PX under strains from unexpected supply increase

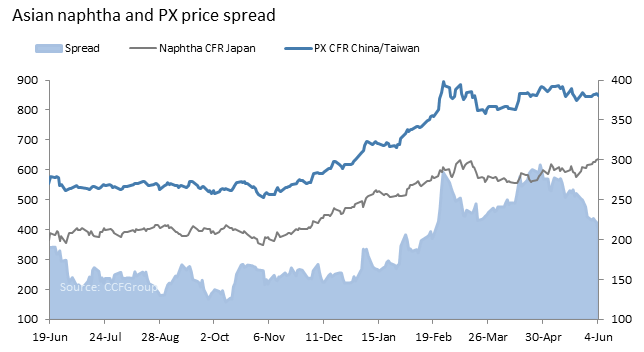

PX price was under pressure, relatively weaker compared to the feedstock crude oil and naphtha. PX-naphtha spread narrowed fast to $221.6/mt on Jun 3 and further to $212.4/mt on Jun 4. The spread was squeezed heavily, with feedstock price rising, as PX supply was ample in China domestic market recently. Then, there did those supplies come from?

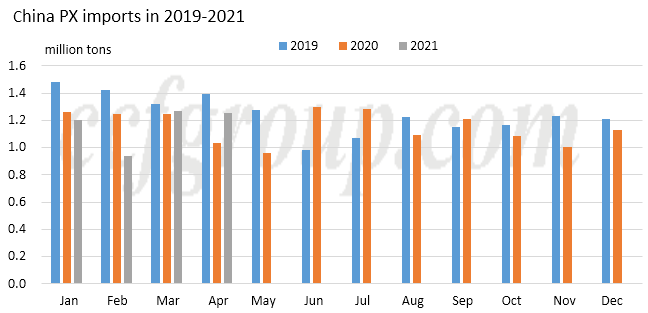

1. China PX imports staying high

In Jan-Apr, China PTA capacity expanded, however overall PTA output was scaled back as plants cut operating rates due to losses. Though China domestic PX output reduced over the same period, the imports kept increasing, leading to mounting PX inventory.

2. Delays of the startups of fresh plants

It was earlier planned that a new 3.5 million mt/yr PTA plant and a new 2.5 million mt/yr PX would start in the second quarter of 2021. The fresh PTA plant was scheduled to start one month ahead of the PX plant, so the PTA producer had already stocked PX in advance. However, both plants were postponed, and the interval between the startups was shortened and the PX plant may even start ahead of the PTA plant. As a result, PX inventory in that PTA producer were quite high.

3. Delays of PX plant maintenance

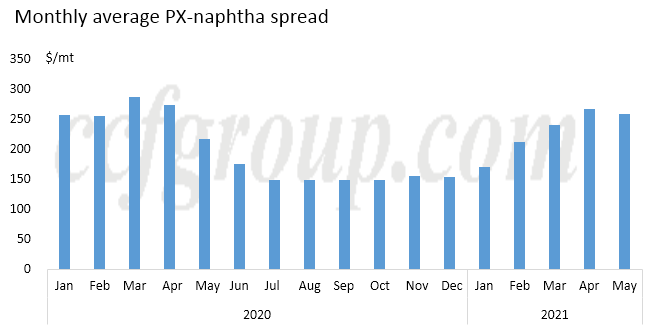

PX-naphtha monthly average spread had been hovering above $240/mt since Mar 2021, and the spread hit 1-year high of $290/mt in end-Apr. PX margins coupled with good economics of benzene drove producers to raise plant operating rates. Some maintenance of PX plants was preliminarily scheduled in May, but had been delayed, which also led to increase in supply.

4. Squeeze of PTA margin and unplanned plant shutdown

In the first half of May, with some PTA plants recovered operation from the maintenance, and some polyester plants cutting production due to poor sales, PTA margins were squeezed again. Some PTA producers thus announced maintenance plan in Jun. With margins narrowing and inventory increasing, some delayed maintenance was again brought forward.

Meanwhile, one 2.2 million mt/yr PTA plant was shut unexpectedly in Ningbo, Zhejiang in end-May. The shutdown could last for 2 weeks, leading to reduction of PX consumption and dwindling storage space for PX.

In a conclusion, the unexpected PX supply increase could bring pressure on PX in Jun.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price