Soaring sea freight difficult to fall back before September

The congestion of ports outside China remained. The transshipment rollover ratio at some large ports extended higher as global container supply chain was hard to cope with the “common congestion”. The shipping schedule of liner was greatly delayed due to disordered logistic supply chain and lower efficiency. The carrier performance has plunged to near 20% from the normal level 70%. The longest detention time of container in the terminal could be 2 months, and it was more common to see containers be rolled over. In some ports, the rollover ratio in April was as high as 64% and that of shipping companies approached as high as 56%.

According to the latest data from Project44, mounting rollover ratio of major container ports in April affected near 39% of delivery volume.

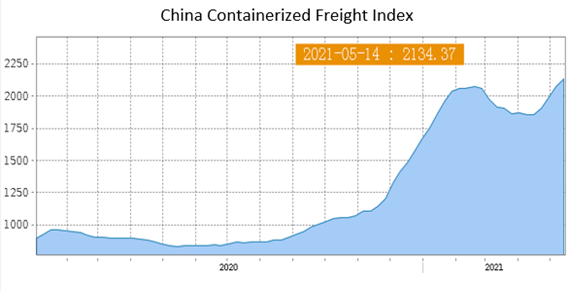

The freight rates of near 80% of routes climbed up worldwide. Statistics showed that among the 21 maritime routes worldwide, the freight rate of 16 lines advanced, with the rest 5 witnessing falling rate. Among ports along the "Maritime Silk Road" area, 12 ports saw increasing freight rate. Insiders expected high freight rates may be hard to reduce before Sep.

Source: Shanghai Shipping Exchange

One exporter in Cixi, Zhejiang has orders filled into Aug from Europe and US but only less than 10 containers were delivered every day amid short shipping space and tight containers, which ended up with massive accumulation of cargos. Logistics enterprises were busy in searching for boats, shipping space and containers for their customers. PIC of Ningbo Southeast Logistics Group expressed that their order volume exceeded 10,000 boxes every day but actual delivery volume was below 50%.

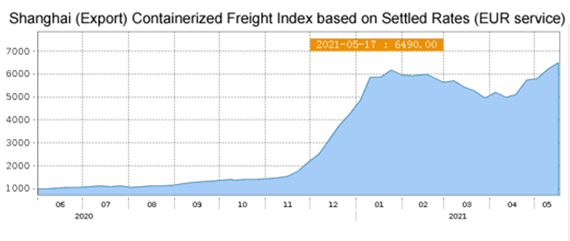

European routes:

Source: Shanghai Shipping Exchange

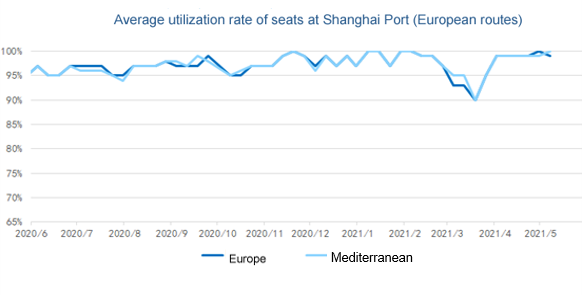

The confirmed COVID-19 cases tended to stabilize in Europe. Many nations have carried out eased pandemic prevention measures. That meant better demand for transportation. In addition, the shipping space may be tight in short run affected by the earlier congestion of Suez Canal. The average utilization rate of seats at Shanghai port was near 100%, and the freight rate continued advancing. On May 14, the freight rate from Shanghai to basic ports in Europe was at $5,438/TEU, up by 16.2% from last period. As for the Mediterranean route, similar market fundamentals were seen, with high demand for transportation, near 100% of average utilization rate of seats at Shanghai port and increasing booking price. On May 14, the freight rate from Shanghai to basic ports in Mediterranean was at $5,320/TEU, up by 10.8% from last period.

Source: Shanghai Shipping Exchange

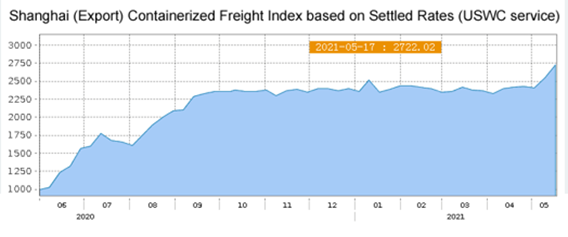

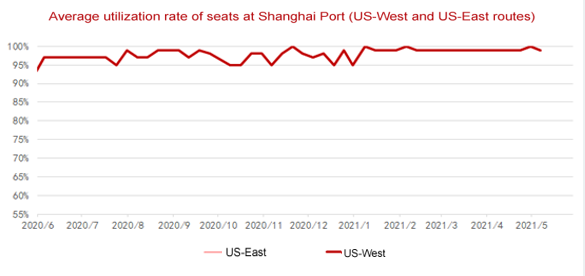

North America route:

Source: Shanghai Shipping Exchange

The pandemic continued in US. The new confirmed COVID-19 cases sustained high although the vaccine has been used for a period. Therefore, whether future economy will keep recovering in US remains uncertain. Transportation demand extended high but containers remained short, ending up with tight shipping space on export market. The average utilization rate of seats in W/C America Service and E/C America Service was near 100% at Shanghai port.

Source: Shanghai Shipping Exchange

Market players thought $5,000 of freight rate in E/C America service in 2020 was a sky-high price, but it seemed not high when looking back. The container price from China to US continued soaring. One cross-border e-commerce seller complained that tight container bothered them again from Apr 2021. It is hard to book container in May and the price for one container in W/C America service could be as high as $9,000, surging by around one time compared with end-2020. Factories wait for delivering orders taken at the beginning of 2021.

According to the latest data from Descartes Datamyne released on May 11, the transportation volume of container from Asia to US surged by 32.1% in Apr compared with the same period of last year. The transportation volume kept growing for consecutively 10 months and hit record high compared with past Aprils.

CIMC, Dongfang International Container (Guangzhou) Co., Ltd and CXIC Group from China produced near 80% of containers in the world. They expressed that production was rising and may increase by 6-8% in 2021 but is still hard to alleviate current shortage of containers.

Why did container remain tight despite of consistent production? Brian Sondey, CEO of Triton, expressed that partial production of this year was used to make up the low production in 2019 and in the first half of 2020. Page, interim CEO of CAI International, thought tight container was partially because China did not expand production capability. Triton International(NYSE: TRTN) and CAI International(NYSE: CAI)were 2 top public container leasing companies in US.

When will tight containers ease? Tight containers started due to the global blockade on the outbreak of the COVID-19 pandemic. The port congestion was serious in the late 2020 amid hot export, and the earlier congestion of Suez Canal worsened the status. Many players did not expect the bottleneck on the market will disappear rapidly, but they also do not think this problem will not be solved forever. It is important to work out the way to clear the bottleneck. Such tightness will not continue unless hot trade mitigates. Insiders expected high freight rates may be hard to reduce before Sep. Some participants expect normal supply of container may emerge in end-2021 or early-2021. However, it remains uncertain as there are variables in the market.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price