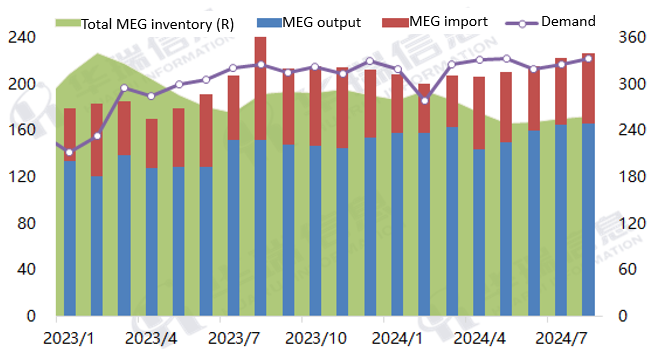

MEG: Limited Inventory Accumulation in the Near Term

Recently, the MEG market has shown a strong and stable trend, with spot prices ranging from 4,500 to 4,600 yuan/mt. The price increase is mainly driven by market news, with strong support at lower levels. Fundamentally, the MEG supply-demand structure remains neutral, with a balanced market expected from June to August, making significant inventory accumulation unlikely in the short term.

unit: 10,000 tons

Domestic Supply:

The recovery of traditional units has been slow, with Fujian Refining & Petrochemical's ethylene output still affected by compressor issues, delaying the restart of its MEG unit. Zhongke Refining & Petrochemical has completed product optimization and plans to increase operating rates to around 90%, slightly delayed from initial expectations. Zhejiang Petroleum & Chemical plans to restart its unit around the weekend, focusing on balancing ethylene demand. The stability of its operations will be monitored. Syngas-to-MEG units, such as Tianying and Meijin, are still under maintenance, with operating rates expected to recover to around 70% by early June. While EO prices have recently declined, they remain more profitable than the MEG segment, leading to a shift in production focus within EG/EO units.

Import Market:

Supply of deep-sea cargoes remains relatively stable, with attention on whether PRefChem can operate normally. Overall, MEG supply is cautiously optimistic, with some coal-based plants facing tight shipments due to low storage tank levels.

Demand:

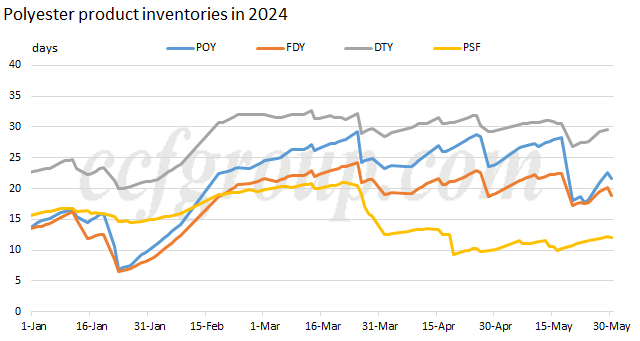

Polyester polymerization rate is around 89%, but product inventories are high, with POY inventory exceeding 20 days. Polyester prices show a disparity, with low-priced goods being purchased as needed, while high-priced raw materials see cautious buying.The average monthly operating rate is expected to be around 87%-88.5%, with attention on how changes propagate through the industry chain.

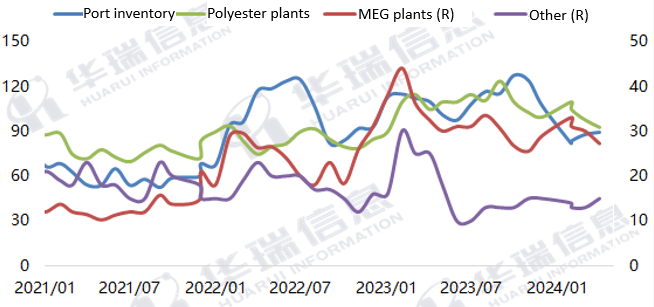

Inventory:

MEG inventory has been reduced to low levels, but a process of reaccumulation is anticipated, with port inventories expected to fluctuate around 750kt in the near term.

China's MEG inventory structure

unit: 10,000 tons

Outlook:

In the short term, the MEG fundamentals remain neutral, with strong support at lower levels. However, as prices rise, some suppliers are eager to sell, which may exert pressure on prices. Eyes could rest on PFY sales ratio and macroeconomic changes.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price