China CPL-nylon import and export evolution

I. China's nylon import and export evolution

In 1900, Otto Wallach discovered the compound caprolactam, and the commercial synthesis consists of the acid-catalyzed Beckmann rearrangement of cyclohexanone oxime. Then the German IG Farben polymerized it into polyamide 6 and applied it in the textile field, and the industrial production of caprolactam began in 1941. In the following decades, world CPL production capacity continued expanding, and the downstream applications were spreading widely into civil and industrial sectors.

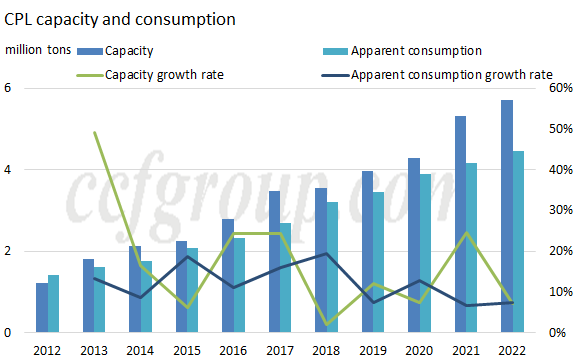

China first realized the industrial production of CPL in the 1990s. China's production capacity has gradually grown from the initial 50,000 tons/year to 5.7 million tons/year in 2022,

accounting for more than 50% of the global production capacity. China is gradually changing from the world's largest CPL importer to an exporter.

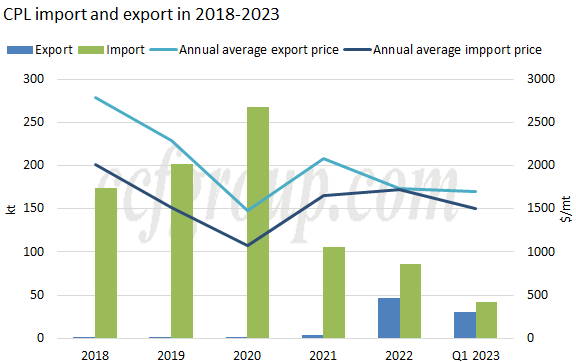

In 2021, CPL imports ended the continuous growth, with imports plunging 60% year-on-year, and gradually started the export development, with cumulative exports of 47,000 tons in 2022, jumping from the world's 12th exporter to the 6th. Estimated from the data of the first quarter of 2023, China's CPL exports are expected to reach 120,000 tons in 2023. However, benefiting from the relatively low import prices, imports in the first quarter increased by 90%, significantly easing the trend of decline since 2021.

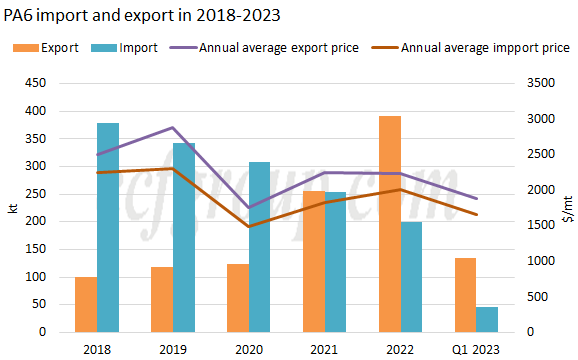

The import and export changes of nylon 6 are relatively moderate, with 2021 being a key turning point. 2021 saw the export of 256,000 tons of nylon 6 chips, up 108% year-on-year, basically achieving a balance between import and export quantities.

With the release of domestic production capacity of chip, the import of nylon 6 chip peaked in 2013, with the quantity of more than 630,000 tons, then it declined year by year. The import quantity was around 200,000 tons by 2022, with an annual decrease of 13.4%.

II. Reasons behind the changes

1. Mismatch between consumption growth and capacity expansion

China's CPL production capacity has expanded by a total of 4.49 million tons in the past decade starting, while CPL consumption demand has grown from 1.43 million tons to 4.47 million tons, a cumulative increase of 3.04 million tons, which is far less than the growth of production capacity.

This mismatch fundamentally determines the import and export pattern of CPL. In 2012, China domestic capacity was 210,000 tons lower compared to consumption. But in 2022, the capacity has exceeded the consumption by 1.24 million tons. The current growth rate of CPL consumption is relatively stable around 6-7%, lower than the growth of production capacity.

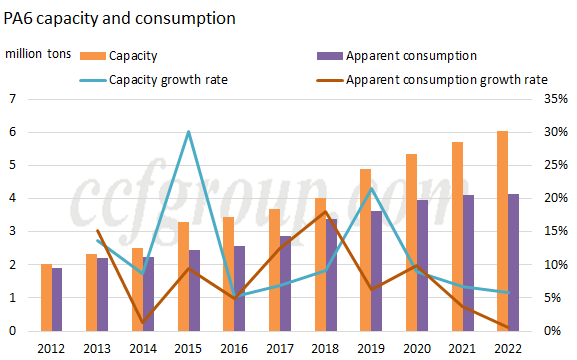

Compared with CPL, the overcapacity of nylon 6 chip is more severe. Nylon 6 chip capacity in China has expanded by 3.99 million tons since 2012, while consumption only grew by about 2.23 million tons, with the gap between capacity and consumption expanding to 1.89 million tons in 2022. The consumption growth rate is not optimistic, with basically zero apparent consumption growth in 2022. Therefore, the surplus domestic supply of PA6 also dragged down the import volume.

