Methanol loses advancing momentum as coal price pulls back

With increasing demand for coal due to freeze in winter, National Development and Reform Commission have rolled out regulation measures once again to curb coal prices. The NDRC have required Shanxi Province twice in recent half month to restrict coal prices. As a result, 5500 kcal mine-mouth coal price from state-owned mines in Shanxi Province plunged. On Nov 9, China Coal Group lowered the selling prices of coal at coastal regions as well as mine-mouth coal prices. Then, thermal coal futures on Zhengzhou Commodity Exchange slumped by more than 7% on that day.

Though Jiangsu Sailboat restarted its 800kt/yr MTO plant on Nov 8, methanol futures market was barely driven up. The futures continued consolidation while spot to futures spread strengthened. Due to limited supply availability, spot goods were at a premium of 150yuan/mt to Jan futures contract, compared to spot price at parity to futures contract in the beginning of the month.

Focus in methanol market:

1. Restarts of methanol plants with rebound in profits

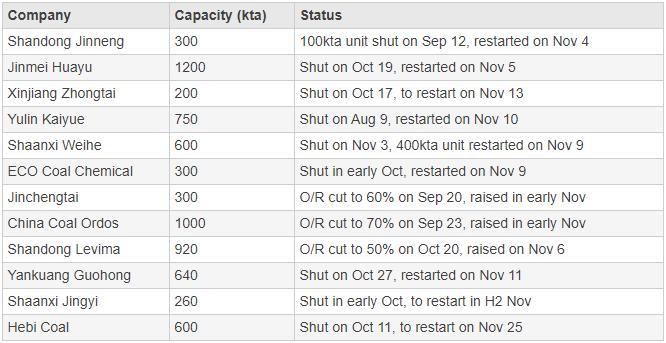

Measures to stabilize coal price and ensure supply are effective. Some domestic methanol plants in inland China, which were shut earlier due to shortage of coal and high coal price, are now restarting. The average operating rate of Chinese methanol plants rose to 68.53% in the week ending Nov 10, up 2.58 percentage points from a week earlier. Meanwhile, some natural gas-fed plants in Qinghai with combined capacity of 1.6 million mt/yr have shut in early Nov due to gas restrictions, and some plants based on natural gas in Southwest China are going to shut on Nov 20. Therefore, domestic supply increase is limited.

Recent restarts of methanol plants

2. Improvement in MTO profits

With coal price returning to normal range, the profits are fed through to downstream sectors in the industry chain. Along with the rebound in coal-to-methanol profits, MTO profits have also improved. Jiangsu Sailboat has restarted its MTO plant on Nov 8, and it is focused on the restart schedules of Zhejiang Xingxing, Nanjing Chengzhi and Datang Duolun. Ningbo Fund has postponed the maintenance on its MTO plant to Dec.

3. Discharging of cargoes speeding up

Discharging of cargoes at Yangtze Estuary has accelerated somewhat in Nov. Though port logistics were restricted temporarily from the end of the last week to the beginning of this week, cargoes arrivals exceeded 200kt in the past week, and port inventory increased heavily in East China. About 0.95 million tons of cargoes are expected to arrive in Nov, leading to rise in inventory.

In the short term, measures to curb coal prices are expected to continue with peak demand season in winter. Support from feedstock coal would weaken, while profits would improve. With discharging of cargoes speeding up, the inventory is expected to rise. The market would continue backwardation structure.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price