Styrene weakens tracking drops in energy prices

China domestic styrene prices were volatile in the second half of October and fluctuated to the downside this week.

The market went up Monday on speculations of New Solar shutdown and the maintenances in October and November. Coupled with firmer oil prices and delays of new unit startups, futures participants were bullish about the market. In addition, operating rate of stand-alone producers were pressured by the continuous production losses.

Then styrene prices receded in anticipation of weakening supply-demand situation. In addition, coal, crude oil and some other energy futures declined, heavily weighed on downstream chemicals these days.

Zhejiang Petroleum & Chemical was approved to import around 12 million tons of crude oil on October 25 for its Phase II. The company has restarted one of its styrene line with 600kta recently and the maintenance of the other 600kta line has been postponed. This would increase the supply in short term.

In demand side, with easing power restrictions, operating rate of EPS plants will increase slightly. However, demand in the winter will gradually decrease and the consumption for styrene will also slow down.

Some market participants believed that the drop in styrene was larger than that of feedstocks, which could lend some supports to the market. But in short term, the market is likely to continue its weaknessdue to the drops in thermal coal and crude oil futures.

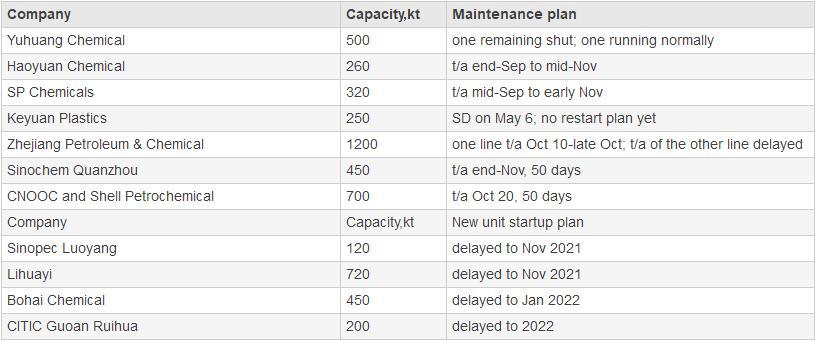

Styrene unit maintenance and new unit startups:

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price