2. Industry transfers to Southeast Asia

China's industry is changing from high-speed development to high-quality one, and the labor costs in China are rising continuously in recent years. Nylon downstream textile and engineering plastics are labor-intensive industries, so in recent years, they have been constantly moving to Southeast Asia. China has perfect industrial supporting facilities for upstream chemicals and related auxiliary materials, so it has industrial advantages in the field of CPL and PA6, and gradually becomes an important supplier of downstream in Southeast Asia.

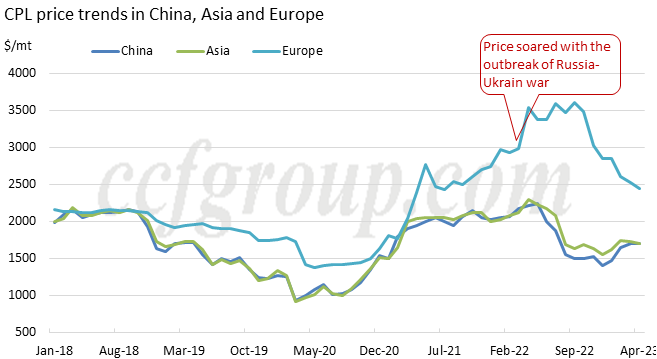

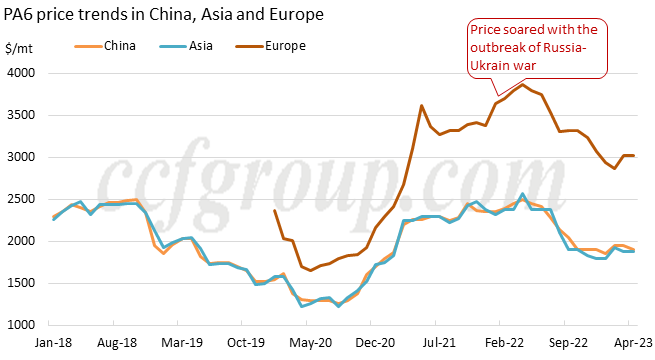

3. The Russia-Ukraine conflict accelerates China's exports

From the chart below, we clearly see the profound impact of the Russia-Ukraine war, with soaring energy prices in Europe triggering a sharp rise in CPL and PA6 prices. The price difference between European and Asian CPL market has widened from around $300/mt to $1800/mt before 2021, and the price difference of PA6 has also expanded from $400/mt to around $1400/mt. The huge price difference has made it difficult for the European market to maintain normal export trade, and the regional market has also been encroached by Asian suppliers, and China has rapidly expanded its export trade to Southeast Asia and the Middle East during this period.

4. Tax advantages

Regional Comprehensive Economic Partnership Agreement (RCEP) and China-ASEAN Comprehensive Economic Cooperation Framework Agreement are playing a great role. China's CPL exports to Korea, China Taiwan, Vietnam, India, Indonesia and other countries and regions have increased rapidly in recent years, and the advantage of low or zero tariff has been fully revealed. For example, the tariff of CPL exported from Russia to Korea is 3%, while the tariff of China's export to Korea is implemented at 0 under the FTA.

III. Major export destinations of CPL and nylon 6 chip

East Asia is the most important exporting destination for CPL and chips of China. In the future, with the relatively slow growth of demand in East Asia, more and more export growth will be in Central Asia, Europe, America and other regions.

| CPL export destination in 2022 | Volume (mt) | Proportion |

| South Korea | 17437 | 36% |

| Taiwan, China | 14980 | 31% |

| Viet Nam | 7029 | 15% |

| Indonesia | 2638 | 6% |

| India | 1874 | 4% |

| Italy | 1406 | 3% |

| Saudi Arabia | 1050 | 2% |

| Slovenia | 1024 | 2% |

| Other | 371 | 1% |

| Total | 47809 | 100% |

| PA6 export destination in 2022 | Volume (mt) | Proportion |

| India | 119305 | 31% |

| South Korea | 62306 | 16% |

| Thailand | 26514 | 7% |

| Viet Nam | 20625 | 5% |

| Indonesia | 19660 | 5% |

| Brazil | 18365 | 5% |

| Japan | 18157 | 5% |

| Turkey | 11305 | 3% |

| Other | 94782 | 23% |

| Total | 391019 | 100% |

IV. CPL and nylon international trade outlook

We are feeling a more and more the intensified competition in nylon raw materials market. For Chinese manufacturers, export to overseas market has become an inevitable choice, thus breaking the original world trade pattern and becoming a historical challenge for global manufacturers. As China's exports increase dramatically, Chinese suppliers will play an increasing role in the pricing of international trade in CPL and PA6. The trade settlement method may also change, as the original single negotiation by order may also evolve into a contractual quotation and settlement system like the China domestic market.

In addition, a shift in the major export destinations is taking place. China's current main export destinations are still concentrated in Southeast Asia, and it is likely to break regional restrictions and expand to Central Asia, Europe and America in the future. With RCEP and the continuous improvement of bilateral trade system, China, as the world's largest industrial country, will cooperate deeply with more and more countries to provide policy convenience for the export of industrial products such as CPL and PA6.

For now, the impact from the Russia-Ukraine war on of energy price is far-reaching, and this could obstruct some overseas manufacturers to compete freely with China. However, based on the historical experience of some countries, it is possible that countries may delay or change the current trade vulnerability in the future by imposing punitive tariffs. This is also an uncertainty factor in world trade development, where there are initiatives to promote trade such as bilateral trade agreements, but also the use of tariff barriers and other means to defend the interests of the country after an imbalance in trade position.

Therefore, we believe that in the international trade of nylon raw materials, China is a force that is bound to make huge waves in the global market, and there will be a full round of reshuffling in the industry. For each link of the industry chain is also full of opportunities and challenges.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price