New seed cotton arrives on the market, with extraordinarily high prices

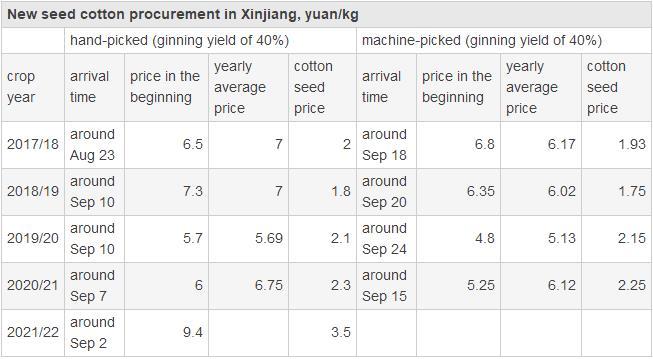

In early Sep, new seed cotton for wadding (for civilian use) starts to be procured in Xinjiang and inland, and the volumes are very limited. On Sep 2, it was heard that purchase prices of seed cotton with ginning yield of 42% were pegged at 9.6yuan/kg in South Xinjiang, and the market anticipation for the competition for seed cotton procurement arouses again. With the improved macro sentiment, ZCE major contract, Jan’22 contract rebounded quickly on Sep 3 by 2.66%. Later, some players were heard that the prices were above 10yuan/kg. Though the planting costs of new cotton are high, and ginners are forced to compete for new seed cotton with all kinds of fees, is it too high for the prices of 10yuan/kg and above under the not favorable demand in traditional peak season? We analyze the purchase prices of seed cotton in recent crop years.

Very small quantity of new cotton started to arrive on the market in early Sep. The new upcountry cotton comes slightly later this year, while hand-picked Xinjiang cotton comes slightly earlier compared with last year. In recent years, the planting areas for upcountry cotton have reduced significantly, while that for machine-picked cotton in Xinjiang have risen quickly (the proportion of machine-picked cotton may reach above 75%), so the machine-picked cotton costs are more representative. In addition, the early-arrived hand-picked cotton in South Xinjiang is for civilian use, whose supply and demand relations are totally different compared with cotton for spinning, so the prices of new seed cotton in South Xinjiang have no big meaning for reference. However, the prices of 9.4-9.6yuan/kg make market players full of imagination. There were sayings about prices of 10yuan/kg. In terms of the early-arrived seed cotton prices, the prices for both upcountry cotton and Xinjiang cotton are 50% higher than the same period of last year. No matter for the increment of planting costs, production reduction range, consumption growth of cotton or the increase of currency, there are no such high fluctuation range on cotton supply and demand. By Sep 6, CCFGroup Chinese 3128 cotton has risen by 43% year on year, and ZCE cotton futures rise by 45%, which is lower than the rise of seed cotton. Currently, ginners take ZCE cotton futures as reference to settle prices of seed cotton, while ZCE cotton futures want to be guided by seed cotton prices. Meanwhile, downstream buyers have to accept high cotton prices with no production cut and no shifting to other products. Nevertheless, downstream buyers have shown some weakness in accepting the high prices and the traditional peak season is not buoyant as expected. So market players shall be cautious about the high prices and keep an eye on the risks.

Looking for the Xinjiang machine-picked cotton, the arriving time is normally mid-to-late Sep. North Xinjiang will start to purchase much during National Day holiday (after Oct 1), and the time is earlier than South Xinjiang. Viewed from the price spread between machine-picked and hand-picked seed cotton, the prices of machine-picked ones are usually 0.7-1yuan/kg lower than hand-picked ones. This year, machine-picked seed cotton has not arrived on the market. The arriving time of machine-picked cotton in North Xinjiang is earlier than that in South Xinjiang. In 2021/22 season, the production in North Xinjiang is supposed to reduce higher than that in South Xinjiang and the ginning costs are higher in North Xinjiang to rent factories, so the competition for seed cotton is supposed to be fierce. In South Xinjiang, the yield in some areas is even likely to rise this year, and there are anticipation of cotton prices falling, which may drag down the overall purchase prices of machine-picked in Xinjiang. But the details shall pay attention to the downstream demand and purchasing condition of large ginning factories.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price