EO/EG spread narrows, rate adjustments show regional differences

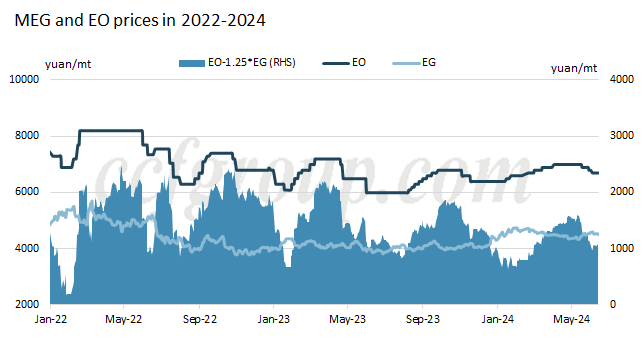

At the beginning of June, ethylene oxide (EO) prices further declined to around 6,700yuan/mt. The downstream demand for water reducers continues to weaken as it enters the off-season. Meanwhile, MEG prices remain firm, narrowing the EO-MEG price spread to 1,000-1,100yuan/mt. Some producers are adjusting their product mix, though regional differences are evident.

South China

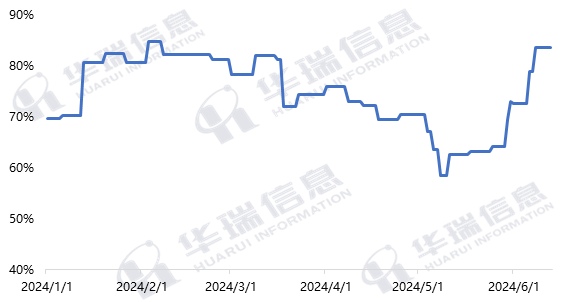

Since the end of May, Zhongke and FREP have resumed production and stabilized operations, leading to a significant increase in EO production in South China. However, downstream demand remains weak, with recent EO prices hovering around 6,650-6,700yuan/mt. The sluggish EO market has prompted adjustments at Gulei and Sinochem Quanzhou, increasing daily MEG output by approximately 250-300 tons. Overall, the MEG operating rate in South China (including Fujian) has risen to around 85%.

Central and Southwest China

In this region, co-production units include Sinopec-SK Wuhan and PetroChina Sichuan Petrochemical, with a combined MEG capacity of 640kt/year. Both units previously operated at low rates, primarily producing EO. Currently, Sinopec-SK Wuhan is making minor adjustments to balance downstream EO demand, maintaining low overall rate levels. Sichuan Petrochemical has gradually increased its rate since mid-May, with MEG operating rates now around 70%, up from a previous low of 30%.

Operating rate of MEG units in South China

East China

In East China, co-production units continue to prioritize EO production, with no clear plans to increase MEG output. The EO supply-demand balance remains dynamic, with some plants, such as Sinopec Shanghai, ZRCC, and Yangzi, still shut down. Other EO units are operating at low rates. Downstream demand for EO remains weak, particularly with the onset of the rainy season, which slows construction and reduces water reducer demand. Companies report weak downstream reception, and future changes in the operating rates of joint production units in East China need to be monitored. Satellite Petrochemical plans to restart one of its 900kt/year lines by the end of the month, with the potential to run both lines simultaneously for a period.

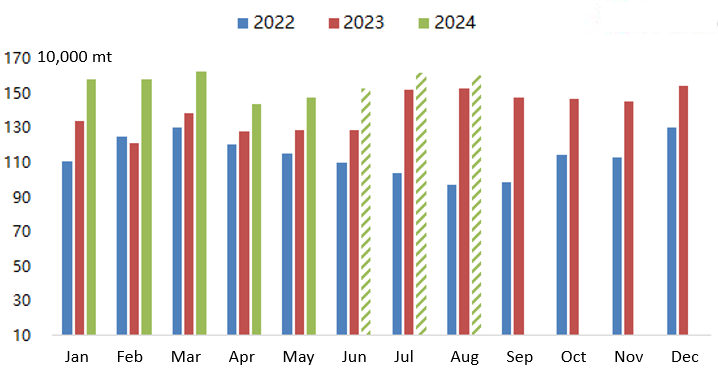

Monthly MEG output (forecast) of China

Overall, adjustments in some joint production units are expected to increase monthly MEG output by around 20kt. Additionally, coal chemical plants are operating at high loads, suggesting that domestic MEG production will continue to increase in the near term.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price