Spandex market expected to sustain strong in August

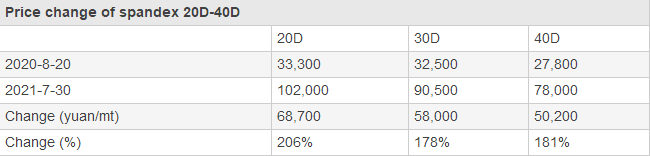

Price of spandex was till under uptrend. The price increment of spandex 20D-40D was at 50,000-69,000yuan/mt or 178%-206% since late-Aug, 2020. Current spandex price has been the highest level since Apr 2008. May-Jul are traditional slack season on spandex market, while downstream demand for spandex was hot this year. The production of some autumn and winter fabrics has been ahead of schedule. Price of spandex 40D increased by 14,000yuan/mt with tight supply. Most spandex producers and dealers saw low inventory. How will spandex market fare in Aug as spandex price has surged to high level?

Supply: growth mainly comes from the release of new capacity

Rising production of spandex will mainly come from the release of new capacity in Aug. Huahai’s 30kt/year new unit that started operation in Jul saw gradually ascending run rate. Huafon Chongqing’s 50kt/year spandex unit is expected to commission production in end-Aug. There are some points to be concerned: The engineering connection of old units and new units and the influence on the operating rate of spandex plants, as well as the progress of new units.

Cost: to bottom out substantially

Production of spandex needs 2 major feedstock PTMEG (0.78) and MMDI (0.18). Major feedstock cost of spandex hit yearly high in the first half of Apr, at 40,000yuan/mt, but slipped to 32,200yuan/mt thereafter. In Jul, price of BDO, the feedstock of PTMEG, rose rapidly as players held optimistic view toward market outlook in the second half of year in expectation of massive demand for BDO from biodegradable plastics and PBT market. Therefore, cash flow of PTMEG declined. In addition, downstream spandex plants witnessed high profit and there will be new capacity. Under such circumstance, PTMEG plants are eager to follow the uptrend on BDO market. Price of PTMEG is anticipated to rise apparently in Aug.

Demand: rigid demand enjoys support

Downstream buyers turned to purchase spandex to cover the pressing demand now instead of being active in restocking earlier. Many new spandex units are expected to start operation in Q3-Q4. Production of thick fabrics is mostly earlier than past years amid high spandex price. Some downstream plants became cautious in producing products containing spandex and tended to hoard up fewer stocks than previous years.

Operating rate of downstream fabric mills has declined from high level now. Some plants slashed run rate as it was hard to scramble spandex and price of grey fabric was hard to track the uptrend on feedstock market with insufficient orders. Operating rate of circular knitting plants dropped to above 60% in Zhejiang, Jiangsu and Chaoshan, Guangdong, that of warp knitting plants inched down to near 90% in Haining, that of circular knitting mills in Foshan, Guangdong and lace knitting plants in Fujian dropped to above 30% and that of warp knitting plants and covered yarn mills sustained at 70-80% in Guangdong. Lace knitting, braid, diaper and ear band of mask market weakened apparently, and producers ran at low capacity.

Market outlook

Downstream fabric market has started weakening. Supply of spandex keeps tight. Stocks of spandex are low among dealers and manufacturers. Spandex suppliers continue raising price amid increasing major feedstock price. Price of spandex may extend higher in short run. There are some points noteworthy: the trial production of Huafon Chemical's 50kt/year new unit in end-Aug and the stability of this unit; the stability of Huahai's new 30kt/year unit; whether downstream market will track the uptrend of feedstock market.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price