Spandex price may be easy to increase after LNY

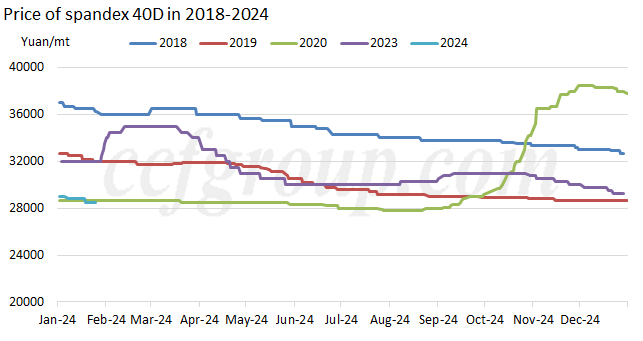

After shivering for around 2.5 years, spandex price has been around the historic bottom now. With rising prices of NFY, PFY and cotton yarn and the chasing-up of orders for some spring and summer goods and some export orders, buyers were active in purchasing. Customers in Chaozhou and Shantou of Guangdong were active in restocking and some buyers in Zhejiang and Jiangsu also followed up. Some indicators of spandex industry may gradually touch bottom recently. There is anticipation toward traditional peak season in spring. Price of spandex may touch periodical bottom in medium-to-short run and is expected to easy to rise but hard to fall after the Lunar New Year (LNY) holiday.

Price of NFY, PFY and cotton yarn increased but that of spandex declined for large orders

As some domestic and export tail-in orders chased up before the Spring Festival holiday, the cost of NFY and PFY still enjoyed support amid the Red Sea tension and price of cotton and cotton yarn climbed up, buyers were active in restocking and stocks apparently decreased since Dec. Price of spandex has been near the historic bottom and shivered weakly. Minor discounts were available for large orders and rapid payment.

|

Price change of major raw materials of chemical fiber and cotton textiles |

|||||

|

Date |

Chemical fiber |

Cotton textiles |

|||

|

Polyester POY150/48 |

Nylon FDY70D/24F |

Spandex 40D |

Cotton yarn C40S |

Rayon yarn 30S |

|

|

2023/12/1 |

7,475 |

17,500 |

30,000 |

22,725 |

16,820 |

|

2024/1/25 |

7,620 |

18,350 |

28,500 |

24,100 |

17,000 |

|

Change: yuan/mt |

145 |

850 |

-1,500 |

1,375 |

180 |

|

Change: % |

1.9% |

4.9% |

-5.0% |

6.1% |

1.1% |

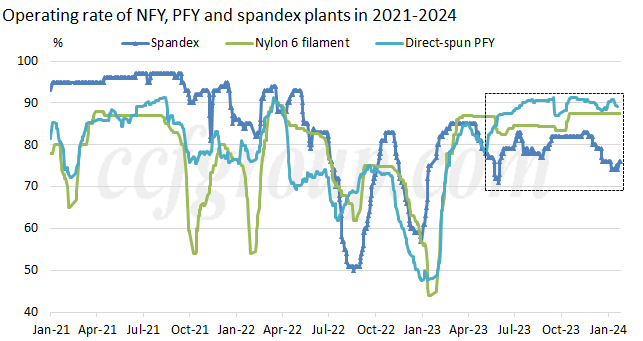

The operating rate of spandex plants was the lowest among chemical fibers

Spandex capacity kept expanding in 2021-2023, but the growth rate of demand was lower than that of supply. The operating rate of spandex industry was high in 2021 but was the lowest among chemical fibers since the second half of 2023. The operating rate of spandex plants was at 70-80% in late-Jan, 2024. Among the 16 dry-spun spandex companies, 7 enterprises suspended production and many companies still faced big operation pressure. The operating rate of some companies will increase to around 80% in the second half of Jan after some downstream buyers increase restocking and supply of some varieties becomes tight. Among NFY, PFY and spandex, the run rate of spandex plants remains the lowest.

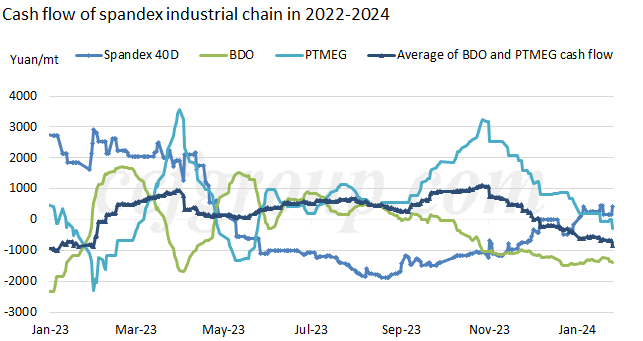

Spandex feedstock producers faced apparent pressure from losses

BDO-PTMEG-Spandex producers encountered pressure in gaining profit, especially BDO plants who suffered heavy losses. Supply of PTMEG turned long when new units released capacity in end-2023/early-2024. The cash flow of PTMEG plants was during negative territory. After more plants cut or suspended production and the feedstock cost dived, price of spandex decreased far smaller than that of feedstock in end-Q4 of 2023 and Jan 2024, ending up with slightly improving cash flow.

Some downstream orders chased up

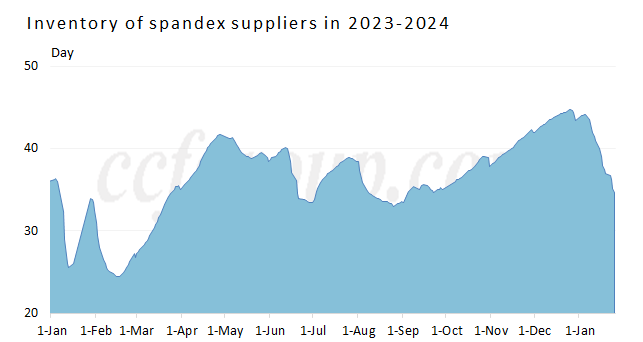

The cold weather in Dec favored the destocking of winter products. Fabric mills in South China saw rising new orders and showed higher intention to hoard up stocks, mainly producing spring and summer products. Sales of circular knitted fabrics in Zhejiang and Jiangsu, warp knitting super-soft fabrics and knitted velvet fabrics in Haining and covered yarn sustained moderate. Buyers in Guangdong and Haining, Zhejiang were active in purchasing. Some purchased spandex to cover 1-1.5 months of production. The inventory of spandex suppliers apparently decreased to 10-30 days. Supply of 20D and 30D for high-density circular knitted fabrics and black spandex turned tight.

Downstream fabric mills were active in restocking before the Spring Festival. Most started holiday later this Spring Festival and normal production will not appear until end-Feb. Spring apparels will arrive to the market by that time and the production of summer apparels will start. Therefore, spring and summer domestic orders should be placed in advance before the Spring Festival. Export orders warm up in some companies, which is partially for the Ramadan holiday. In addition, fabric mills still need to restock.

In summary, recent spandex price has been near the historic low and spandex plants run at medium-level capacity. There is anticipation toward peak season after Spring Festival. Some buyers replenish according to orders and demand and some purchase spandex to cover around 15 days of production, longer for one month or above. Spandex price is estimate to hit periodical bottom in medium-to-short run, which is anticipated to be easy to rise but difficult to decline after holiday.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price