Methanol price may have reached a plateau

China methanol market has been strong since Jul. Firstly, domestic plant operating rate drops and thus the supply shrinks regionally. Secondly, coal price is firm amid the anticipation of peak consumption season, supportive to methanol price. Then, will methanol market maintain the strength?

Coal price rise slowing down

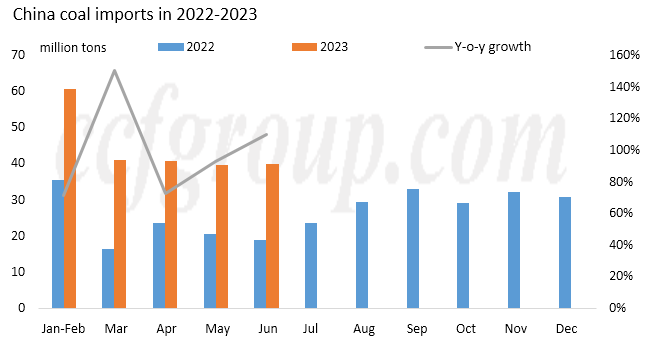

After the continuous rise, coal price stabilized last week, and softened slightly in some regions. Production from major coal mines in China was stable and imported materials increased, leading to higher inventory to be consumed. According to China customs data, the country imported 39.871 million tons of coal in Jun, up 110% on year and up 0.7% from the month earlier. During Jan-Jun 2023, China coal imports amounted to 221.93 million tons, up 93% from the same period of last year. The imports may further increase in Jul as electric power plants would continue buying.

Expectation of restarts of methanol plants and startups of new plants

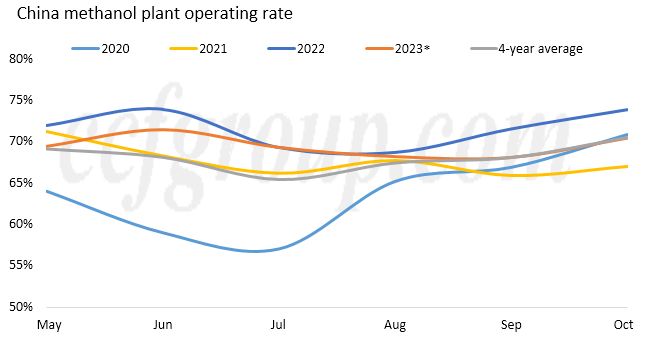

China domestic methanol plant operating rate reached a peak but then fell back in the first half of Jul, which was in line with expectation, mainly because of maintenance of coal-based plants, shutdowns of natural gas-based plants as well as power rationing.

Jiutai's 2 million mt/yr plant, Zhongyuan Dahua's 500kt/yr plant failed to restart; Zhongxin's 300kt/yr plant, Yankuang Guohong's 640kt/yr plant and Shaanxi Changqing's 600kt/yr plant were shut for maintenance; and in addition, Jiangsu Sopo's 500kt/yr plant went offline due to power rationing. Plant operating rate reduced to low, and the pressure from high inventory on methanol plants has relieved.

In the latter half of Jul, however, some coal-based methanol plants are expected to restart. Methanol price may have reached a plateau in the near term. Firstly, it is currently slack demand season, and methanol is in the lack of advancing momentum in terms of demand. Secondly, the reduction on supply side is coming to an end, with limited maintenance plans later. Thirdly, several new methanol plants are expected to start up in the third quarter, cargo arrivals may rebound and methanol inventory may keep increasing, capping the rise in methanol price.

New plants schedule in the latter half of 2023

| Company | Location | Capacity (kt/yr) | Startup schedule | Feedstock |

| Hualu Hengsheng | Hubei | 800 | End-Jul or early Aug | Coal |

| Inner Mongolia Heimao | Inner Mongolia | 120 | Q3 | Coke oven gas |

| Jinkai Yanhua | Henan | 300 | Q4 | Coke oven gas |

| Sierbang | Jiangsu | 100 | Q4 | CO2 hydrogenation |

| Inner Mongolia Junzheng | Inner Mongolia | 550 | End-2023 | Coke oven gas/ furnace tail gas |

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price