What makes “Hai’an” so outstanding in nylon filament market?

Nylon 6 textile filament market had declined since mid-March 2021, and just ceased the downtrend in end-April. In the one-and-a half-month adjustment, nylon 6 filament producers who focused on producing semi-dull products were under comparatively higher pressure, as their inventory accumulated due to unbalanced sales/production conditions.

However, as a major production base of semi-dull nylon 6 textile filament, Hai'an Zhejiang market had performed well out of the bearish look. Most local POY producers were running at their full capacity, and the supply was still tight. Local DTY plants also kept operating at high rates, and their inventory was under control. Added to this phenomenon, Hai'an market was concentrated on low-end conventional filament varieties.

What makes Hai'an the exception?

1. Cost advantage

The cost advantage of Hai'an's textile filament is mainly in two aspects: production cost and raw material cost. The production cost advantage mainly lies in electricity fee, management, packaging, etc., but the cost saving in terms of air-conditioning electricity and paper tube recycling is limited, not enough to drive a significant shift in demand to the Hai'an market. In comparison, raw material cost advantage of has played a greater role in the past two months.

Local filament producers in Hai'an mainly use nylon 6 high-speed spinning chips from Luxi Chemical, Yongtong, Hongsheng, Hengyi, Fangyuan and Huajian, and Luxi Chemical is their largest supplier, taking a proportion over 30% of the regional HS chip consumption.

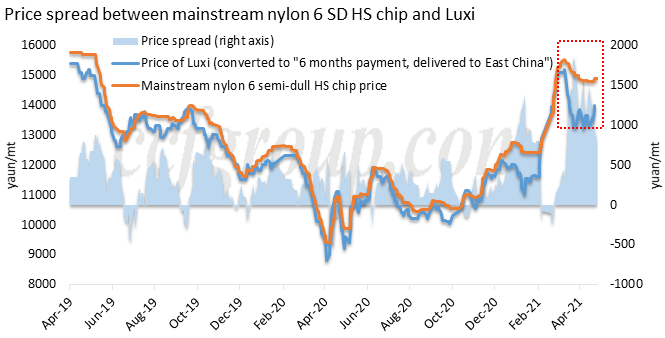

Tracing HS chip prices in the past two years, Luxi Chemical's semi-dull HS chip is normally 200-500yuan/mt lower than mainstream HS chip sources. And this spread has widened evidently since the end of 2020, and has reached 1,200-1,800yuan/mt in Mar-Apr 2021, almost lower than the price of mainstream CPL spot even. Therefore, Luxi Chemical has an absolute price advantage in the low-end HS chip market, and its sales had been very smooth or over their production volume when demand for other conventional HS chip was tepid in Mar-Apr.

2. Higher consumption from seasonal hot-sold product

Nylon 6 DTY in Hai'an has also fund its good consumer in nearby market Yiwu, Zhejiang before 2021 summer. “Ice sleeve”, a product to protect the skin from sunshine in the hot weather is in hot sales. And local fabric and textile producers have been actively producing the product in the past two months.

Raw material for ice sleeve has been shifting continuously recent years, as its original raw material is 2070D and 2050D spandex/nylon sigel covered yarn, and then to 1050D spandex/nylon air covered yarn, and has changed to nylon 6 30D/12D plied DTY. All these shifts are mainly for lower cost, since spandex prices have been hiking since the second half of 2020 and fine count spandex yarn has been in tight supply. Ice sleeve plants are forced to give up spandex and use nylon DTY as a major raw material, and they also added different shapes to the product to meet the shortage of less elastic nylon DTY.

The cost-advantageous DTY products in Hai'an have won the rising consumption from ice sleeves.

3. Advantage in integrated filament-yarn production chain

Hai'an market is winning in another sector—feather yarn.

The product has been performing quite good in 2017-2018, as it was for a time out of supply and producers were gaining lucrative profits. After capacity expansion and fierce competition, it has already become a conventional product in nylon filament market, and profit has returned to normal range. The market is almost saturated.

However, Hai'an's feather yarn industry has been expanding in the past few years, and replaces some of the Wenzhou and Zhangjiagang's share. The overall feather yarn industry is shifting toward Hai’an.

This is due to a more complete and cost-saving industrial chain in the region. The 980a crochet plants in Hai'an are mostly equipped with DTY production, and also equipped with texturing and twisting machines. Local filament-yarn producers outsource FDY40D and produce DTY 70D by themselves, and finally applied to feather yarn. This is absolutely a more cost-saving mode than Wenzhou yarn producers, considering the cost of DTY, twisting, and transportation. Hai'an yarn producers are gaining more profits with lower price, thus drawing the industrial chain quickly to the region.

Above all, nylon filament in Hai'an market, with its low cost edge, has taken an obvious superior position in downstream sectors including ice sleeve, feather yarn and other conventional areas. In addition, local filament-yarn integrated production chain has further strengthened this favorable factor, making Hai’an’s filament more competitive in the market. Even in the slack season for feather yarn, local nylon filament plants are still operating well with good sales.

Nevertheless, the consumption demand from ice sleeve is gradually ending toward June, and local DTY producers will be more concentrated on feather yarn production. When he inventory of feather yarn has accumulated to some extent, with plied yarn demand from ice sleeve dwindled, local filament sales will still be under some pressure.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price