CPL probably continues destocking in June

Before the May Day holiday, we had analyzed in the insight "CPL will continue to slowly destock in May" that the continuous decline in CPL in April was initially due to inventory accumulation. Towards the end of April, despite a series of production cut and shut down for maintenance, CPL still remained weak because inventory levels had not decreased enough to let downstream feel a tight supply, along with the customary pre-holiday sales by CPL sellers. We also pointed out that CPL would continue destocking in May, with a slow decline in total inventories, expected to gradually shift the supply-demand balance in favor of sellers.

Looking back at May's performance, the intuitive perception from both buyers and sellers and the price performance essentially confirmed our previous analysis. Based on the maintenance and restart plans announced by the upstream and downstream players, it is estimated that CPL will continue its destocking trend in June, but the intensity of destocking is expected to weaken marginally.

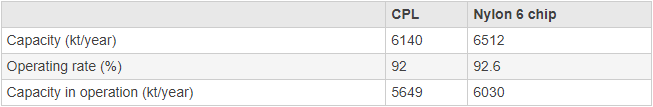

The figure above shows the current operating rates of CPL and nylon 6 chip plants. A detailed calculation reveals that the current production of CPL is still less than the actual consumption, indicating that total inventories of CPL are still on a downward trend. There is a gap of 400,000 tons, equivalent to 1,200 tons per day.

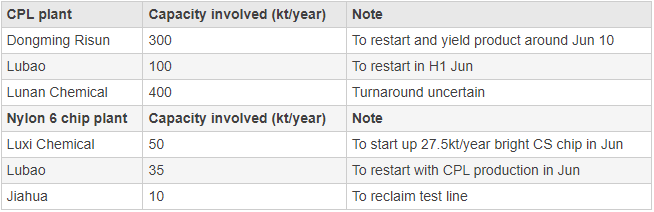

The figure 2 presents plans for the restart and capacity expansions of upstream and downstream facilities in June. It is noticeable that by mid-June, with the resumption of supply from Dongming Risun and potentially the restart of Lubao (which may undergo technological modifications but not necessarily reach full production), this will essentially offset the current supply gap of 400,000 tons. While some new PA6 units will come online, their impact on the balance sheet will be minimal.

The variable lies in Lunan Chemical's turnaround plan of its 400,000 ton/year CPL plant. Although it was previously delayed for certain reasons, it has not been canceled. Therefore, if Lunan Chemical undergoes maintenance in June, CPL will likely continue its slow destocking trend. Otherwise, by mid-June, after Risun and Lubao restart, with all CPL units running at full capacity, market dominance may tilt back towards buyers.

Balance sheet calculations suggest that CPL will continue destocking in June, but the intensity of destocking will slightly diminish compared to May. However, a question remains whether the currently high operating rates of chip plants can be sustained. Given the current production, sales, processing fees, and inventory conditions, reducing production does not seem to be a concern for chip plants in June.

It should be noted that nearly all CPL production capacity is fully utilized at the moment. In case of any unforeseen circumstances leading to sudden maintenance, CPL supply could tighten. Based on the current favorable processing fees, downstream factories are advised to act prudently and not adopt a bearish stance, and maintain adequate safety stock levels.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price