Spandex application in sanitary materials

The 31st China International Disposable Paper Expo (CIDPEX2024) was held at the Nanjing International Expo Center from May 15th to 17th, 2024, utilizing eight exhibition halls (Halls 1-9) at the center. The exhibition included participation from enterprises related to paper-making equipment, sanitary products, and raw materials. The author specifically visited the booths of spandex factories and some downstream paper product manufacturing companies.

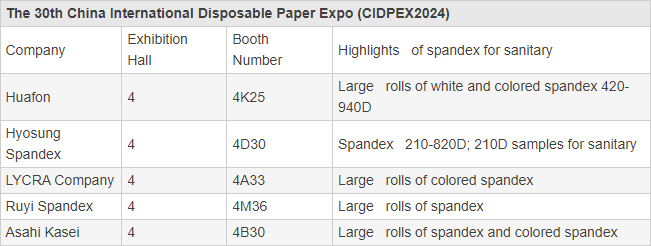

Figure. Exhibition booth layout and highlights of various spandex factories

According to data, the global diaper market is steadily expanding, with a particularly rapid growth in menstrual panties. Global diaper sales are estimated at 487.27 billion yuan in 2023 and are projected to reach 592.54 billion yuan by 2030, with a compound annual growth rate (CAGR) of 2.83% from 2023 to 2030. Europe is the largest market globally, holding approximately 25.16% market share in 2023, followed by the U.S. market at around 17.03%. The global market for menstrual panties is also steadily expanding, with a market size of 440 million USD in 2023 and an expected increase to 3.79 billion USD by 2030, with a CAGR of 36.25% from 2023 to 2030. North America is the largest consumer region globally, accounting for nearly 50% of the consumption market. The second-largest consumer region, following Europe, accounts for around 30% of the consumption market.

With the development of spandex production capacity in China in recent years, leading enterprises have been focusing on research and development of differentiated spandex filament products. As spandex capacity increases and equipment diversifies, processing costs have mostly maintained a slight downward trend. Additionally, there is significant competition among downstream paper product companies, leading to persistent demands for cost reduction in raw materials. Currently, the price of spandex used in sanitary materials has hit new lows for several years, as shown in below chart, and the demand for spandex in the sanitary materials sector continues to increase. While the use of spandex in children's diapers and diapers has decreased due to low birth rates, the demand for adult diapers and women's menstrual products is rapidly increasing, driving the growth of spandex demand in the sanitary materials sector.

Through visits and communication, it was found that the monthly production volume of paper diapers in China is around 4,000 tons, with about 60% for domestic sales and 40% for export. Spandex used in sanitary materials mainly focuses on 420D, 560D, and 720D, with some slightly finer or coarser spandex filaments. In terms of spandex filament winding heads, a few stable and higher-priced spandex filament products are still produced on 4 or 6 head devices, while some devices have 8 or 16 heads, and there are also sources with higher head counts at 24. Depending on the product performance, the spinning speed ranges mostly from 400 to 600 meters per minute, while some lower-cost sanitary products have spinning speeds of 800 to 1000 meters per minute.

In the field of sanitary materials, Hyosung Spandex has maintained a high market share for many years, with most products sold China domestically and a few exported overseas. Hyosung's spandex for sanitary is produced without oil agents, making it safer for the body and more environmentally friendly, while also possessing excellent resistance to deformation and reducing the amount of hot melt adhesive used. They can supply large rolls of 4.5 kilograms or more, reducing the number of roll changes during production and improving production efficiency. They can meet diverse color and size requirements and offer spandex filament specifications ranging from 140D to 1100D, with a focus on the application of 210D spandex in sanitary materials.

Huafon has made significant breakthroughs in product quality and production volume in the sanitary materials sector in the past two to three years, significantly increasing production and market share. They can provide products of different specifications and performance according to customer requirements, with large roll packaging and products featuring tail threads to enhance production efficiency and reduce costs.

Lycra and Asahi Kasei supply spandex for some branded customers in the sanitary materials sector, maintaining prices at the top tier of the spandex filament market and ensuring stable product quality. They also offer colored spandex and large roll packaging.

Ruyi Spandex mainly produces coarse denier filaments, and in recent years, the share of spandex used in sanitary materials has remained relatively stable at this factory, showcasing large spandex filament products for sanitary and tape applications at the exhibition.

In the past two years, although some spandex filament factories in Jiangsu and Zhejiang provinces have expressed a willingness to increase production of spandex filaments for sanitary materials, they have been limited by costs and technological levels, resulting in slow progress. Coupled with the high-speed production of downstream sanitary product factories, there are high demands for product indicators such as breakage rate, tail threads, rewinding, tension, and price pressure, leading to losses for some factories in the spandex filament market for sanitary materials. Maintaining market share has become more challenging, with some experiencing declines, and in some cases, certain brands have exited the spandex for sanitary section.

The current annual consumption of household paper in China has exceeded that of Eastern Europe, but there is still a gap compared to the United States, Japan, and Western Europe. With the development of the economy, changes in lifestyle, the increasing demand for adult incontinence products due to the aging population, and the gradual penetration of women's menstrual products, it is believed that the demand for spandex in hygiene materials will continue to show strong growth.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price