PX-naphtha spread widens to break through $400/mt

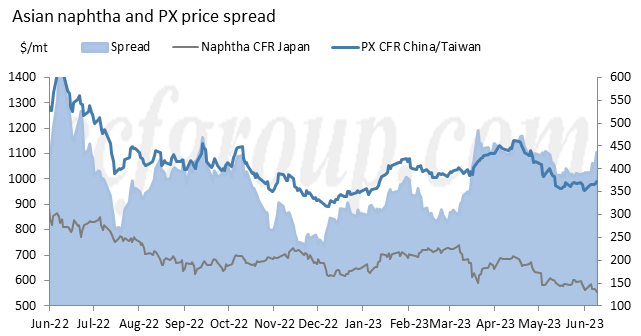

PX-naphtha price spread broke through $400/mt again in the week ending Jun 9, after hovering in the range of $380-390/mt for a month. On Jun 8, the spread advanced to $415/mt, up 6% from the week earlier.

Firstly, feedstock crude oil and naphtha weakened.

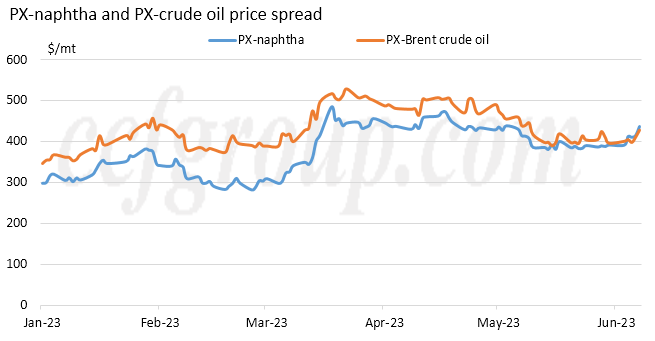

Both PX-crude oil and PX-naphtha spread widened, sharing a same trend. Crude oil hiked before paring gains, hit by lukewarm demand and weak economic sentiment, despite that Saudi Arabia announced to cut production by an additional 1 million barrels a day in Jul. Meanwhile, PX tracked the rebound in crude oil and then kept strong, leading to the widening of price spread.

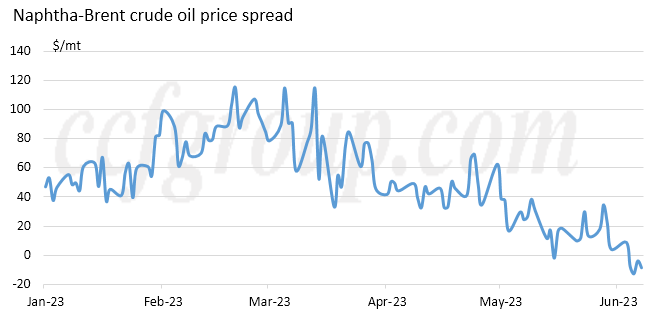

As for PX-naphtha spread, it turned higher than PX-crude oil spread for the first time this year, as naphtha to crude oil spread flipped to negative, indicating the change in naphtha supply and demand.

Since late Mar, naphtha to crude oil has been fluctuating down. In Jun, the spread dropped to as low as -$11/mt. The weakening of naphtha was one of the driving force to PXN spread.

In terms of fundamentals, the turnaround season for crackers in Northeast Asia is coming to an end. LG Chem's 800kt/yr cracker, Hanwha Total's 1.5 million mt/yr cracker, YNCC's one 900kt/yr cracker are expected to restart in the first half or mid-Jun. Demand for naphtha could theoretically increase, however, the profit of olefins could worsen with supply recovering. In addition, naphtha price could get impacted as exports of naphtha from Russia to Asia maintained high in Jun.

The price spread of propylene to naphtha and ethylene to naphtha has been squeezed since mid-May. And recently, the spread narrowed again, bringing pressure on naphtha price.

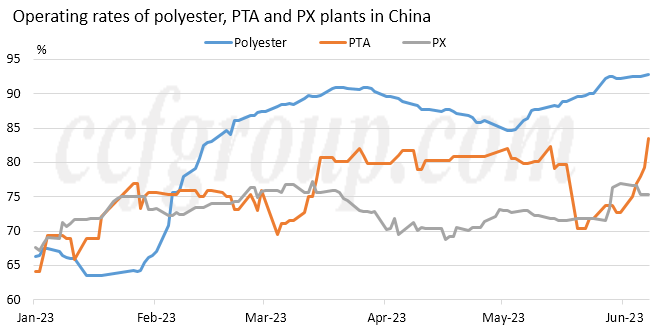

Secondly, PX price was bolstered by rise in PTA plant operating rates.

China polyester plant operating rate has been hovering high at around 90% since late May, and exceeded 93% unexpectedly in Jun. It is expected to keep high before mid-Jun. China PTA plant operating rate hiked obviously to 83.5% as of Jun 9, with several plants completing maintenance and getting restarted, refreshing this year's high. The rise in polyester and PTA plant operating rates led to good expectation of demand for PX.

Feedstock PX inventory at some PTA plants was low, and there was stocking requirements. With PTA operating rate rising, buying in PX became more active, supportive to the price. In addition, Shenghong cut PX plant operating rate unexpectedly due to mechanical problem.

In a conclusion, PX price is expected to stay strong in the short term, and its spread to naphtha is likely to hover around $400/mt.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price