China's PSF imports from Southeast Asia and Africa in Jan-Sep, 2021

According to the China customs, in Sep 2021, China's uncombed polyester staple fiber exports were 62,600 tons, down 7.64% month on month and down 19.02% year on year, and imports were 9,000 tons, down 34.9% month on month and 38.15% year on year. Compared with the same period in 2019, exports declined by 20.81% and imports reduced by 58.95%. In the first three quarters of 2021, exports totaled 687.1kt, up 23.54% year on year, and imports totaled 125.5kt, down 9.69% year on year. Compared with the same period in 2019, exports declined by 8.05% and imports reduced by 23.1%.

HC virgin PSF prices declined affected by continual fall of MEG and PSF futures. Price spread between virgin PSF and re-PSF narrows quickly. Currently, virgin PSF at lower price level is close to the re-PSF at higher price level. In late Oct, domestic sales turned thinner, and prices were under negotiation.

HS code 55032000 is synthetic staple fibers, of polyesters, not carded, including virgin PSF and recycled PSF. And the imports from Southeast Asia and African are mainly the recycled PSF. The following are the changes in recent years.

In the import origins of PSF, Myanmar appeared in 2017, and the overall imports were not much. In 2019, one HC re-PSF production line in Hangzhou was moved to Myanmar, and has not started production till now. In 2020, the imports reduced largely, and in the first nine months of 2021, imports were 378 tons.

Vietnam started to exert force in 2018. Following the solid waste ban, domestic plants moved to foreign countries gradually. Vietnam has gathered solid re-PSF and a few HC virgin PSF plants. Imports in 2018 soared to 13,113 tons and reached 19,196 tons in 2019. In 2020, imports climbed up to 19,955 tons. Imports have exceeded over 10,000 tons in the first quarter of 2021, and reached 20,508 tons in the first half year, which has surpassed the overall imports of 2020. In Jan-Sep, 2021, imports totaled 26,240 tons. In terms of the monthly data of Vietnam, the imports have been high since October 2020. Previously, the monthly imports were 1,000-2,000 tons, but since October, 2020, the imports maintained above 2,000 tons, even 4,600-4,800yuan/mt in January and March, 2021. It was mainly attributed to the demand recovery, larger price spread between virgin PSF and recycled PSF and the speculative demand around the Lunar New Year. Last year, a few new plants engaged solid re-PSF put into operation, with a capacity of 50 tons per day, and the products are mainly delivered to China, so the monthly imports from Vietnam are higher than last year. Imports were 729 tons in Sep, the lowest in recent two years. Since the outbreak of epidemic in May, Vietnam took the most strict lock-down measures. In the southern part of Vietnam, electricity consumption has shrunk significantly since Jul. In the third quarter, electricity consumption was 268 million kWh, a decrease of about 23.4% from the second quarter, a decrease of 82 million kWh, and a decrease of about 13.6% from the same period last year. The imports are supposed to remain low in Oct.

The imports from Thailand has tripled in 2019 compared to 2016, to 45,000 tons. The local re-PSF capacity is about 250kta in 2020, and the competition focuses on HC re-PSF. In January 2021, Jiulongthai Phase II unit started up, with a HC re-PSF capacity of 100 tons per day. The products mainly export to Europe and the United States. In 2020, imports were 42,127 tons, and in Jan-Sep, 2021, imports totaled 21,740 tons.

In January-February, 2021, imports from Cambodia were seen a small volume, while the imports were zero in Mar, May, Aug and Sep. In the first nine months of 2021, imports totaled 1,261 tons.

Imports from Southeast Asia were 23,749 tons in 2016, 29,228 tons in 2017, 43,374 tons in 2018, 98,390 tons in 2019, 78,779 tons in 2020, and 59,135 tons in Jan-Sep, 2021.

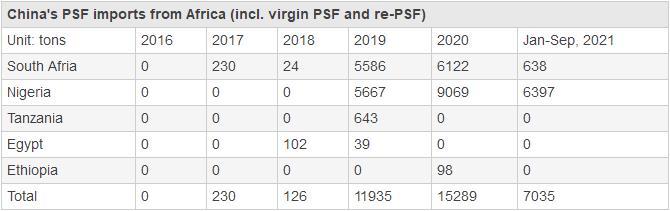

The African market has gradually risen in recent years, especially in 2018-2019, some domestic production lines have also been transferred to Africa. Therefore, the exports to China has increased rapidly from 2019. Imports in 2020 have grown by 28%, mainly from South Africa and Nigeria, but in 2021 imports from South Africa shrank sharply affected by the riots, which caused disruptions of plant operation. Imports from Nigeria were normal. In March 2021, imports reached 2,728 tons. The table below shows imports from Africa.

Power rationing regulations continue. Pay attention to the actual policy in different regions. Currently, price spread between virgin PSF and re-PSF narrows obviously, especially HC virgin PSF with higher prices, there is still downward space, weighing on HC re-PSF market.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price