuan/mt) | Price differnce(yuan/mt) | |

| Vietnamese carded 32S for air-jet | 2.73 | 22800 | 22700 | -100 |

| Indian carded 32s | 2.79 | 24100 | 22700 | -1400 |

| Pakistani siro-spun carded 10S | 525 | 19600 | 19700 | 100 |

There is a significant price difference between domestic yarn and imported yarn, at around 900yuan/mt. With spinners and fabric mills reducing operating rates, the sluggish sales of both domestic and imported yarn may be sustained in the short term. With the expected increase in arrivals, there is a higher possibility of imported yarn inventories hitting bottom and rebounding.

| Offer($/kg) | On RMB parity(yuan/mt) | Selling price(yuan/mt) | Price differnce(yuan/mt) | |

| Vietnamese carded 32S for air-jet | 2.73 | 22800 | 22700 | -100 |

| Indian carded 32s | 2.79 | 24100 | 22700 | -1400 |

| Pakistani siro-spun carded 10S | 525 | 19600 | 19700 | 100 |

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price