CPL enters the stage of easy to rise and difficult to fall

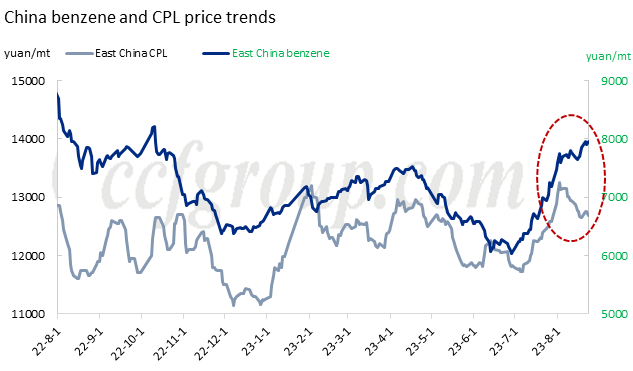

Earlier this month, based on concerns about the decline in benzene (styrene) prices, the author proposed a short-term bearish view for August. Looking at the trend over the past two weeks, CPL has indeed experienced a slight decline, but it appears to be less correlated with benzene in terms of influencing factors.

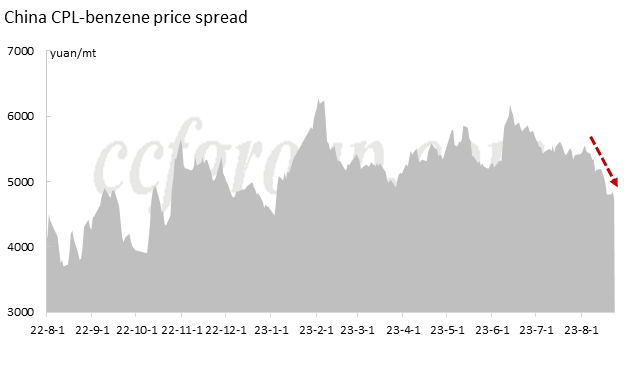

As we can see, benzene has rebounded after a slight pullback, while CPL prices formed a "scissor gap" with the trend of benzene. Therefore, CPL-benzene price spread has further deteriorated until the middle of the month, compared to the beginning of the month.

In retrospect, looking back at CPL's performance in the past half month, why did the price spread fail to provide support? I think the problem may lie in these two factors.

First, the rebound in the profitability of ammonium sulfate since July has provided some subsidies to CPL producers. The current rise in ammonium sulfate prices preceded that of liquid ammonia, and since the rebound of ammonium sulfate profitability in mid-August, it has been able to provide more room for discounts in CPL prices compared to the first half of the year.

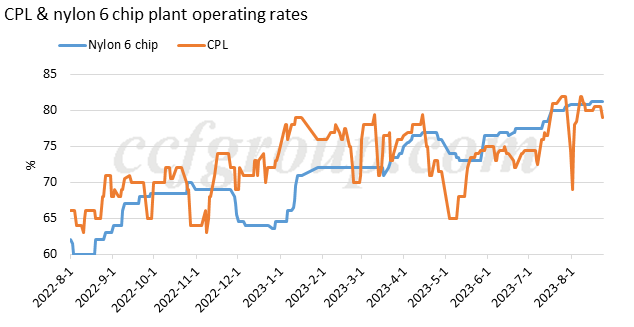

Second, the operating rate of CPL is still too high. Although the operating rate of nylon 6 chip plants is not low either, the overall estimation shows a basic balance of supply and demand in CPL. However, without a clear bullish outlook, the balance of supply and demand implies a lack of purchasing crisis, meaning that the initiative in spot trading lies with downstream buyers.

Especially in the Northern China-East China concentrated trading area, since mid-August, all CPL plants in North China such as Shandong and Shanxi have been operating at full capacity. Moreover, since mid-August, the performance of downstream conventional spinning chip has been sluggish, with a cautious and bearish sentiment dominating the market. Therefore, the seller's mentality naturally weakens as they wait and wait.

So, what will be the next trend? Following the above analysis, from the perspective of processing margins, with the rise in liquid ammonia and the decline in ammonium sulfate prices, the subsidy effect has weakened, and CPL spot prices have basically no room for compression.

In terms of transaction situation, starting this week (Aug 21-27), nylon 6 factories have become more proactive in stocking up compared to the middle of the month, and trading volume has significantly increased within the price range of 12,600-12,700yuan/mt.

Additionally, there are also several plant turnaround and capacity expansion plans in September.

| Time | Enterprise | Capacity (kt/year) | Note |

| end-Aug | Dongming Risun | 150 | To shut for one-week turnaround |

| end Aug | Tianchen Yaolong | 350 | To cut run rate by 50% for one month |

| early Sep | Shenma | 200 | To shut for one-week turnaround |

| Sep | Hubei Sanning | 140 | To shut for one-week turnaround |

| Sep 5 | Lubao | 100 | To shut for technical update for 45 days or 60 days |

| Total | 940 | ||

| Sep | Hunan Petrochemical (Baling Petrochemical) | 300 | To start up new capacity, supply may be limited |

| Sep | Shenyuan | 200 | To start up new capacity, supply may be limited |

Two new units (Hunan Petrochemical and Shenyuan) are expected to have limited or even no incremental supply in September due to factors such as incomplete supporting facilities and moderate delays. Therefore, after entering September, CPL is expected to break free from the constraints of abundant supply and actively raise prices to restore processing margins.

Demand is unlikely to see a significant decline in September compared to August. Currently, downstream filament factories have low inventory storage and high operating rates, which does not pose a significant obstacle to price increases on the raw material side. Downstream stocking for nylon 6 conventional spinning chip is not high, and there is potential for price increases in chip market.

Benzene destocking trend is expected to continue in September, maintaining a relatively strong momentum. From the inventory perspective, both ports and downstream manufacturers have generally low inventories of benzene. Unless there is a widespread reduction in downstream production, it is difficult to see a significant downward adjustment in benzene prices.

Therefore, it is believed that CPL has gradually entered a phase of being more prone to price increases than decreases since late August.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price