Polymerization rate: PET resin and PSF to rise but PFY to sustain low

Rigid demand recovered in some companies since May stimulated by higher cost, eased pandemic and improving logistics. Prices of major polyester products were in upward consolidation, with increment of POY the highest at 13% and that of DTY the lowest at 7%. Price of FDY and PET resin both advanced by 10% and that of PSF and PET fiber chip rose by around 8%.

| Price of major polyester products since May (Unit: yuan/mt) | ||||||

| PET fiber chip | PET resin | POY | FDY | DTY | PSF | |

| Low in end-Apr | 7225 | 8100 | 7550 | 8125 | 9115 | 7800 |

| 2022-5-20 | 7825 | 8950 | 8495 | 8950 | 9775 | 8440 |

| Change | 600 | 850 | 945 | 825 | 660 | 640 |

| 8.3% | 10.5% | 12.5% | 10.2% | 7.2% | 8.2% | |

With increasing prices, the losses of major polyester products shrank, with deficit of POY and FDY recovering by around 550yuan/mt. The profit o PET resin expanded by near 300yuan/mt. The deficit of PSF and PET bottle chip reduced by around 100yuan/mt.

Most polyester products were under losses now, except for PET resin with good profit and PET fiber chip under minor profit. The losses of POY and FDY remained big. Large DTY producers were near the break-even line and small DTY plants saw heavy losses based on spot raw material price.

| Cash flow of PFY, PET resin and PSF (Unit: yuan/mt) | ||||||

| POY150/48 | FDY150/96 | DTY150/48 | PET resin | PET fiber chip | PSF | |

| 2022-4-29 | -745 | -715 | 330 | 510 | -65 | -185 |

| 2022-5-20 | -190 | -235 | 80 | 815 | 40 | -75 |

| Change | 555 | 480 | -250 | 305 | 105 | 110 |

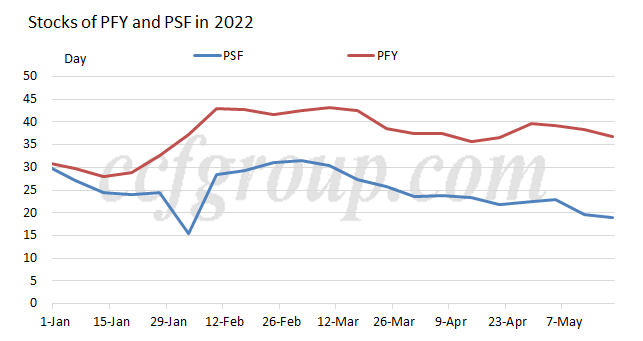

The spread of pandemic in Jiangyin resulted into delivery tightness on PET resin market since May. Buyers purchased actively with rising price. As a result, sales of PET resin were tight periodically. Stocks of PSF fell to below 20 days now from above 1 month after the production was slashed since Mar. However, PFY companies were late in cutting output. The stocks of PFY shivered around 35-40 days since Apr.

PET resin saw the best market fundamentals among major polyester products, followed by PSF, and PFY was the weakest.

Rigid demand for PFY fell when the operating rate of DTY plants, fabric mills and printing and dying plants extended lower in recent two weeks. Meanwhile, speculative demand for PFY was also meager with higher PFY price and inadequate downstream orders. PFY stocks of downstream plants were not high.

Stocks of grey fabrics kept high. Fabric mills were slow in hoarding up stocks for the following season under rising raw material price and heavy losses, especially knitted fabric producers.

| Operating rate of downstream plants in recent three weeks | |||

| Description | May 5-6 | May 9-13 | May 16-20 |

| DTY operating rate in Zhejiang and Jiangsu (%) | 72 | 78 | 74 |

| Fabric mills operating rate in Zhejiang and Jiangsu (%) | 59 | 63 | 59 |

| Fabric mills operating rate in South China (%) | 40 | 48 | 48 |

| Printing and dyeing O/R in Zhejiang and Jiangsu (%) | 70 | 69 | 67 |

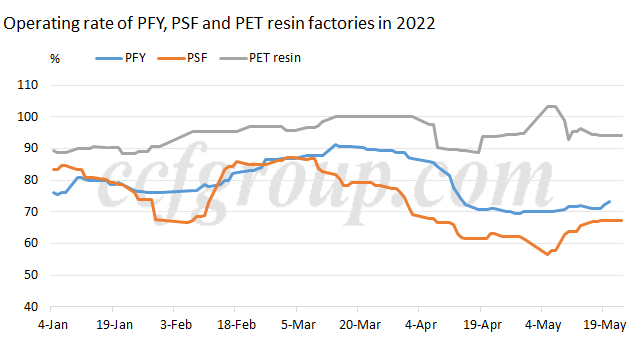

The operating rate of PET resin and PSF plants is likely to rise in short run after the lockdown in Jiangyin ended. The operating rate of PFY companies may sustain low as companies face inventory burden in end-May after downstream plants slashed run rate again. The polyester polymerization rate is expected to shiver around 81-82% in end-May.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price