Spandex market keeps hot

Price: slower increase

Price of spandex has increased for 3 quarters. Price of spandex 20D hiked by as high as 152% to current 84,000yuan/mt from 33,300yuan/mt in early-Aug, 2020, and that of spandex 40D surged by 134% to current 65,000yuan/mt from 27,800yuan/mt in early-Aug, 2020. Soaring spandex price was mainly due to low capacity expansion, mismatch of supply and demand, growing demand from ear band of mask, hot foreign orders in the second half of 2020 and sound demand for stretch fabrics for sportswear and yoga clothes.

Price of spandex 20D rose by 5,000yuan/mt or 6.3% in Q2 2021 and the increment of 30D was at 2% amid tightness, mainly stimulated by high-density circular knitting market and fine covered yarn market. Price of spandex 40D was in fluctuation. Price of medium-denier spandex for lace knitting and so on reduced by 2,000yuan/mt or 3.1%. Spandex market remained sellers' market with low stocks. Sales ratio was high and price of conventional varieties was raised further although downstream buyers retreated to sideline. Price of medium-to-coarse denier spandex inched down with slower sales.

| Price change of spandex (Unit: yuan/mt) | ||||

| Date | 20D | 30D | 40D | 140D |

| 2020-8-3 | 33300 | 32500 | 27800 | 27500 |

| 2021-3-31 | 79000 | 75000 | 65000 | 63500 |

| 2021-5-13 | 84000 | 76500 | 65000 | 61500 |

| Change in Q2 | 5000 | 1500 | 0 | -2000 |

| Change in Q2 | 6.30% | 2.00% | 0.00% | -3.10% |

| Change (since end-Jul 2020) | 152.3% | 135.4% | 133.8% | 123.6% |

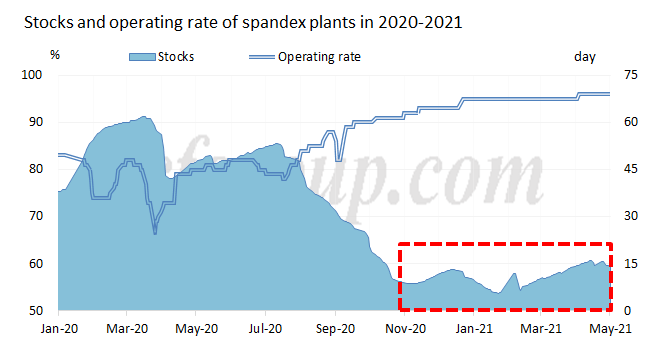

Operation: high run rate and slightly mounting stocks

Operating rate of spandex plants remained high in Q2, mainly above 95%. Some units that have been offline for long were active in resuming operation due to tight supply and high cash flow. Spandex market saw slightly increasing monthly production, hitting historic high.

Stocks of spandex slightly increased in Q2 2021 but were still near 15 days. Supply of spandex has been in short since Nov 2020, especially in Q1 2021 with good domestic and export orders, high run rate and intensive delivery of orders taken earlier, with stocks mainly around 1 week. In Q2, tight balance was seen on spandex market. Downstream buyers turned to mainly purchase to cover the pressing demand in Apr amid high spandex price and their purchasing volume reduced on the month. Supply of 35D-40D tightened again in May when orders for thermal fabric increased, intensive order placement appeared from local and foreign customers and better procurement from dealers was seen. Supply of conventional fine denier spandex was the tightest while that of medium-to-coarse denier was ample as downstream lace knitting and braid mills were reluctant to buy high-priced spandex. Slower sales resulted into slightly falling price of medium-to-coarse denier spandex.

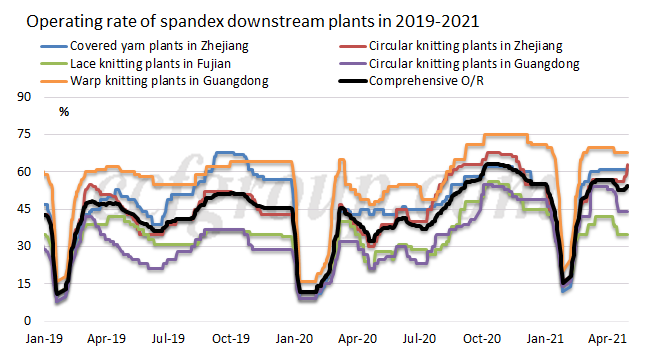

Fabric mills: slightly rising run rate

Downstream fabric mills continued running at high capacity in May. Production and orders for thermal fabrics increased, ending up with slightly higher run rate of some plants. As a result, rigid demand for spandex improved on the month.

Operating rate of circular knitting plants in Zhejiang, Jiangsu and Guangdong, lace knitting plants in Fujian, braid mills in Guangdong and conventional covered yarn plants in Zhuji and Yiwu was at 30-60% and that of cotton core-spun yarn and air covered yarn plants in Zhangjiagang and warp knitting mills in Haining and Guangdong was at 70-80%. Sales ratio could be above 90% in the first half of Q2 in spandex enterprises. However, downstream buyers turned to be cautious in restocking after earlier stocks reduced, and some even turned to produce products without spandex.

Market outlook

Price of upstream feedstock dipped recently and run rate of downstream mills inched down compared with Q1. That meant the support from upstream and downstream market both weakened. Price of PTMEG is expected to head south in May and upstream BDO price has dropped by more than 9,000yuan/mt compared with the peak in Mar. Price of MMDI also moved down. Major feedstock cost of spandex has dropped by above 2,000yuan/mt on the month in May. However, recent downstream demand for conventional spandex improved. Sales ratio apparently climbed up with increasing local and export orders. Under such circumstance, price of spandex was raised further. How long will uptrend continue? It is suggested to be cautious in holding bearish view toward spandex market with loose monetary policy worldwide and low inventory. Price of conventional spandex is likely to remain high in short run, with slightly rising price for tight varieties, and that of medium-to-coarse denier is anticipated to seesaw.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price