CPL will continue to slowly destock in May

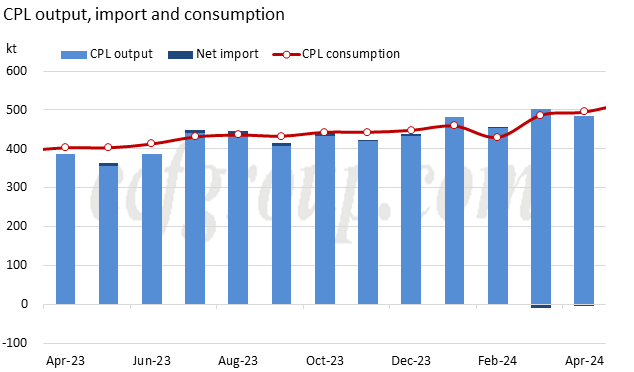

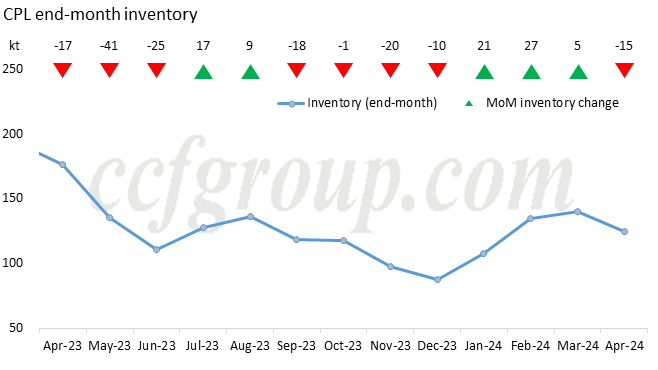

Although CPL plant maintenance began in the latter half of April, prices continued to fall, erasing most of the gains from the first half of the month. The key problem was still inventory. In simple terms, CPL has been accumulating inventory until the complete shutdown of the major line in Cangzhou Risun in March and April. Despite the start of destocking with the maintenance of Cangzhou Risun, Yangmei, and Hubei Sanning in mid-April, total inventories remained at moderate to high levels. Looking at the inventory structure, due to high replenishment levels and pre-sale of chips in the early period, most of the inventory was in the hands of buyers. Therefore, in price negotiations in the latter half of the month, as downstream players adopted a wait-and-see approach, sellers remained in a weak position.

Furthermore, with the approach of the May Day holiday (May 1-5), the impact of holidays and payment processes has led many CPL factories to rush for pre-sales, resulting in continued downward pressure on prices. Past experience shows that CPL often tends to weaken before medium-long holidays, mainly due to the rush for pre-sales, which is a lesson need to be learned.

Given the weakness before the holiday and the restart of the major line in Cangzhou after the holiday, does this mean prices will continue to fall post-holiday? Not necessarily. This still depends on how you understand the inventory situation. Although CPL prices continues to decline in the latter half of April, destocking is indeed happening, but it has not yet reached a level where chip plants feel tightness or where CPL sellers feel confident.

|

CPL enterprises |

Capacity (kt/year) |

Remarks |

|

Cangzhou Risun |

300 |

Restarted in early Apr, may recover after May Day holiday |

|

Yangmei |

200 |

May restart around May 15 |

|

Lunan Chemical |

400 |

To shut for half a month around mid-May |

|

Hunan Petrochemical (Baling Petrochemical) |

600 |

To recover to full capacity operation in early May |

|

Eversun |

280 |

To shut for one week in mid-May |

|

PA6 enterprises |

Capacity (kt/year) |

Remarks |

|

Eversun |

140 |

Shutdown for TA till late May |

|

Luxi Chemical |

100 |

To start up two new lines in May |

| Kangwei |

15 |

To restart around May 15 (long-term idled) |

Comparing CPL and nylon 6 chip plant operation plans in May, there may be more additional supply from chip side, especially the possible startup of Luxi Chemical, in advance of its CPL expansion. In addition, Lunan Chemical's shutdown will be a major impact on CPL spot in May. The consumption in May is likely to be higher than that in April, while CPL production will be reduced.

Therefore, according to the latest estimates of the operating rates of upstream and downstream CPL, taking into account the maintenance and restart plans currently announced, the supply and demand balance for CPL in May indicates a destocking trend.

Although the destocking pace is slow, the total destocking effort for the month may reach around 30,000 tons. Considering that most physical CPL inventories are concentrated in the hands of buyers, withdrawing 30,000 tons from buyer tanks would mean an average reduction of liquid levels by about 4-5 days for mainstream buyers in the East China. Additionally, with varying levels of inventory among different buyers, there is a possibility that some chip plants may feel a tightness in procurement if not careful.

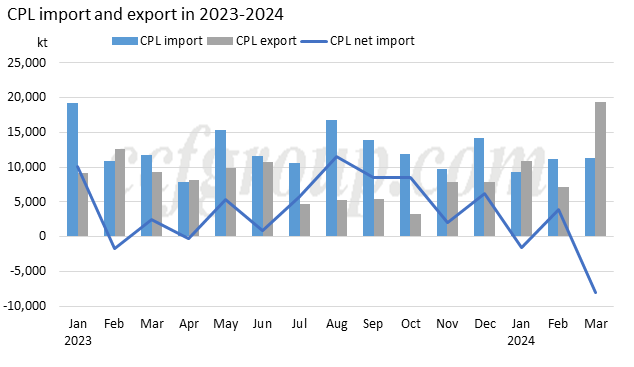

In addition, CPL export has seen a growing trend since Aug 2023, except for the influence of Spring Festival in Feb 2024. The net export in Mar reached around 8,000 tons, as CPL import maintained month-on-month, while export volume peaked to 19,415 tons. It means the arbitrage window is opened further. This is a minor figure compared to total China consumption volume, but still makes sense when market situation is relatively tight.

Therefore, from a quantitative analysis of supply and demand, if chip demand remains strong and chip plant operating rates stay above 90% in May, along with the gradual decrease in inventory, CPL may gradually reverse the current price disadvantage in the market. Furthermore, with a high likelihood of strong benzene prices continuing in May and June, and CPL processing fees being at risk of losses, even with the restart of Risun, it is not advisable to take it bearish on prices in May.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price